Back in 2017, if you ventured into the world of cryptocurrencies, chances are high that Tether crossed your radar. Tether (USDT) : the good, the bad, and the ugly.

The 'stablecoin,' known for keeping its value steady regardless of the crypto market's mood swings, has certainly had a high-stakes 12 months.

Let's explore Tether together: its essence and the whirlwind of attention it has commanded lately.

Tether 101

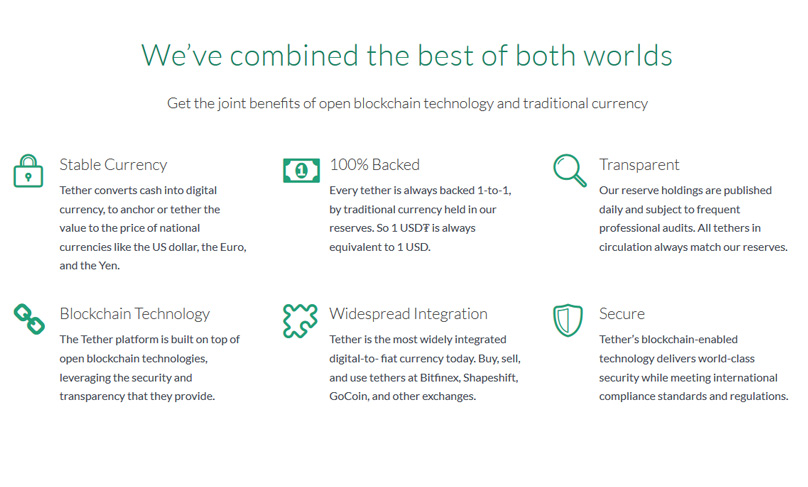

Tether is an Ethereum-based ERC20 token Dubbed a 'U.S. dollar token,' Tether claims each token is tied to equal fiat reserves, though these funds stay under wraps in bank accounts managed by Tether Limited, the project overseer.

Tether tokens link to various currencies; USDT, tied to U.S. dollars, is the front runner. Euro-linked EURT exists, and a yen version is underway.

The Tether Foundation justifies these reserves by stating the... project’s accounts are audited , but we’ll touch more on that later.

The concept behind Tether is to offer investors and merchants a streamlined way to convert fiat to crypto, leveraging its seamless trade benefits without leaving profits vulnerable in bearish times.

Tether Limited purportedly mints and burns tokens based on deposit and withdrawal directives.

Where Tether Is Found

Stablecoins have long been coveted in crypto trading, with tether tokens playing a pivotal role in trading pairs on many top-tier exchanges.

These exchanges include:

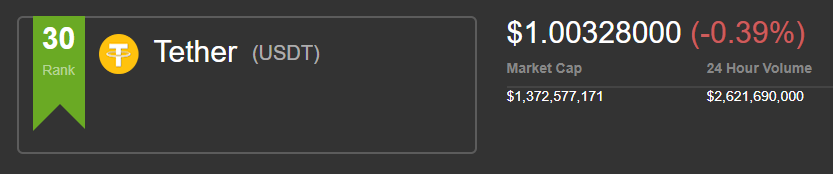

USDT and EURT have emerged as go-to options for traders looking to steer clear of the tax entanglements typical in crypto-fiat exchanges, a sentiment reflected in the surging tether supply, now topping 1.3 billion tokens.

Image via Coincap.io

Worries surface about exchanges heavily tethered to Tether's potential collapse. We’ll delve deeper into this shortly.

Currently, it’s critical to acknowledge that many investors are gravitating toward tether tokens, bearing significant implications for Tether's fate.

The Bitfinex Allegations

As Tether's use in crypto commerce grows, the project faces intensified scrutiny, with the community raising unsettling concerns.

If USDT genuinely has a fiat backing, everything is in order, confirming its status as a stablecoin.

Rumors swirling around revolve around Tether's ties with the prominent crypto exchange Bitfinex.

Speculations involve allegations of questionable collaborations, such as:

- unbacked (reserve-less) tether productions.

- money laundering

- collaborative cover-up

For clarification, both entities have fervently refuted these claims, dismissing them as baseless conspiracy theories while promising accountability and taking legal steps against the detractors.

Yet, despite these robust defenses, rumors persist...

The revealing of financial records in the Paradise Papers disclosed an unexpected revelation: as per The New York Times, Tether and Bitfinex... share top executives.

This remarkable connection is due to Giancarlo Devasini's executive roles at both firms, alongside Phil Potter's dual role as CSO.

Phil Potter, Image from New York Times

These previously hidden ties spark many questions. As the world's largest cryptocurrency exchange by volume, Bitfinex validates USDT. When tether volumes surge on Bitfinex, bitcoin prices jump suspiciously.

Why is this concerning? Because if USDT lacks solid backing, phantom liquidity infiltrates crypto markets, artificially inflating prices – akin to buying crypto with non-existent money, impacting values like bitcoin.

Is the crypto sphere truly facing this threat? Difficult to determine, yet the worry has grown significantly recently.

Tether And Bitfinex Respond

As noted, both projects are committed to defending themselves.

They shared a financial report in September outlining their situation, met with skepticism due to its informal nature and provided by a less-known accounting firm, lacking access to some data.

Amidst this, Bitfinex and Tether have enlisted 5W Public Relations to manage the fallout, steadfastly refusing to disclose their banking partners, citing past account closures like those at Wells Fargo as justification.

Apocalypse Tether

What's the worst-case scenario if the critics are proven right?

If exposed as unbacked, a domino effect could ensue.

Imagine the fallout if markets learn Tethers aren't entirely backed, triggering a USDT collapse.

An immediate drop in bitcoin prices on non-USDT exchanges would ensue as astute crypto investors rush to safety in fiat.

Following that, investors would migrate their holdings from USDT-dependent exchanges to those without USDT pairs, risking unintentional closures due to extreme trading volume.

Lastly, tether-reliant platforms, like Bittrex, may face insolvency as USDT and crypto prices plummet.

This nightmare is far from desirable, yet if Tether indeed stages a scam, exposure is inevitable, regardless of timing.

Our suggestion? Evaluate how swiftly you can switch your crypto to cash. Such practice could be invaluable if the worst unfolds.

Is the crypto realm prepared for a significant upheaval?

Crypto has faced downfall before, reminiscent of the... Twitter years ago, when many lost everything, and bitcoin nosedived by 86 percent. Yet, recovery followed, and... LinkedIn .

Should there be any fire beneath the USDT smoke, the crypto world might experience its second colossal downfall akin to Mt. Gox, with outcomes worsening before they improve. Those safely out of harm's way, cashed out, will prevail. Those entwined in the implosion could lose everything.

As it's often said, crypto values can plunge to zero without warning. We hope it doesn’t happen, yet preparing for the worst remains wise.