For enthusiasts of investing, blockchain technology has unveiled a vast new cosmos of asset opportunities. This revolution has occurred on a global scale, standing in stark contrast to traditional stock markets that often put regional constraints on investors.

A significant limitation previously encountered when investing via blockchain was the constraint to digital currencies and tokens.

Synthetix Synthetix is paving the way for change. Through an intricate framework of synthetic derivatives, it aims to enable blockchain investors to gain exposure to an extensive variety of asset types—including gold, crude oil, soybeans, and a host of fiat currencies.

A Brief Overview of Synthetix

In the realm of the newest DeFi platforms, Synthetix stands out as one of the more intricate and abstruse, especially for novices in derivatives and synthetic assets.

To tackle this complexity, we'll start with a sweeping overview of Synthetix. Once you're ready to delve into the technical nitty-gritty, we suggest delving into the detailed documentation. official white paper (PDF).

Synthetix is an Ethereum-based DeFi platform The platform offers a mechanism for investors to market their funds in asset classes tracked by price. For instance, a future investment could be made in Starbucks through purchasing a synthetic Starbucks token, sSBUX, provided by Synthetix for trade and creation.

Though sSBUX tracks Starbucks' stock price, holding it as a token does not equate to owning part of the company, hence no dividend collection on offer.

Synthetix suggests this principle could extend past mere stocks into realms like commodities futures (think corn or steel), other cryptos, currencies beyond stable coins, precious metals, among others.

Currently, assets like fiat currencies, selective cryptocurrencies, and premier metals like gold and silver find support. The Synthetix team intends to broaden the scope to include any asset carrying a price ticker. Users can also explore index assets diversifying across multiple cryptocurrencies.

Besides the act of trading synthetic derivatives ('synths'), seasoned users might dive deeper into the ecosystem by minting these synths and staking their SNX tokens.

Minting and Staking With Synthetix

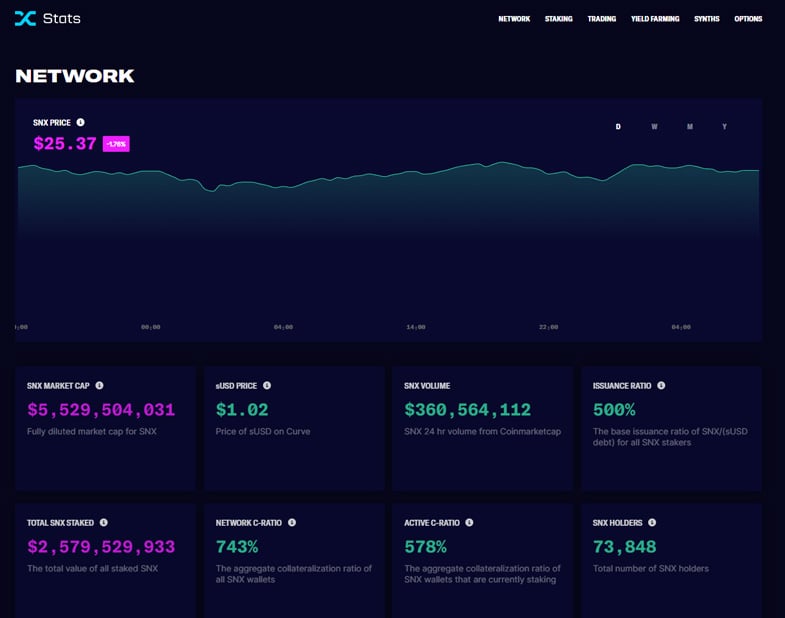

At its core, Synthetix functions on its native token SNX under the Ethereum chain. This token has experienced a notable surge, now approximately priced between $25 and $26 as recent data suggests.

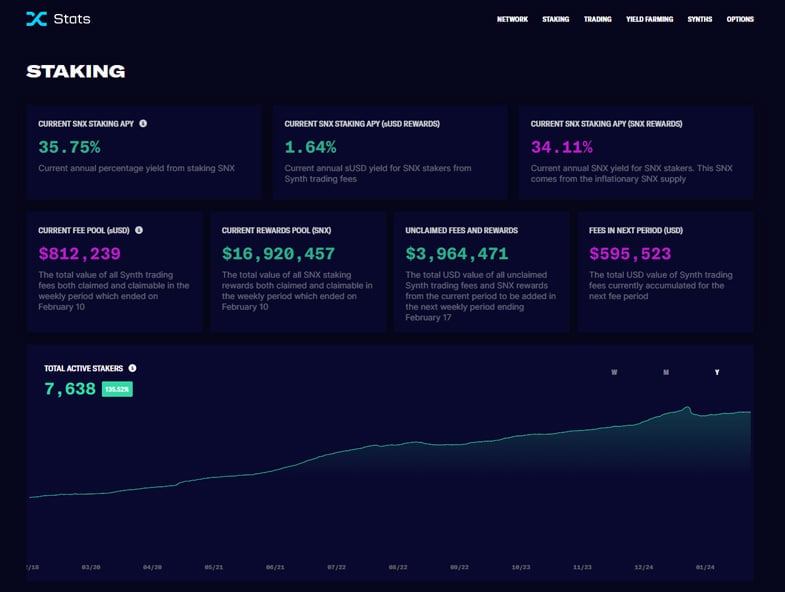

If you hold SNX, a rewarding facet is the ability to earn trading fees aligned with your staked tokens. However, unlike conventional staking setups, staking SNX introduces considerable risk, resembling speculative bets much more than passive interest accrual.

Here's a breakdown: acquire SNX tokens from key exchanges, then use them to mint synthetic assets. You'll effectively have to speculate on these assets' future price directions. short position via an inverse synth like iBTC).

Before minting, prepare to have 750% of the intended mint value lined up in SNX. For example, synthesizing sCAD worth $100 Canadian dollars necessitates an SNX equivalent of $750 CAD in the marketplace.

Choose wisely, and if the prices sway as predicted, earnings arise both from market movements and a share in platform fees. Additionally, while the platform undergoes inflationary phases with fresh SNX distributions, this will taper down by September 2023.

Understanding Synthetix “Debt”

Confused when price trends deviate from expectations? That's where it intensifies regarding platform debts. Minting and staking equates to handling a slice of Synthetix's collective debt pile. When assets excel, profits emerge at the expense of less fortunate investors. Conversely, failure results only metaphorically in a debt to the system.

Adding to the complexity, even when an asset remains stationary, liabilities may still arise. Imagine holding a stablecoin amid a sBTC surge; the disparity could almost punish your steadiness, or inversely reward you amidst larger downturns.

A mandatory caveat: Synthetix stresses a 750% over-collateralization for its assets. Falling short means trading fee collections cease until the deficit is covered either by burning tokens or increasing your SNX allocation.

The official litepaper describes it this way:

Synths currently abide by a 750% collateral standard, subject to potential future amendments by community governance. SNX stakers acquire debt on minting and must clear it to release and unlock their SNX by burning Synths.

Keen on initiating minting and staking? Head over to the official Mintr app at mintr.synthetix.io. A compatible Ethereum wallet like Meta Mask, topped up with some ETH and SNX, is all that's needed to begin.

Who is Synthetix For?

Given Synthetix's complexity, it's clear it isn't everyone’s cup of tea. However, those willing to grasp its concepts and engage with synth assets may see the potential for benefits.

Consider how challenging it might be to open a short position against a rising Bitcoin conventionally—accounts, brokers, contracts—but Synthetix simplifies it into a straightforward process with inverse Bitcoin, iBTC.

A further group likely interested in Synthetix comprises individuals eager to engage with global stock or futures markets hindered by regional barriers. Imagine residing in China and aspiring to invest in Apple: obtaining sAAPL might just be your ticket post-launch on Synthetix.

Who should steer clear of Synthetix? Those unversed in DeFi, seeking streamlined staking, or adverse to risk should explore alternative platforms like other DeFi and PoS options with fewer uncertainties than Synthetix’s dynamic staking.

Do the risks and complexities of Synthetix staking repel or attract you? Share your thoughts in the comments.