Over the past ten years, the crypto trading landscape has transformed into a multifaceted domain, notorious for its unpredictability and complexity, especially for investors.

With the sheer number of cryptocurrencies today, monitoring the market and adjusting portfolios can demand a full-time commitment, and even seasoned traders find these tasks daunting.

Robo advisors offer partial solutions but still demand significant user input to set baseline parameters.

Rocket Vault Finance plans to present a more viable alternative through its innovative product.

Their automated 'Smart Vault' offers effortless access to prime crypto trading possibilities at the click of a button, intelligently managing assets to optimize returns while mitigating risks.

In essence, Rocket Vault Finance enables cryptocurrency usage as a means of passive income, even for those with minimal industry experience.

What can Rocket Vault Finance Do?

Rocket Vault Finance has devised an innovative Smart Vault mechanism utilizing Machine Learning and AI; simply deposit funds, and the system takes over with zero human intervention.

The tool scrutinizes huge datasets to identify high-performing pools, weed out risky ones, pinpoint optimal entry points, and secure the best positions.

Put simply, these Smart Vaults might well fill the shoes of skilled fund managers when it comes to cryptocurrency value investing, boasting a remarkable 100% APY since launch.

How Does Smart Vault Work?

Rocket Vault's innovative strategy emphasizes an advanced trading system surpassing human capabilities, currently offering access to over 700 stablecoins for a diversified portfolio.

Here’s the process by which Smart Vaults operate.

Using Real-Time Data

Smart Vault is equipped with a real-time data acquisition engine interacting with global crypto exchanges via endpoint APIs, hosted on a Hyperscale, allowing near-instantaneous market data access.

This capability allows the execution of trades at the moment opportunities emerge, employing algorithmic tools to establish the quickest connections between exchanges and trading protocols.

Using AI and machine learning, you can anticipate market trends.

Smart Vault’s core AI/ML trading system operates solely on market data as its foundation, with RVF now incorporating over 700 stablecoins into its framework.

The operational process encompasses the following stages:

- The AI engine deeply dives into vast data volumes, applying data modeling and statistical analytics.

- Machine Learning then utilizes pattern recognition and predictive analytics to forecast ideal market entry points and tradable assets.

- Smart Vault employs LSTM-based neural networks to identify volume anomalies and time-series trends.

- The system curates potential tokens for monitoring and adjusting.

Asset Rebalancing

Rocket Vault Finance implements an asset balancing technique to manage investor funds via pools, comprising a Treasury and Monitoring Engine.

Here's a snapshot of these technologies in action:

Treasury Management Engine

The Treasury acts as a safeguard to process withdrawal requests instantly, equipped with key functionalities as follows:

- Determining investment amounts for each token, relying on current volume.

- Monitoring reserved amounts within the Treasury to facilitate withdrawals.

- Determining profit margins to secure across various cryptocurrencies.

- Communicating data through blockchain-powered Smart Contracts to allocate rewards.

Monitoring Engine

As implied, this technology oversees current orders and decision-making processes, adjusting trades according to market dynamics. Consequently, a monitoring engine can accomplish:

- Supervising all order executions, both buying and selling.

- Tracing these orders to figure out the optimal selling price.

- Recalibrating orders based on token performance.

RVF Data Sets

To construct an infallible system, RVF has developed a training model spanning two phases and distinct datasets.

- Training datasets originated from alliances with many crypto exchanges, like Binance and Bitfinex, via APIs.

- The testing model involving data serves to verify accurate system results.

Scalable System

Clearly, RVF has orchestrated an intricate system aimed at easing trading efforts. They have also strategically ensured their framework can scale for individual and institutional traders alike.

Diverging from other trading platforms, RVF refrains from providing diluted versions of its product for retail investors, delivering superior expertise to all traders, regardless of investment scale.

Moreover, during its private beta run, RVF imposed investment caps, gradually elevating deposit limits to ensure that its strategies are responsive to fund flow.

RVF Token

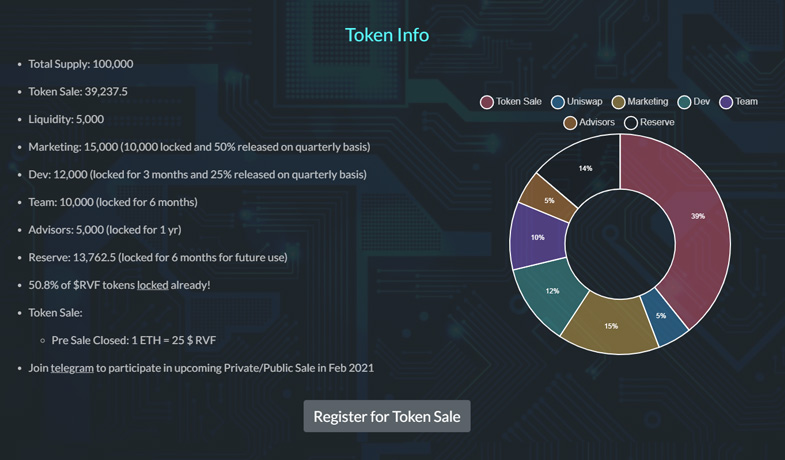

RVF, following the path of other crypto platforms, has introduced a proprietary ERC-20 utility token.

Limited to 100,000 tokens, they cannot be minted further. Their purpose is to constrain supply in an effort to boost the asset's market value.

Accessing RVF tokens comes with prerequisites, such as a minimum contribution of two Ethereum coins for participation. For instance, owning 50 RVF tokens grants eligibility for a full refund of the initial investment over time.

Possessing an RVF token offers reduced platform fees, with discounts tied to chosen subscription models.

RVF Subscription Models

At present, RVF provides two distinct subscription plans—targeting both retail participants and institutional entities.

For retail clients, the subscription plan is complimentary, meaning zero management fees or annual commissions.

Other notable points include:

- KYC procedures are postponed until tradable funds exceed $10,000.

- Rewards compound automatically.

- Failure to maintain the RVF token balance results in a 5% deduction from profits.

- A modest percentage of profit covers fees.

The premium institutional plan offers:

- 2% management fee

- 5% of profits as a fee per year

- Locked rewards for a minimum annual duration, distributed quarterly thereafter.

- Pay in RVF tokens and save 0.5% on fees

- Close the account any time

The Verdict

The RVF team identified a market gap in cryptocurrency trading, crafting a bespoke product to address it.

Achieving a remarkable 100% APY thus far stands out, but sustained results can't always be assured.

Despite being relatively fresh, the platform necessitates more transparency, particularly on fees and commissions.

Still, the potential of Smart Vault technology is promising for novice and veteran traders alike. As with any investment, thorough due diligence and risk assessment is advised prior to investing.