Imagine you’ve been in the Bitcoin scene for a while, with some BTC hanging around that you’re willing to play around with.

If that sounds familiar, you might have also caught wind of Ethereum's booming decentralized finance scene where BTC can be put to use in various innovative ways, even if the starting line hasn't appeared clear yet.

If you're feeling this vibe, your search for a starting point ends here. Follow this simple walkthrough on Ethereum’s top BTC token right now, thanks to BitGo's support, and explore the varied avenues to make this token productive within DeFi. WBTC project Explore #3 – Enhance Protocols with Liquidity

The ERC-20 BTC Boom Has Begun

Throughout 2020, Bitcoin and Ethereum have grabbed the spotlight, flourishing as the cryptoeconomy leans decisively bullish, marking a significant upswing not witnessed in years.

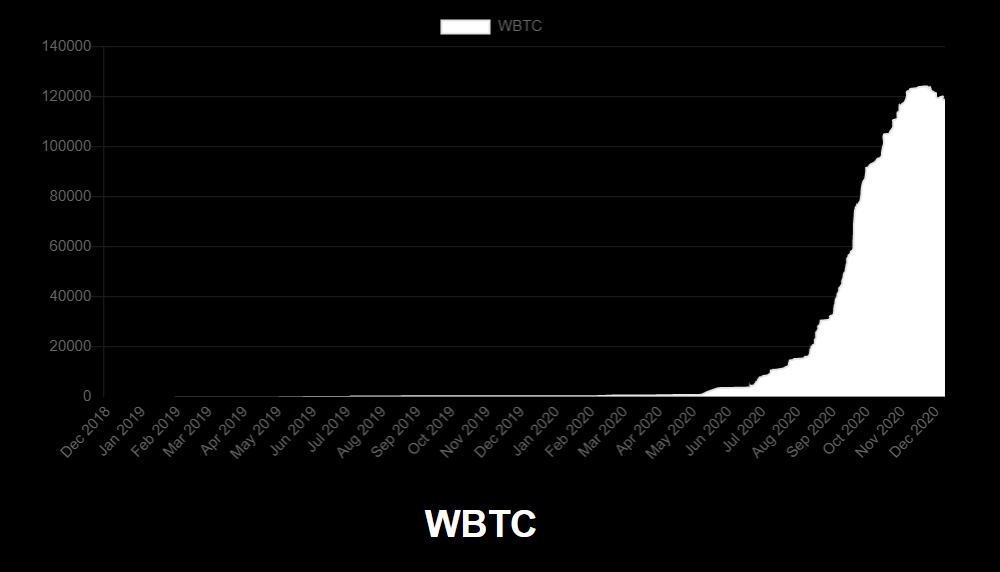

As such, we’ve seen a tokenization boom around BTC Take, for example, data from a tracker site: there are now over 145,000 BTC transformed into tokens on Ethereum, with the lion's share — surpassing 117,000 at present — achieved through the WBTC initiative.

To appreciate the sharp rise of WBTC this year, check out the following graph and observe how WBTC only went past its 20,000th unit milestone in August. This means the number of minted WBTC rocketed by roughly 500% in the span of just a few weeks! btconethereum.com This surge in activity has been predominantly focused around one thing at the moment: Ethereum DeFi.

The DeFi ecosystem opens the door to novel financial engagement methods, all executed in a decentralized manner. This dynamic has sparked significant buzz in Defi across the cryptoeconomy this year.

In January, DeFi projects managed assets valued under $1 billion. Fast forward to now, and the space has exploded to nearly $15 billion AUM, and it's not even been a full year.

DeFi: the New Frontier

This explosion is fueled by maturing promising projects, the arrival of new initiatives, and the growth of diverse segments such as decentralized borrowing, lending, derivatives, and more.

In this thriving environment, WBTC has become a hot commodity as people uncover different ways to put their bitcoin to work. Let's delve into these top usage scenarios and see what might intrigue you!

Perhaps the most effective use of your WBTC now is to take a loan against it through lending protocols like Maker and Compound, all without the need for paperwork or in-person consultations!

To demonstrate why this feature stands out, let’s take a hypothetical scenario involving Bitcoin Pizza Day hero Laszlo Hanyecz, who famously lost out on millions by purchasing two pizzas for 10,000 BTC back in 2010. Had Maker or Compound been around then, Hanyecz could’ve borrowed stablecoins against his WBTC to purchase the pizzas using the stablecoins while paying back the loan bit by bit, thus preserving his WBTC which could rise in value versus USD-linked tokens.

Idea #1 – Borrow Against Your WBTC

In essence, if you're looking to gain immediate liquidity and purchasing power from your BTC holdings without parting with them, borrowing against WBTC in DeFi is indeed an exciting possibility. You could even use your borrowed funds to go long by acquiring more WBTC!

On the other side of the DeFi borrowing story is the lending aspect.

This lets you lend out your WBTC to other users in the DeFi space, although the current returns may not be overly impressive. Keep that in mind!

Idea #2 – Lend Your WBTC

However, if you're keen on exploring productive avenues for your WBTC, lending it should definitely be on your radar. Platforms like Aave and Compound stand prominent here.

Another crypto-native way to earn with your WBTC is by engaging in liquidity providing (LPing).

Consider the leading trading protocols today, such as Uniswap and SushiSwap. WBTC pools within these protocols are currently popular, allowing you to earn considerably from trading fees by acting as an LP in either scenario.

Explore #4 – Engage in Yield Farming using WBTC LP Tokens

For instance, the largest DeFi farm by total value locked (TVL) at the moment is SushiSwap's.

The farm's rewards may dip and rise, but with current returns at 20% annually, they’re quite attractive. Expect to witness similarly enticing LP strategies in the coming years.

Suppose you're interested in LPing but aren’t sure about the next steps. It might be time to check out staking! WBTC/ETH pool The process is easy: find a yield farm you are keen on providing LP for, and partake in the farms you favor by staking your LP tokens in any of the endorsed farms.

Explore #5 – Fuel Decentralized WBTC Options

This toolkit simplifies locating suitable WBTC farming avenues, granting you the freedom to dive in when you see fit.

Another route to consider is offering WBTC liquidity to Ethereum-focused derivatives projects like Hegic.

As for finding farms, I recommend the CoinGecko farming dashboard Taking a closer look, Hegic is a decentralized protocol that conveniently allows you to take out DeFi insurance policies based on your choices. Since the DeFi derivatives sector is in its infancy, the idea is to serve as a WBTC LP and earn accordingly. Yet, numerous risks exist given the project’s newness, so proceed with caution.

Ethereum stands as the leading platform for smart contracts, adept at tokenizing virtually anything. The ERC-20 token standard on Ethereum provides a seamless way to represent and trade assets like bitcoin, which exist outside the network, right atop Ethereum.

One of this year’s major DeFi highlights revolves around DeFi indexes, with notable mentions centering on the latest offerings by PieDAO.

As a result, it makes complete sense for WBTC holders eager to mint their WBTC into a broader DeFi index offer, given the current conservativeness of these offerings.

Idea #6 – Mint a DeFi Index like BTC++

Just bear in mind that there are certain fees involved if you're planning to slot into this cautious farming setup. If you're comfortable with such fees, the future of Ethereum could very well be your playground! Farm thoughtfully, though!

OpenSea stands as a leading NFT marketplace currently, offering a comprehensive NFT marketplace where you can use WBTC for purchases.

As such, OpenSea has recently enabled WBTC transactions. This means you can buy both tangible and digital items, among other things, at participating stores, all in NFT form. Ensure you look for the best offers available!

Idea #7 – Shop for NFTs on OpenSea

Let’s imagine you have amassed a good sum of WBTC, and you're contemplating cashing out. Coinbase is your go-to!

Essentially, if you possess some WBTC you wish to convert into fiat currency, WBTC to USD is a straightforward transaction on Coinbase (or Gemini, or any service facilitating crypto-to-fiat exchanges).

Idea #8 – Cash Out on Coinbase

Thus, you can either retain your WBTC or decide to cash it out as you see fit. The choice rests with you, but there’s always the prospect that BTC’s value could soar upwards!

William M. Peaster is a seasoned writer and editor specializing in Ethereum, Dai, and Bitcoin within the cryptoeconomy. His work has been featured in Blockonomi, Binance Academy, Bitsonline, and more. He loves exploring smart contracts, DAOs, dApps, and the Lightning Network. He's diving into Solidity as well! Reach out to him on Telegram at @wmpeaster

Ethereum (ETH) Performance: Plummets 45% in Q1 2025 Despite Leading DEX Trading Activity