The two titans of the cryptocurrency world, Bitcoin and Ethereum , employ fundamentally different transaction paradigms, each suited with its own perks and challenges. Grasping these models aids in comprehending not just their mechanics but also the foundational tech that elevates similar blockchain enterprises.

On cryptocurrency fronts, arriving at a consensus is key for network security and authenticity of blockchain states, but a platform's transaction model is what really cements the claim over tokens. Bitcoin champions the UTXO mechanism, whereas Ethereum banks on the Account-Based system. These models, foundationally speaking, are schemes for managing a digital database's state trail, playing pivotal roles in their respective ecosystems.

As the pioneer of digital currencies, Bitcoin introduced the UTXO model, an abstract shift in handling transactions, while Ethereum's Account-Based model mirrors the traditional financial account systems.

The UTXO Model's Role in Bitcoin's Architecture

The lightly veiled intricacies of Bitcoin's UTXO model rise in abstraction compared to Ethereum's more tangible account-based approach. This intricate component allows Bitcoin to maintain its transparent nature, interlinking transactions via a digital signature chain.

Read: Our Guide to Nakamoto Consensus

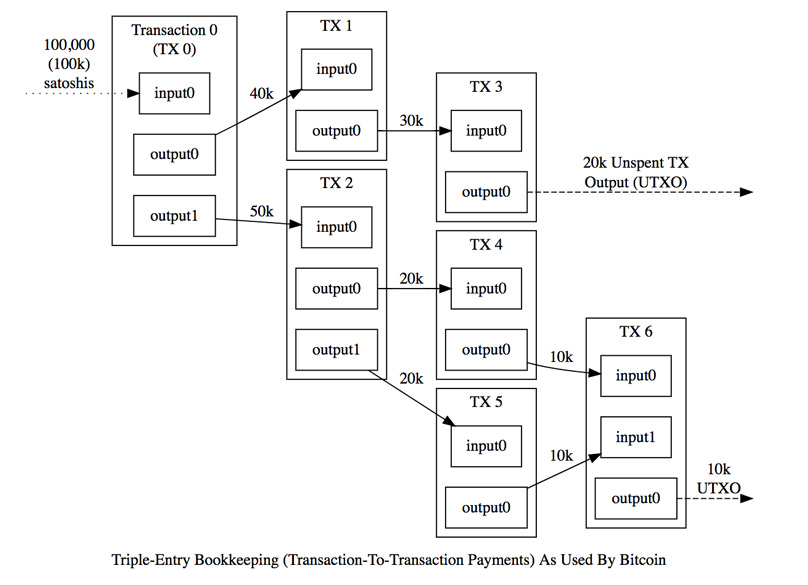

In UTXO systems, token transfer is executed through digitally signing the previous transaction's hash and the subsequent owner's address, achieving a progressive cycle of inputs and outputs. Token owners don't directly manage tokens but possess outputs signed over as inputs to new owners, shaping control over fresh outputs. The UTXO model centers on three core rules.

- Every transaction needs to validate that its input totals surpass the output totals.

- Every referenced input should be unexploited and authenticated.

- An input's ownership signature must be aligned with the transaction’s input address.

A common UTXO scenario unfolds with Alice and Bob: Alice, possessing 10 BTC, intends to transfer 5 to Bob, who has none. Instead of holding 10 BTC outright, Alice possesses transaction outputs akin to 6 and 4 BTC. Her wallet singles out a fitting output for Bob—in this instance, 6 BTC, transferring ownership of 5 BTC to him as he provides the fitting address and digital signature to assume control of the new output. The remaining 1 BTC is Alice’s unspent transaction output (UTXO). Consequently, Alice's new holdings are 1 and 4 BTC, while Bob commands 5 BTC. This ownership trail can be authenticated by a payee through signature verification on the public distributed ledger. Notably, Bitcoin originates through a special 'coinbase' transaction, devoid of any input.

UTXO Model, Image from Bitcoin.org

Theoretically, the UTXO model lends to streamlined scalability and simplifies Bitcoin's consensus protocol (PoW), thereby fortifying the network's broad-scale security and operational scalability. Moreover, Bitcoin's support for multidimensional scripts advocates more nuanced payment processes.

The UTXO framework boasts numerous benefits within the Bitcoin ecosystem. Significantly, it enables Simple Payment Verifications (SPV), allowing for decentralized, trustless engagements with the blockchain, sparing the need to download the full blockchain, which is resource-efficient for mobile apps.

Plus, UTXO empowers concurrent processing across diverse addresses, bolstering the infrastructure's scalabiility potential. Transactions undergo parallel processing since they relate to autonomous inputs. Furthermore, generating fresh addresses per transaction enhances privacy despite blockchain transparency. Yet, tracing techniques, growing more prevalent, challenge the presumed fungibility within Bitcoin.

Despite UTXO's inherent strengths within Bitcoin's setup, applying this model in complex, all-encompassing environments like Ethereum unearths some setbacks. Application creation based on UTXO mandates restricted state effects per output, and since the UTXO format doesn't readily align with smart contract deiagns, it's unwelcome in scenarios needing multilateral output ownership.

Ethereum's Account-Based Framework and Its Implementation

The Account-Based model, familiar to many, operates comparably to traditional financial systems in Ethereum. It facilitates direct value and data transitions through state transformations.

Read: Our Complete Guide to Ethereum

To illustrate, let's consider Alice and Bob's transfer. Alice proposes sending Bob 5 tokens; Alice's balance shows 10 tokens, Bob's shows zero. The Account-Based model docks 5 tokens from Alice, credits 5 tokens to Bob—Alice and Bob now both hold 5 tokens. This formation parallels classic finance's transactions, where centralized authorities regulate transactions, preventing double spends.

Ethereum bifurcates accounts into private key governed user accounts and code-governed smart contracts. This structure justified Ethereum's transition away from the UTXO model, as Ethereum employs Solidity, a Turing complete language accelerating smart contracts and benefiting from the Account-Based model's inherent simplicity despite UTXO complexities in Bitcoin. Given Ethereum's plethora of decentralized apps containing varied states and codes, adopting Bitcoin's UTXO model fails to fit Ethereum’s needs.

Ethereum accounts manage individual balances, storages, and code-space for transactions, valid if adequities cover payments and if receiving accounts run corresponding codes to alter internal setups or dispatch supplemental actions potentially affecting other accounts' states. Thus, new blocks can globally redefine account states.

The Account model's primary merits within Ethereum include higher storage efficiency, simplicity, and transaction ease, besides providing enhanced fungibility than found in Bitcoin. Account transactions require merely citing one reference and signature producing one output, maximizing storage on Ethereum's larger scale platform. Furthermore, Ethereum's account model, ensuring increased fungibility over Bitcoin, complicates transaction trails with 'client remote procedure calls', making transaction linking challenging compared to Bitcoin’s digital signature-laden UTXO model. Therefore, Ethereum coins evade merchant blacklists better than Bitcoin.

Nonetheless, the Account model's downsides revolve around platform scalability, reflecting Ethereum's scalability hurdles affecting the expansive industry. Crafting logic on an account architecture comes with complexity compared to UTXO, potentially impacting Ethereum’s evolving design.

Conclusion

Within cryptocurrency ecosystems, distinct design approaches and technical machinations make platforms function viably, securely, and operationally.

Cryptographic transaction models ascertain token ownership verification within networks. While Bitcoin thrives on UTXO precision, Ethereum’s Account-Based model supports its complex contractual needs adeptly.

A Deep Dive into Bitcoin vs Ethereum: UTXO Compared to Account-Based Transactions

4Comments

Great article

very good article

Very nice explanation.

However, one thing is not clear for me:

Bitcoin, being the trailblazer in cryptocurrency, relies on the UTXO model, an abstract yet pioneering approach. In contrast, Ethereum’s transaction model is more akin to traditional bank account frameworks.

Understanding Bitcoin: Unspent Transaction Outputs Explained

Decoding Ethereum: How the Account-Based Model Shapes Transactions

Bitcoin’s use of the UTXO model may seem abstract but it's crucial for linking transactions through a chain of digital signatures, offering transparency.