Trade.io Set to revolutionize the landscape of finance, Trade.io is an emergent blockchain-infused trading platform that promises market democratization. Utilizing peer-to-peer mechanics, the platform facilitates an extensive assortment of asset trades and introduces its native cryptocurrency, TradeToken.

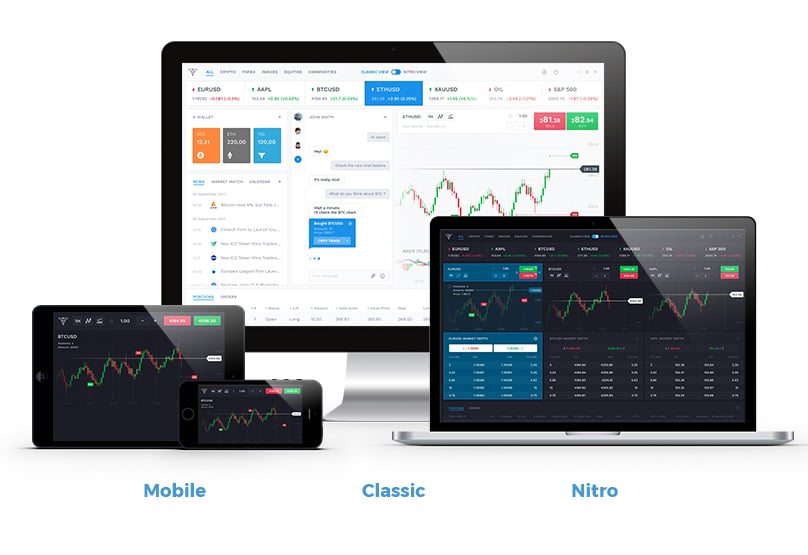

The minds behind trade.io aspire to cultivate the most extensive liquidity pool within trading circles, primarily to reward TradeToken custodians. They envision spearheading the trading of diverse financial assets, all while leveraging blockchain's prowess. Users have a selection of three interfaces to trade from: mobile, Classic, and Nitro.

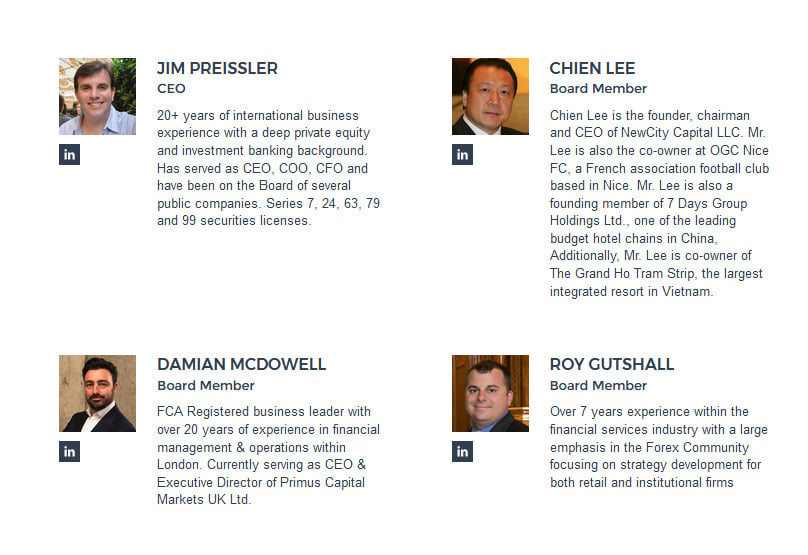

Who Is Behind Trade.io?

The management team behind trade.io Bolstered by over two decades in investment banking, the team brings expertise spanning IPOs, mergers, funding initiatives, and strategic advisory roles. Their leadership reflects an adept understanding of consulting, tech start-ups, and senior roles within publicly-traded entities, such as NASDAQ. At the helm, CEO Jim Preissler boasts hefty experience in the global business arena coupled with a substantial investment banking portfolio.

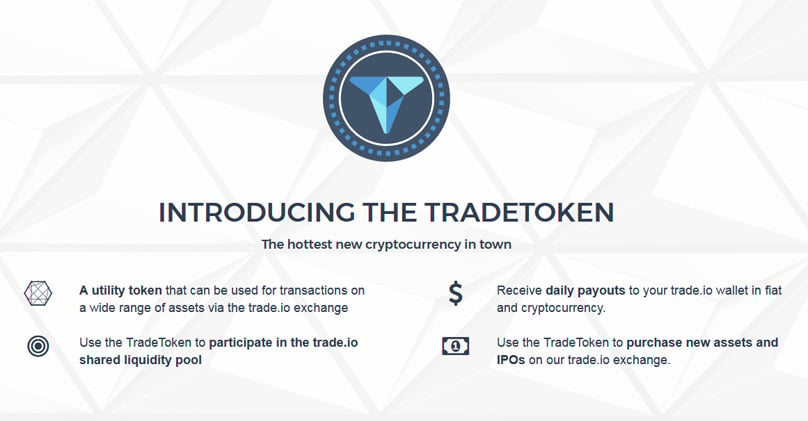

About TradeTokens

TradeTokens, pioneered by trade.io, offer an opportunity for savvy investors. Commencing on November 7, participants can acquire these during the pre-ICO phase, with the main ICO launching on November 22. Dubbed TIOs, these utility tokens serve as the transactional backbone across a spectrum of assets, affording access to the shared liquidity pool and facilitating new IPO acquisitions.ndTrade.io's ICO distinguishes itself by offering an impressive repertoire of 120 instruments, surpassing the usual cryptocurrency constraints of similar ventures. As pioneers in securing regulatory footing for investment banking, they set a benchmark not universally matched. Compared to novices in blockchain maneuvering, trade.io’s initiative is anchored by a decentralized liquidity pool and a wealth of blockchain P2P experience, elevating its fidelity.

What Should You Know About The ICO?

Introducing the ICO's opportunity: 275 million TradeTokens await eager investors, available for purchase as the ICO unfolds.

With the inherent risks tied to cryptocurrency investments, trade.io champions rigorous safety measures, setting a gold standard within the blockchain fintech realm. They diligently adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines, aligning with investment banking regulations.7 December until 4 January 2018.

- Tiered Pricing Structur

- Dec 7th 09:00 CET –Dec 14th 08:59 CET1 ETH = 900

- Dec 14th 09:00 CET–Dec 21st 08:59 CET1 ETH = 800

- Dec 21st 09:00 CET–Dec 28th 08:59 CET1 ETH = 700

- Dec 28th 09:00 CET–Jan 4th 08:59 CET1 ETH = 600

How Are Investments Kept Safe?

To bolster assurance, the ensemble brings vast expertise, including Wall Street veterans. The company collaborates meticulously with global regulators to fortify financial safeguards, enlisting renowned names in banking compliance. In a forward-thinking move, trade.io aims to secure a Swiss Banking license alongside an exchange license, both recognized for their stringent criteria protecting investments.

Steered by a diverse team from fintech, blockchain, and investment banking domains, trade.io benefits from a rich tapestry of experience ensuring its promising trajectory. The platform guarantees unassailable transparency through blockchain technology leaving every transaction with a traceable imprint.

What Sets Trade.io Apart From Others?

While many trading entities limit themselves to singular asset types, trade.io broadens horizons, facilitating diverse asset trades for individuals and institutions alike. An avenue to assist funds in raising capital or securing exchange listings further highlights trade.io's comprehensive scope. Distinguished by regulatory compliance — KYC, AML, and beyond — the platform paves the way.

Unique in its structure, trade.io's liquidity pool boasts varied revenue channels. From transaction proceeds to margin lending, transparency reigns. Participants are privy to daily payouts, integrated seamlessly into their e-wallets, either as fiat or cryptocurrency. The integration of TradeToken simplifies participation, setting trade.io apart.

Demystifying the Liquidity Pool

trade.io envisions the creation of one of the largest trading liquidity pools, promising ample rewards for TradeToken custodians. Approximately 50 million, equating to 10 percent, will integrate into the liquidity pool to aid trading.

Harnessing contemporary tech to ensure security and efficiency, trade.io employs a Web 2.0 Layer underpinned by C#.Net, HTML, and JavaScript. This high-tech infrastructure includes scripting, technical analysis, and charting tools, with data hosted on Azure cloud services, leveraging BigchainDB, IPDB, and IPFS/SWARM solutions. The system also utilizes the Ethereum mainnet and Raiden network for its P2P trading foundation.

What Technologies Does Trade.io Use?

Post-ICO launch on November 22, 2017, pivotal partners like FXPRIMUS and Primus Capital UK will embrace trade.io, amplifying its reach across their networks. The December roadmap is set to roll out the MT4 blockchain integration, with the trade.io Liquidity Pool’s debut in January 2018. An official platform launch is slated for April, succeeded by Swiss Banking licenses and trade.io Investment Bank opening by July. A capped year will witness the trade.io IPO in December 2018.

What Is The Timeline For Trade.io?

Upon its unveiling, trade.io stands poised to streamline asset investments for its clientele. Unlike conventional exchanges, bound by single asset types, trade.io’s vast versatility—spanning over 120 types—makes it an essential ally. Its grounding in regulatory adherence paired with the leadership’s seasoned disposition assures investors, cementing the platform’s triumph.

Conclusion

Leading Blockonomi editor and Kooc Media founder, Oliver offers an unwavering commitment to Open-Source principles, Blockchain advancements, and advocating a Free, Equitable Internet for all.

1Comment

Exploration needed: How swiftly can assets be liquidated during ICO periods, and what steps are involved?

Can it be redeemed before the ICO?

Disclaimer: Content on level-up-casino-app.com serves informational ends solely and doesn't represent offers to transact in any securities, products, or services. Opinions expressed should not be construed as investment advice; professional financial counsel is encouraged.