TLDR

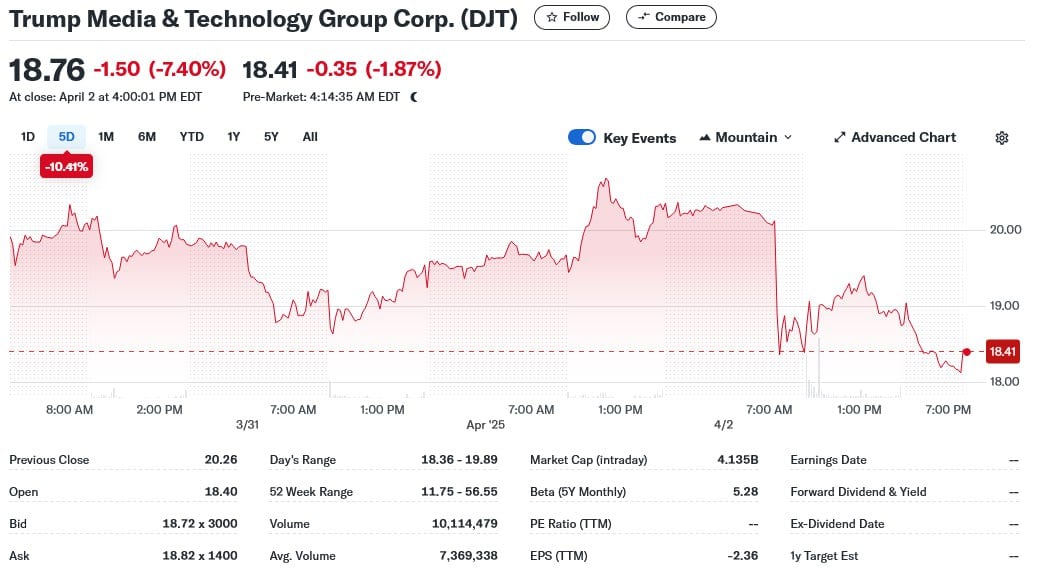

- Post-SEC filing, Trump Media & Technology Group stocks dropped by 7.4%, conceivably allowing Trump’s trust to sell a whopping $2.15 billion in shares.

- Assurances were made by the company, labeling the submission a 'routine filing' with 'no current intentions' of sale.

- A significant 52.2% stake, equating to 114,750,000 shares, are under the Trump trust's control.

- Trading at roughly 75% less than its near-$80 peak, DJT's market value feels the pressure.

- With Trump's 'Liberation Day' tariff announcements nearing and Newsmax entering the public domain, the timing of the share drop seems consequential.

Markets saw DJT shares plummet 7.4% to a low of $18.76, subsequent to a documentation submission to regulatory authorities by the company.

There's now a potential window for a Trump-managed trust to divest approximately $2.15 billion worth in stocks, though immediate sales aren't yet in the cards.

Stock turmoil persists for the company, even as the general market soars concurrently. At a low point, shares were marked down by 9%.

Filing Details and Company Response

Having filed a Form S-3 with the SEC, Trump Media suggests shareholder stock sales intermittently, but no promises of actual sales accompany it.

A company statement expounded, 'Today's S-3 submission, following up on previously registered S-1 shares, keeps our documents current.'

Echoing previous statements, the company emphasized there's no window open for affiliates wanting to dispose of stock, indicating administrative rather than imminent sale motives.

A vast 52.2% of Trump Media is wrapped up in 114,750,000 shares within the Donald J. Trump Revocable Trust, so reads the document.

Among those, a huge chunk, 78,750,000, classify as common stocks, with further 'earnout shares' due to Trump on April 26, 2024.

Insights into Business Movements and Financial Results

It's a bustling period for Trump Media with NYSE Texas having just hosted its debut for public trading while maintaining its primary presence in Nasdaq.

Standing as the pioneering list on NYSE Texas, Trump Media aligns itself with more traditional stock listings as well.

A new collaboration with Crypto.com seeks to innovate with ETFs centered on Bitcoin and alternative digital assets.

Amid vibrant ventures, financial headwinds prevail, hearing $3.6 million in sales reported for 2024.

Reflecting a problematic $400 million net loss, coupled with scant institutional enthusiasm, sheds light on the company's challenge-ridden landscape.

Market Context and Competition

Since its Wall Street inception in March 2024 — through merging with a SPAC — DJT's wall of volatility grows.

Delving 75% beneath its post-merger peak of almost $80 is where the stock currently languishes.

Slotting in just ahead of Trump's 'Liberation Day' tariff update, his anticipated tariffs threaten economic ripples globally.

Amid ominous chatter of trade wars, Trump Media's stock had already witnessed a 50% descension post-Trump's initial presidency entrance.

Shifting tides with Newsmax crashing the public sphere show signs of investor preference swaying from Trump Media toward this emerging competitor.

Offering a dramatic stock narrative, Newsmax's shares shot up early in the week, only to dive nearly 80% Wednesday, yet still surging 425% since launching.

Newsmax's fresh IPO could tempt those in the MAGA cohort, historically loyal to Trump Media's market sector.