Bitcoin has come a long way since its inception in 2009 Cryptocurrency's journey from a shadowy digital coin used on the dark web to a widely recognized digital asset has been rapid. What began as an experimental peer-to-peer currency has now caught the eye of mainstream financial systems.

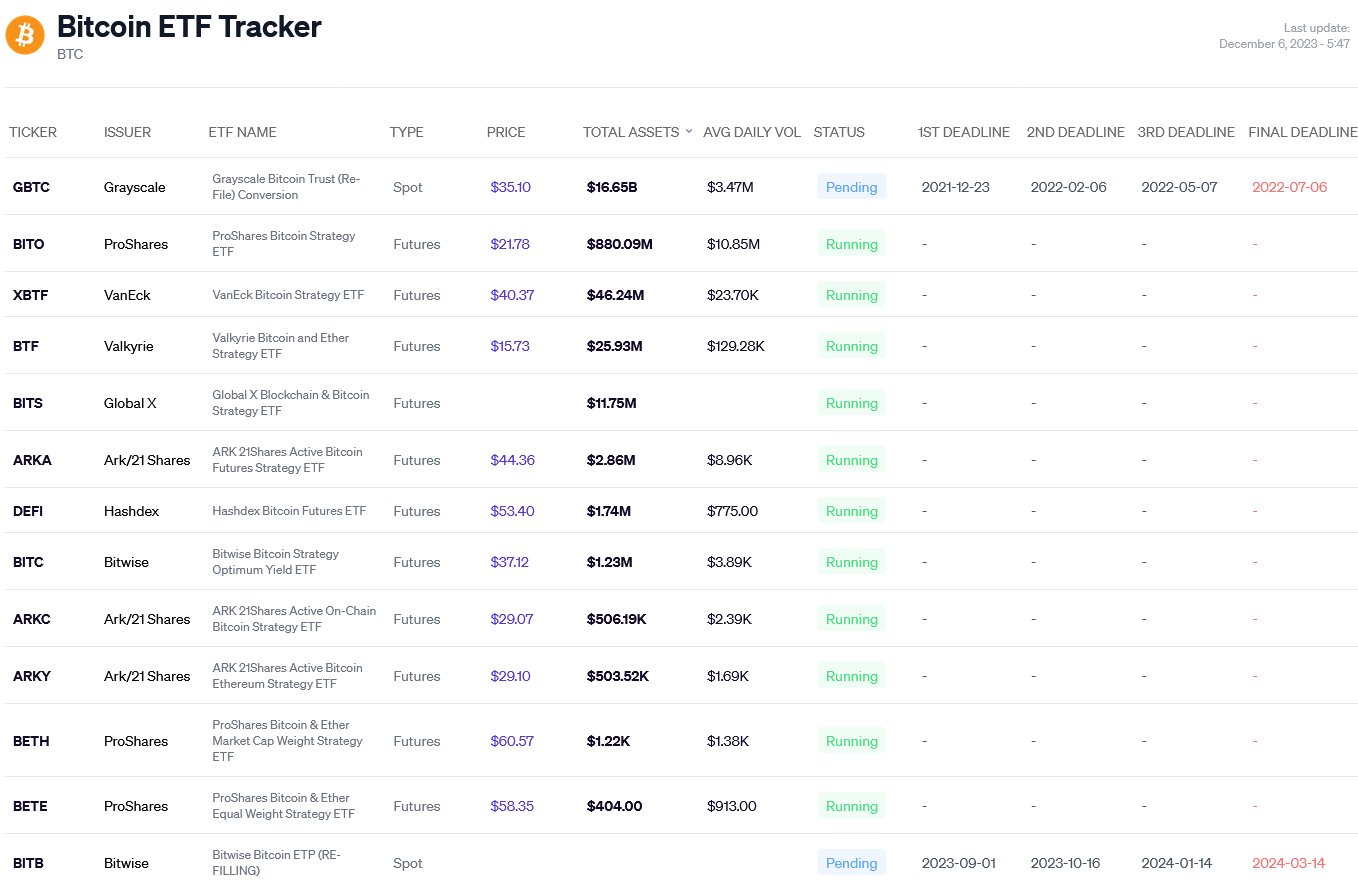

Prominent financial entities like banks and investment powerhouses are now recognizing Bitcoin’s potential as a valuable asset and viable payment method. While the road has been bumpy with significant price fluctuations, increased regulation hints at a stabilizing market. the country of El Salvador Exchange-traded funds (ETFs) have long served as a staple in conventional finance, offering an easier way for people to tap into markets such as stocks or commodities. Now, as Bitcoin gains credibility, it's natural to see the rise of a Bitcoin-specific ETF. So, what precisely is a Bitcoin ETF and why is it gaining attention?

In essence, a Bitcoin ETF provides everyday investors with a way to indirectly own Bitcoin. By holding shares of this fund, they can ride Bitcoin’s price wave without the fuss of managing the asset themselves. This setup mirrors that of gold ETFs, which purchase and secure the metal while facilitating trading just like stocks.

If a Bitcoin ETF were to gain regulatory green light, it would symbolize Wall Street's embrace of cryptocurrency, bringing crypto truly into the mainstream. Still, hurdles like Bitcoin's price swings and questions surrounding crypto asset security have delayed progress. But the momentum is building up, with the financial sector awaiting the day regulators give the nod.

For traditional investors, a Bitcoin ETF promises a chance to enjoy Bitcoin market activity without the complication of managing cryptocurrencies directly. Functioning like any other ETF, it would hold Bitcoin and allow investors to trade shares that reflect its price. This means navigating Bitcoin on platforms they're already comfortable with.

What is a Bitcoin ETF?

Delving deeper, a Bitcoin ETF might either purchase Bitcoin or invest in contracts tied to Bitcoin. In any scenario, the investors merely trade shares, which symbolize stakes in the Bitcoin beneath. The fund handles all the nitty-gritty details of asset management.

What makes a Bitcoin ETF enticing is its convenience and simplicity. By grouping Bitcoin investments into a regulated package, investors sidestep the complex tasks of safeguarding digital wallets, offering a streamlined approach via systems they’re already accustomed to, like Fidelity or Robinhood.

With professional oversight, Bitcoin ETFs add a layer of expertise, where fund managers continuously monitor market dynamics and make strategic decisions to optimize returns while minimizing common pitfalls faced by individual Bitcoin enthusiasts.

Simply put, Bitcoin ETFs open the door to Bitcoin investments without the usual complexities. Much like how gold ETFs pushed that metal into mainstream portfolios, a well-structured Bitcoin fund could offer both accessibility and the thrill of cryptocurrency's potential gains.

Several reasons propel the case for a Bitcoin ETF's approval:

The Case for a Bitcoin ETF

Boosting Credibility – A regulated Bitcoin ETF would lend enormous credibility to the cryptocurrency market, dispelling myths of it being the 'Wild West' of finance.

- Simplifying Access for Ordinary Investors – The technical hurdles of handling digital wallets and exchanges can deter many. An ETF neatly packages Bitcoin in a context they grasp, lowering entry barriers.

- Driving Mainstream Adoption – If we look to gold ETFs, they ignited a surge in investor interest. Bitcoin ETFs could similarly expedite consumer uptake at record-breaking pace.

- Welcoming Traditional Finance – These ETFs don't just cater to retail; they offer an easy inroad for big institutional players, helping even the most traditional finance entities participate via trusted platforms.

- Secure Crypto Engagement – For those keen on crypto yet wary of its risks, a Bitcoin ETF provides a sanctioned method to invest, offering all the upside with reduced complexity.

- The rationale for launching a Bitcoin ETF is compelling. It combines the best of legitimacy, investor reach, liquidity, and regulatory care to harmonize Bitcoin's challenges with significant opportunities.

The ripple effects of a Bitcoin ETF's arrival would touch every corner of the cryptocurrency realm:

Impacts of a Bitcoin ETF

Surge in Investor Interest – A clear outcome would be the vast influx of capital from investors who’ve been biding their time for a regulated entry into Bitcoin.

- Price Stabilization – With heavy capital influx, Bitcoin's notorious price swings could see modulation, bringing comfort to investors unfamiliar with steep market swings.

- Opening Gates for Other Crypto ETFs – Once Bitcoin leads the way, other cryptocurrencies, like Ethereum, might follow suit, expanding the ecosystem over the years.

- Practical Uses of Bitcoin – With greater mainstream financial clout, expect more real-world utilization of Bitcoin as companies explore accepting crypto or integrating blockchain technology.

- Conferring Validation – Ultimately, an approved Bitcoin ETF would elevate its standing, shaking up preconceived notions and inviting traditional finance to reconsider its stance towards digital currencies.

- As Bitcoin surged to prominence over the past decade, it has drawn significant attention from the financial sector. Yet, the crypto space remains intimidating for investors accustomed to regulated frameworks. Enter the Bitcoin ETF, a familiar vehicle aimed at calming these concerns.

Conclusion

The advent of a Bitcoin ETF promises to unite crypto pioneers with those seeking innovative investment opportunities. Just as ETFs revolutionized gold and silver investments, they could similarly integrate Bitcoin into financial portfolios as a gateway to digital currency.

Current challenges like price volatility and crypto custody are barriers, but they haven't stalled the anticipated debut of a Bitcoin ETF. The benefits of market acceptance, liquidity, and regulations are too compelling to ignore.

While a futures-based model has its day, the future might favor the physically-backed Bitcoin ETF, offering more precise market tracking. Either way, an approved fund would fundamentally alter the landscape, presenting a more accessible window to cryptocurrency.

Discussions around Bitcoin ETFs have moved from 'whether' to 'when'.

Leading Blockonomi is a dedicated advocate for open-source initiatives, blockchain advancements, and an equitable internet experience for all.