Umoja is a cutting-edge decentralized finance (DeFi) protocol, hailing from Umoja Labs , aiming to transform the asset hedging landscape across digital currencies, traditional currencies, and tangible assets. The platform introduces an innovative approach that streamlines and automates hedging, making advanced strategies both affordable and accessible.

At its core, Umoja provides adaptable hedging mechanisms and solutions specifically designed for unique assets and individual risk profiles. Users can effortlessly deploy automatic, adaptable hedging solutions that offer protection against challenges like market fluctuations and potential losses. The protocol stands out with its efficiency – fees up to 80% cheaper than traditional models and collateral demands 10 times lower.

What sets it apart is the ease and accessibility. Umoja brings sophisticated hedging methods to everyone's fingertips, from crypto enthusiasts to big-time investors. The process is straightforward – choose a suitable fund, make a payment, deposit refundable collateral, and obtain Hedge Tokens as security. Engaging with Umoja is as intuitive as using your preferred digital exchange.

The protocol innovatively includes an insurance pool powered by fees to shield against major financial incidents. Payouts and collateral returns are proportional to the performance of chosen hedging portfolios, offering tailored protection and guaranteeing accessibility.

Quick Overview: Umoja serves as a decentralized finance protocol, designed to democratize sophisticated asset hedging with automation and affordability for both personal and institutional use.

Quick Summary

- Umoja Delivers automated, bespoke hedging strategies that are user-friendly

- Dramatically more economical than conventional alternatives with fees reduced by 80%

- Highly versatile coverage based on personalized risk appetites

- Incorporates an insurance fund and payout mechanism for handling events

- Prioritizes DeFi accessibility by simplifying the hedging process

Umoja: Key Features and Innovations

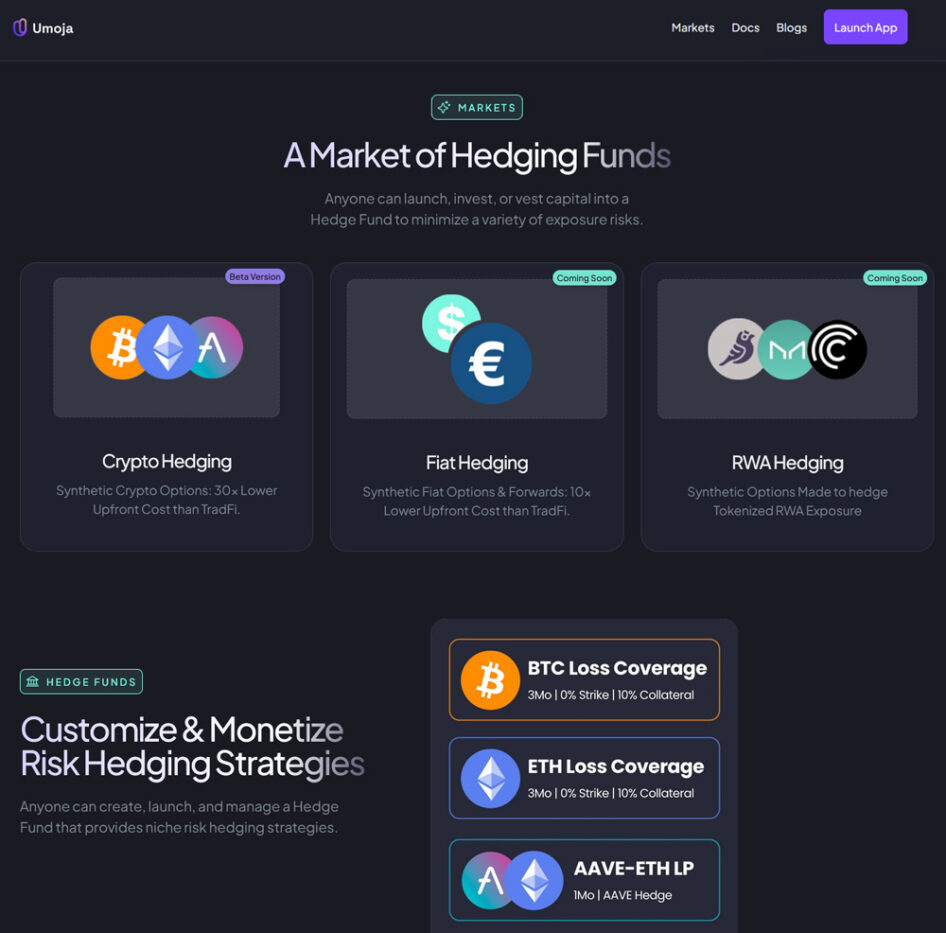

Umoja diverges from standard options markets and hedging programs by being automated and offering high-efficiency strategies at low costs. It's adept at handling diverse assets to aid in managing market risks.

By utilizing cryptocurrencies, standard currencies, and tokenized real-world assets, it becomes a valuable tool for traders and investors.

The initiative provides an innovative toolkit enabling traders to navigate the crypto market using tools vastly superior to traditional alternatives, leveraging synthetic options facilitated by automated trading systems based on leveraged futures.

Noteworthy Attributes of Umoja:

- Tackling Market Instability: Umoja, once a lending platform, now focuses on the volatile DeFi markets, presenting hedge options for events of sudden market downturns.

- Streamlined Hedging Techniques: Requiring a mere 10% margin, entry costs for asset safeguarding are lowered, making hedging more accessible.

- Product Flexibility for Strategic Coverage: Investors can tailor their hedging strategies to match their acceptable risk levels, ensuring adaptable investment risk management.

- Zero-Risk Staking: Umoja introduces a novel feature allowing investors to yield returns from crypto assets without risking the principal, expanding DeFi's reach.

- Vision of Universal Hedging: Umoja aims to establish hedging as a fundamental right, ensuring traditional methods become more affordable and simpler.

- Roadmap for DeFi Shift: The goal is a complete transition to a DeFi platform by the second quarter of the year, bolstered by significant support from industry giants like Avalanche Foundation and Coinbase Ventures.

- Beyond Hedging: Umoja Labs employs technology to resolve real-world challenges, partnering with global organizations to offer digital disaster relief and affordable credit solutions for small businesses.

The platform eliminates the necessity for liquidity providers, thereby saving substantial costs. Implementing new strategies provides investors with flexible, budget-friendly options, making it easier for any investor.

A recent episode of the “ Behind the Startup ” series centered around Robby Greenfield IV, delving into the essence of the platform as it plans to revolutionize traditional cryptocurrency hedging methods.

Greenfield, with a rich background in financial markets, financial engineering, and product management, has held roles at global firms like Goldman Sachs, Amazon, and ConsenSys. His extensive financial expertise positions him well to lead the company.

Revolutionizing Crypto Hedging

The automated hedging feature differentiates the platform in terms of affordability, adaptability, and user-friendliness. It’s a unique asset in the market. The platform delivers a customizable risk management tool within the DeFi ecosystem, bypassing LP liquidity and enabling adaptable hedges.

With these features, Umoja can address liquidity challenges in markets that don’t prioritize ETH or BTC. This innovative liquidity approach could significantly impact the market.

Recently, Umoja showcased an early version of its risk management-as-a-service model entering its testing phase. Additionally, Umoja introduces centralized finance (CeFi) Dynamic Term Loss Safeguards for assets such as Bitcoin, Ethereum, and Avax.

Compared to traditional methods, this approach demands less capital and offers investors more flexibility in shielding themselves from uncertainty’s negative impacts.

Due to a groundbreaking zero-risk staking feature, users can deploy assets for returns without significant capital risk.

The service aims to enhance risk management accessibility. Implementing a safeguard necessitates a recoverable 10% security deposit, reducing entry barriers. To ensure ongoing protection, the deposit should not drop below 5%.

User Experience and Accessibility

Umoja simplifies hedging, ensuring anyone can secure themselves without expert knowledge. No need for extensive knowledge about derivatives, as the platform automates most tasks.

The method involves selecting a token, defining the protection amount and duration, establishing the initiation cost, and selecting minimum collateral with a fee.

This streamlined approach ensures users can protect their assets without dealing with derivatives’ complexities.

Strategic Collaborations and Social Influence

Working alongside industry leaders like First Crypto Hedge Fund, Chainlink, Avalanche, Gogopod, and Benqi, Umoja provides a valuable impact for communities affected by bear markets.

The strategy for 2024’s second quarter includes transitioning from a centralized to a decentralized system, launching both CeFi-based and fully decentralized services by year-end.

Proper risk mitigation allows investors to remain resilient in the unstable DeFi market. In line with Greenfield’s belief, risk mitigation shouldn’t be a luxury!

The Future of Hedging in DeFi

As DeFi continues to grow, the demand for effective risk management becomes urgent. Umoja addresses this by offering a protocol that balances ease, affordability, and adaptability.

Besides aiding those involved in DeFi, Umoja makes it easier for newcomers to overcome cost and process hurdles associated with traditional methods.

Umoja sets the standard for the industry, offering improved risk management, user-friendly interfaces, democratizing safe hedging.

The ecosystem empowers investors to reposition easily, minimizing risks tied to erratic markets.

In light of cryptocurrency’s volatile nature, Umoja’s futures and hedging protocol offers crucial risk management solutions.

Umoja is an excellent choice for anyone looking to secure their crypto holdings. It exemplifies how cutting-edge blockchain technology can create inclusive financial systems.