Anytime Warren Buffett shares his views on money, it's usually well received. His distinguished career are in good order as the 'Oracle of Omaha' includes being the chairman and leading shareholder of global conglomerate Berkshire Hathaway since 1970, and he has amassed a personal fortune of nearly $83 billion, ranking him as the world's third-wealthiest person as of early 2018. Briefly, in 2008, he even became the richest person globally, before trading places once more with Microsoft’s Bill Gates.

Still, Buffett has attracted significant backlash for his harsh criticism of Bitcoin. Without holding back, the seasoned investor has labeled Bitcoin as fraudulent and predicted its unspectacular demise. Whether Buffett’s predictions will be proven right will only be revealed in time, but some detractors argue that his comments reflect bitterness over not having anticipated Bitcoin’s rise.

Early Life and Career

Originating from Omaha, Nebraska, Warren Buffett's roots are deeply tied to the city where Berkshire Hathaway’s headquarters also reside. Hailing from a political family, with his father as a Congressman, Warren embarked on his entrepreneurial journey early. It's said his initial ventures involved reselling sodas from his grandfather's store—earning five cents for every six-pack. five cents apiece —netting him a five-cent profit per pack.

At the tender age of 11, Buffett made his first foray into the stock market by purchasing three shares of CitiesService Preferred at $38 each. He later sold them at $40, only to watch them later soar to $200, a moment that shaped his investment philosophy encapsulated by his famous line: 'The stock market is a device for transferring money from the impatient to the patient.'

Buffett’s academic path took him through several institutions, culminating at Columbia University where he met Ben Graham, a seasoned investor active post-1929 Crash. While their investment styles diverged, with Graham favoring low-risk ventures and Buffett preferring deep dives into a company’s potential for his risk evaluations, they Buffett’s mentor contrasted sharply. Despite these differences, Buffett eventually cashed out a large portion of his investments, retaining key holdings that would lay the groundwork for Berkshire Hathaway.

A young Warren Buffet, Image from YouTube

Today, Berkshire Hathaway outright owns featuring numerous familiar brands such as Dairy Queen, Fruit of the Loom, GEICO, BNSF Railway, and Pampered Chef. Moreover, it holds substantial stakes in firms like Kraft Heinz, American Express, Wells Fargo, Coca-Cola, Apple, and Bank of America.

Buffett has long been a fixture at the White House, having offered economic advice to President Barack Obama and supporting Hillary Clinton’s presidential campaign.

Buffett on Bitcoin

Buffett has always been skeptical towards Bitcoin. In early 2018, he restated his disapproval of the cryptocurrency sphere during prominent interviews with top-tier media.

For Buffett, cryptocurrencies signify a gamble rather than a proper investment. He's gone to the lengths of labeling Bitcoin probably rat poison squared” as a hoax during a Berkshire Hathaway investors' gathering.

Warren Buffett, Talk Bitcoin on CNBC

Additionally, he predicted a dramatic rather than quiet demise for cryptocurrencies.

Buffett expressed to CNBC that cryptocurrencies are bound for an unfortunate outcome. 'Given the chance to buy a five-year put on all cryptos, I'd do so gladly, although I wouldn’t short them,' he declared.

These controversial predictions have met with notable disapproval from the crypto community. The critiques are principally twofold: First, Buffett hails from a bygone financial era, and his grasp of Bitcoin's intricacies is limited. Second, he has a firm understanding of the digital currency dynamic and views it as a competitor to his interests in conventional banking.

Old Money Versus New

Venture capitalists such as Fred Wilson and Balaji Srinivasan, the CTO for Coinbase, responded to Buffett during an event by the Consensus 2018 event in New York City.

'Labeling it 'rat poison' indicates a lack of endeavor to grasp its true implications,' Wilson remarked in an interview with the Wall Street Journal. 'Viewing it merely as a new asset or swap means you miss the revolutionary shift as a pioneering core internet technology, which packs untapped functionalities previously not possible, akin to LAMP stack innovations. This technology underpins a new blueprint for future applications, with tokens fueling this ecosystem.'

Srinivasan noted that while Buffett is among the most visible cryptocurrency antagonists, his position isn't universally held. Influential figures from the IMF and high-ranking authorities at Goldman Sachs are optimistic about crypto's future, with Goldman even laying the groundwork for its crypto exchange.

Critics suggest additional remarks from Buffett illustrate a knowledge gap regarding cryptocurrencies and their long-term viability.

‘We have neither bought, nor shorted, and plan on steering clear of them,’ Buffett stated. 'I already have my hands full with investments I feel I understand, and why would I gamble on something I don’t know?’

An Emerging Threat

At least some market watchers believe allude to his statements as being somewhat performative. Although Buffett's investment foresight has been remarkable, sometimes resisting innovation, he nonetheless adapts to the evolving market, argues some proponents.

It’s far more likely, these observers say , his recognition of crypto’s potential challenge to traditional banks, which align with Berkshire Hathaway’s stakes in institutions like Bank of America, Wells Fargo, and others, is clear in this context.

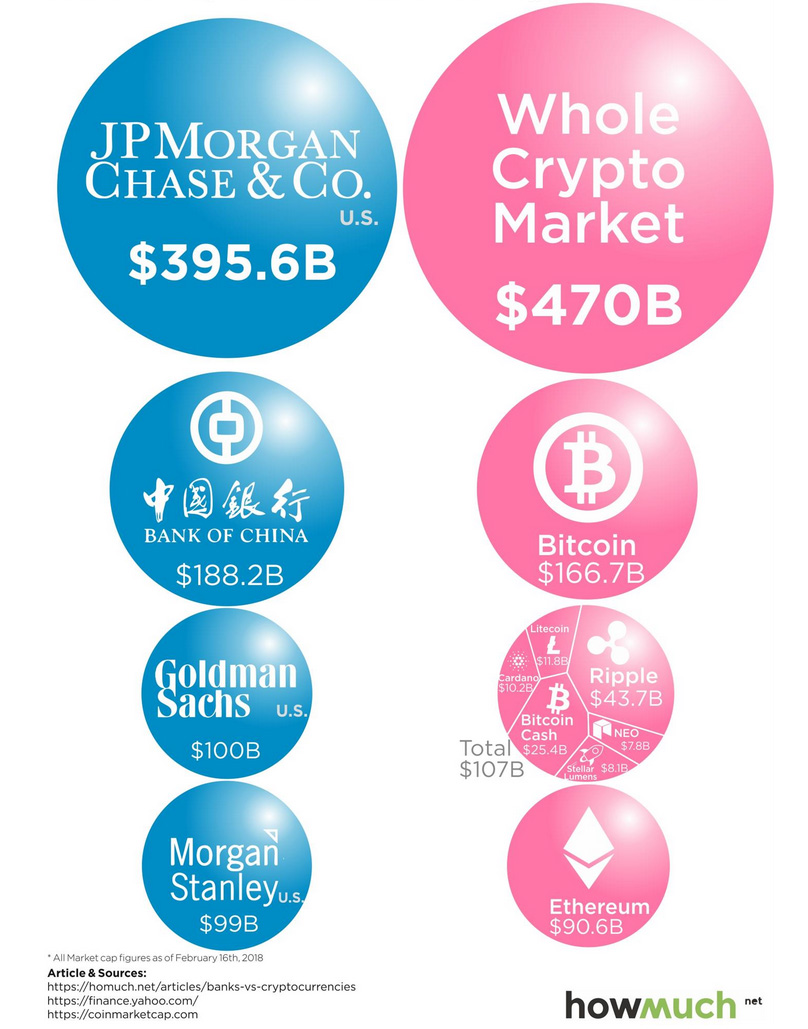

Banks vs Cryptocurrency, Image from HowMuch

The market cap of Ethereum competes with giants like JP Morgan Stanley, while Bitcoin’s value rivals the Bank of China. The apprehension surrounding crypto stems from its disruptive potential to erode banks’ market dominance and eliminate their profitable intermediary functions—a goal explicitly articulated by Bitcoin creator Satoshi Nakamoto ’s Bitcoin paper .

‘The need is for a cryptographic-based payment system enabling direct transactions between willing parties without needing a trusted intermediary,’ Nakamoto penned. ‘Transactions unfeasible to reverse would shield sellers from deception, with straightforward escrow mechanisms safeguarding buyers.'

Buffett: Relevant or Rusty?

Whether cryptocurrencies thrive or collapse over the long run, within Buffett’s lifetime, may remain unknown. Some crypto ventures plan over extensive timeframes, and having been involved in business long before WWII, Buffett’s remarks, as well as his sway over conventional banking, might persist even beyond his legacy. The question lingers whether his perspective labeled ‘rat poison squared’ validates or timestamps his enduring influence.

References

- https://www.thebalance.com/warren-buffett-biography-356436

- http://www.businessinsider.com/lessons-warren-buffett-learned-from-benjamin-graham-2015-5

- http://www.businessinsider.com/facts-about-warren-buffett-2016-12

- https://www.cnbc.com/2018/05/05/warren-buffett-says-bitcoin-is-probably-rat-poison-squared.html

- https://bitcoinmagazine.com/articles/fred-wilson-explains-why-warren-buffett-doesnt-get-bitcoin/

- https://themerkle.com/are-gates-buffet-and-munger-all-threatened-by-bitcoin/

- https://howmuch.net/articles/banks-vs-cryptocurrencies

- https://bitcoin.org/en/bitcoin-paper

- https://www.nasdaq.com/quotes/institutional-portfolio/berkshire-hathaway-inc-54239