TradeCloud seeks to bring innovation to the commodity markets through its securities offering. security token offering . TradeCloud is a digital platform for the exchange of information and contract negotiation among traders, users, and producers of physical goods, usable on both desktop and mobile devices. It's been operational for over a year.

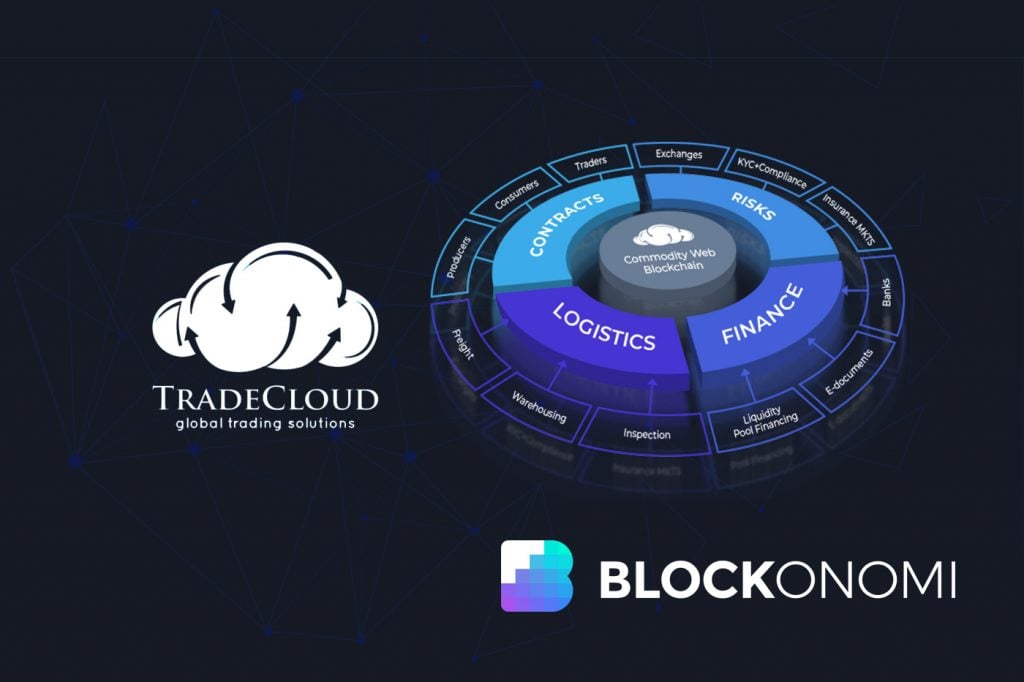

TradeCloud aspires to elevate the commodity industry via integrating advanced digital technologies. The system offers a pioneering communication hub known as The Commodities Web, a blockchain-based service network.

Identifying TradeCloud Goals

The brainchild of TradeCloud addresses the slow adaptation to technological changes in commodity markets, notably the limitation of outdated communication methods between service entities and market participants, leading to inefficiencies.

Rampant fraud and the poor adoption of digital solutions within the commodity domain have enabled manipulations like altered email payment directives. The disconnect weakens access to crucial services, including credit insurance and finance channels.

Outdated price discovery and operational inefficiencies pose challenges. These antiquated systems cause compressed margins and escalated operational costs.

By fostering communities and connectivity, TradeCloud offers a user-friendly, secure platform. Leaning on the Corda blockchain, it ensures swift and dependable processing of physical commodity transactions, enhancing fiscal margins and trimming costs.

History of TradeCloud

Engineered by experts in IT and commodities, TradeCloud is finely crafted to serve the physical goods market effectively.

Within just a year, TradeCloud has amassed over 400 users and 200 companies spanning more than 36 nations, enabling approximately $500 million in traded physical goods, with no signs of slowing down.

What Markets Does TradeCloud Serve?

Initially serving the metals sector, TradeCloud plans to expand into agriculture and energy, aiming for a substantial slice of an $8 trillion combined market—a potentially lucrative, yet untapped, e-commerce realm.

TradeCloud Token

TC tokens not only offer practical value but also entitle holders to 10 percent of the annual net profit over a decade, distributed equally among 50 million tokens through ETH airdrops.

Tokens exchanged for service use forfeit their profit-sharing capabilities, keeping utility and security traits separate. TradeCloud tokens offer services such as insurance, logistics, and trading.

Token Sale

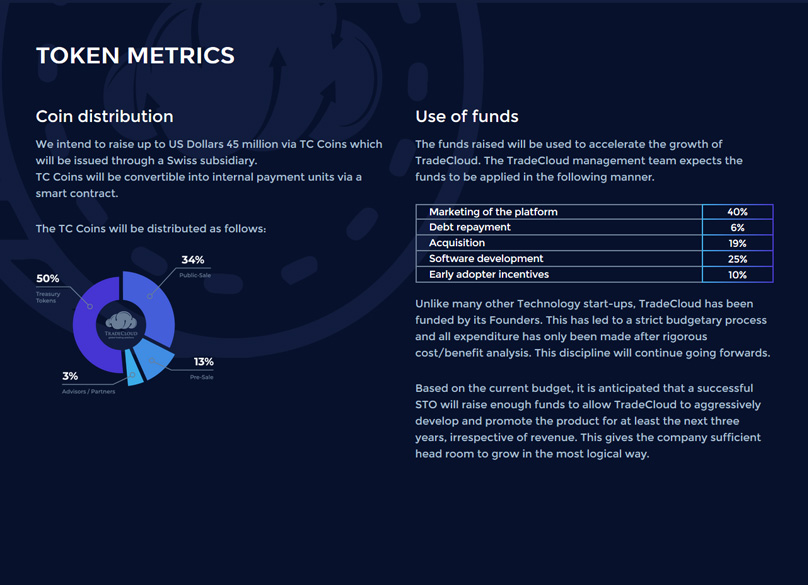

Funds for TradeCloud will be raised by selling TC Coins via a Swiss branch, aiming to gather up to $45 million. The coins enable convertible smart contract payments.

Tokens enter the market at $1 each. Private investors receive a 25% bonus while the public sale offers a 10% bonus. Minimum investments are $25,000 privately and $10,000 publicly.

In total, public sales account for 34% of TC Coins, 13% for pre-sales, 50% for treasury, and 3% for advisors and partners.

Begun in Q1 2019, the private sale precedes the public sale, both capped at 50 million tokens. Holders will gain from 10% of TradeCloud's net profits and token utility.

Due to regulations, citizens of the USA, South Korea, and China are excluded from this offering, with other regions also facing similar restrictions.

Allocation Strategy for STO Funds

The proceeds from TradeCloud's STO will fuel the platform's enhancement. Management plans to spend 40% on marketing, 25% on software development, 19% on acquisitions, 10% on incentives for early users, and 6% will address debt.

TradeCloud's founders have meticulously budgeted thus far. Remaining budget-conscious, they align spending with a detailed assessment of cost and benefit analysis.

With proper budgeting, TradeCloud anticipates adequate funding from the STO for the next three years, regardless of interim revenue—fueling development and promotion essential for solidifying TradeCloud's future.

TradeCloud Road Map

Born in August 2016, and live by October of the next year, TradeCloud has demonstrated its capabilities, buoyed by the $500 million trade mark and a strong global clientele since August 2018.

Pre-sales started in January 2019, soon to be followed by the public and private offerings.

Who Is Behind TradeCloud?

Backed by leading industry experts with passion and prowess, TradeCloud is set on advancing the world of physical commodities into the digital forefront.

Simon Collins brings his 25+ years of market prowess in commodities. With over 20 years under his belt, Matthew Botell adds substantial experience in trading physical commodities while Mark Cheong carries a broad array of senior financial responsibilities across sectors. Justin Wilson's IT consultancy and expertise bolster this dynamic team.

TradeCloud leverages well-established partners: Blocksmatter AG for advice, CMP AG handles escrow and AML, Inacta AG supports blockchain infrastructure, Dr. Mattia L. Rattaggi advises on regulations, Intrum AG oversees KYC compliance, with Volo developing software and R3 on blockchain under Microsoft Azure.

Conclusion

TradeCloud is at the forefront of merging the commodity sector with cutting-edge digital solutions to streamline costs and enhance profitability.

A thriving project, marked by significant trade volumes and a worldwide user base, TradeCloud is driven by a diversely experienced team in IT, technology, and commodity markets.

The STO's financial injection will propel further innovation, promising transformative impact on commodities through wider adoption.