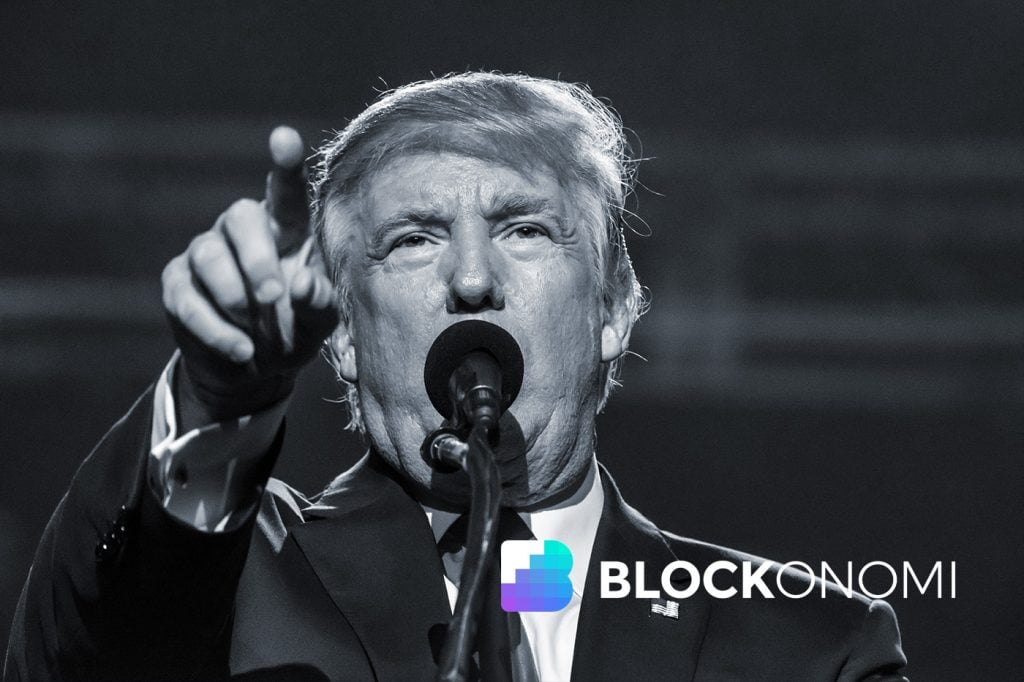

The anticipated commentary from Trump concerning Bitcoin has finally appeared. It arrived with fierce criticism of the cryptoeconomy.

On the night of July 11th, President Trump unleashed a Twitter storm against cryptocurrencies. He labeled Bitcoin and similar currencies as wildly unpredictable, with values built on nothing substantial, often associated with illegal operations.

As expected, his remarks ignited a flurry of reactions online, with many cryptocurrency enthusiasts defiantly responding.

“I am no enthusiast of Bitcoin or other cryptocurrencies; they aren’t real money. Their value swings wildly and lacks a solid base. Unregulated digital assets can enable unlawful acts, such as drug trafficking and other illicit activities...

— Donald J. Trump (@realDonaldTrump) July 12, 2019

In another tweet of his triad, the president pointed out that Facebook's upcoming Libra currency would have minimal stability or trustworthiness, only being the latest regarding officials at a global level casting doubt on Facebook's crypto project. He further stated that if Facebook or similar companies wish to function as banks, they should pursue banking charters and comply with banking regulations akin to other banks. In concluding his Twitter tirade, the president emphasized the dominance of the dollar, stating the U.S. has one authentic currency in circulation, stronger and more reliable than ever. What a formidable declaration!

...and on the international scene. The U.S. has a singular genuine currency, unmatched and consistently powerful globally — The United States Dollar!

These tweets emerged after months of efforts within the crypto community to prompt Trump into making a statement on Bitcoin. However, the president's current statements didn't align with the favorable comments many influencers had hoped for.

A possible reason for this surge was the president's awareness of Federal Reserve Chairman Jerome Powell’s earlier declarations that day voicing concerns about Libra and describing Bitcoin as a speculative value storage akin to gold.

— Donald J. Trump (@realDonaldTrump) July 12, 2019

President Trump has been an outspoken critic of Powell's financial strategies recently, monitoring the Chairman's actions closely.

The main question seems to be why now?

USD Maximalist at the Bully Pulpit

Powell’s remarks about cryptocurrencies were made before the Senate Banking Committee on Friday, implying that Trump might have observed the unfolding testimony as the day progressed, potentially learning about Bitcoin — possibly for the first occasion.

“Bitcoin...is a speculative store of value similar to gold.”

Federal Reserve Board Chair

Fascinatingly, during his testimony at Congress, Chairman Powell — leader of the United States central bank system — likened Bitcoin to digital gold:

— Jerome H. Powell

“Almost no one uses bitcoin for purchasing; it's viewed more as a substitute for gold. It's a speculative value-bearing asset.” https://t.co/64rk6XU0G3— Balaji (@balajis) July 11, 2019

Such an opinion may not resonate well with President Trump, who lately has been staunchly supporting the dollar, urging Chairman Powell to

to intensify competition with foreign currencies like the euro and the yuan.

China and European nations are engaged in substantial currency manipulation, injecting funds into their systems to rival the USA. We should EQUALIZE, or we risk being the naive observers as these countries continue their long-time tactics! use inflation President Trump has financial matters at the forefront, and he now clearly perceives cryptocurrencies as lacking real monetary value.

However, those invested in the cryptoeconomy argue that Trump's understanding is outdated. Even Supreme Court Justice Stephen Breyer has speculated before the nation's highest court that 'maybe one day employees will be remunerated via Bitcoin or another cryptocurrency form.'

— Donald J. Trump (@realDonaldTrump) July 3, 2019

Trump's recent calls for the Fed to maintain low rates and engage in quantitative easing (QE) underscore some of the primary selling points of Bitcoin: its perpetual deflationary nature and its immunity to political or economic influences of a finite term.

With key countries like China and Russia seeking to minimize reliance on the dollar amidst an environment of political mistrust, there could be a future for currencies like Bitcoin to emerge as reserve currencies exempt from single-nation control.

Currency Wars in Our Midst?

William M. Peaster is a skilled writer and editor specializing in the crypto realm, focusing on Ethereum, Dai, and Bitcoin. His work is featured in Blockonomi, Binance Academy, Bitsonline, and more. He tracks innovations in smart contracts, DAOs, dApps, and the Lightning Network. He's also honing his skills in Solidity. Connect with him on Telegram at @wmpeaster

Qubetics reaches $15.2 million during presale. What aspects make it stand out as one of the best choices for crypto newbies? Featuring Arweave's data storage and Astra's AI security.