TLDR

- President Trump has taken a bold step by signing an executive order to set up a Strategic Bitcoin Reserve, relying on seized crypto as a foundational resource.

- The new reserves are to be filled with Bitcoin that the government has already confiscated in legal proceedings, with no current intention of purchasing more, which reflects a cautious approach.

- Following the news, Bitcoin experienced a dip in value by approximately 5%, settling around $85,000, as the market processed the implication of stagnant government purchases.

- Secretaries Bessent and Lutnick have been given the responsibility to explore 'budget-neutral' ways to potentially enhance these reserves, a move welcomed cautiously by observers.

- The federal administration estimates its Bitcoin holdings at roughly 200,000 and is planning a comprehensive audit to accurately assess its digital asset wealth.

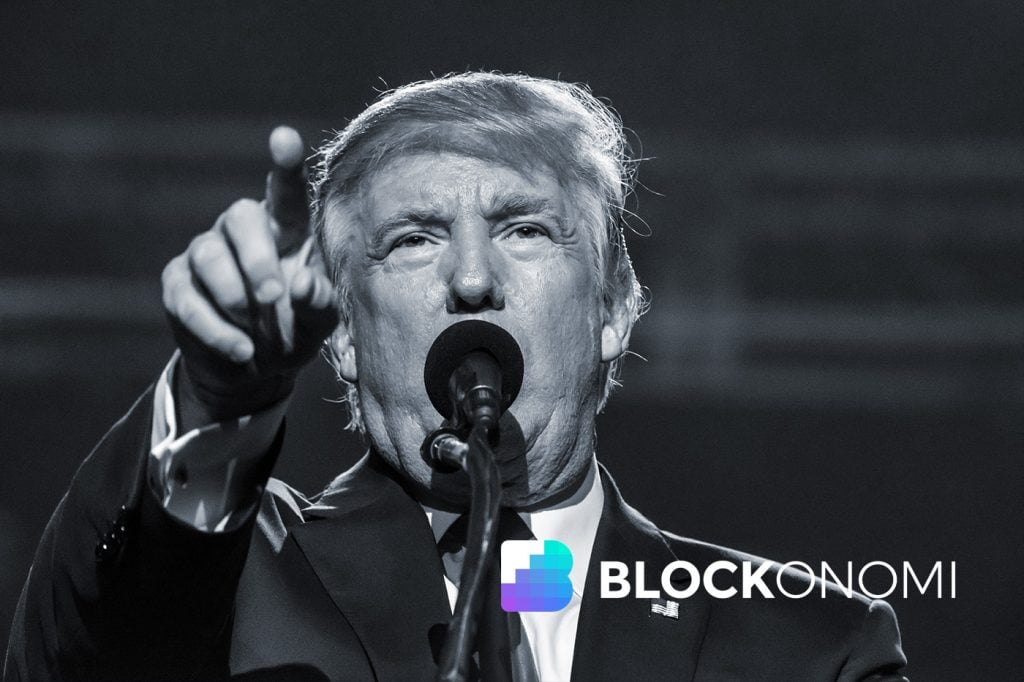

In a marked development dated March 6, President Trump officiated the establishment of a Strategic Bitcoin Reserve, signaling a noteworthy alteration in national digital asset strategies.

The directive aims to make the best of seized cryptocurrencies by holding onto them for future value, rather than liquidating them, reflecting a shift in asset management policy.

Tasked with overseeing the reserves, the Treasury will manage Bitcoin separately, while the Digital Asset Stockpile will encompass other seized cryptos.

The market didn't take too kindly to Trump's announcement, with Bitcoin swiftly dropping over 5% to about $85,000, before experiencing a mild rebound.

The decline seems to mirror investor frustration stemming from the government's decision not to proceed with immediate Bitcoin acquisition, in contrast to Trump’s previously hawkish crypto comments.

Market Disappointment

David Sacks from the White House clarified that the funding for the reserve will be sourced entirely from already-seized Bitcoin, ensuring that the initiative doesn't financially burden taxpayers.

Sacks further revealed the U.S. government's control over about 200,000 Bitcoin, with Trump calling for an exhaustive audit to account for these digital assets.

Moments ago, President Trump enacted an Executive Order to create a Strategic Bitcoin Reserve, heralding a new epoch in government-controlled digital assets.

Set to be funded by Bitcoin secured through legal forfeiture, this Reserve represents a strategic vault aimed at long-term gains rather than immediate sales.

— David Sacks (@davidsacks47) March 7, 2025

The order also restricts any sales from this Bitcoin securing its status as a steadfast store of value, akin to the nation's revered gold reserves.

A clear mandate has been given to Treasury Secretary Bessent and Commerce Secretary Lutnick to craft 'budget-neutral strategies' for either obtaining more Bitcoin or enhancing current reserves.

Yet, the order is sparse on specifics or timelines for broadening the reserve's assets, adding to a lukewarm reaction from investors eager for more transparency.

This initiative is timely, arriving just ahead of a major White House cryptocurrency summit where leaders are set to deliberate future digital currency policies.

Earlier statements from Trump indicated that this strategic reserve might diversify to include cryptocurrencies like Ether, XRP, Solana, and Cardano, drawing immediate feedback.

Such diversity in assets has stirred debate among followers, including Bitcoin mogul Tyler Winklevoss, who voiced concerns about the suitability of certain digital currencies. Bitcoin Sacks has previously criticized past decisions to sell seized Bitcoin prematurely, leading to significant financial losses, a mistake this policy aims to rectify.

Analysts caution that an unmanaged reserve could be vulnerable to market swings, with some worried about possible vested interests at play.

Trump's family involvement in cryptocurrency ventures, like meme coins, and a stake in crypto platform World Liberty Financial have been disclosed, but aides assert control has been transferred elsewhere. Bitcoin Crypto specialist Charles Edwards openly expressed his dissatisfaction, branding the reserve a mere rebranding of existing holdings without new acquisitions.

Despite mixed sentiments, proponents of the order argue that it marks a pivotal step toward asserting U.S. dominance in the digital asset realm.

This executive move marks a turning point in federal digital currency policy, hinting at long-term confidence in crypto amidst uncertainties about its actual rollout.

Maisie, with her wealth of experience in financial journalism, has contributed significantly to various publications as an Editor in Chief, providing crucial insights into the world of digital currency.

Bitcoin experienced a sharp drop, touching $83,400, coinciding with Trump's announcement around tariffs, a move that rippled through the crypto market.