You might have heard the term “ Whale In the realm of cryptocurrency, whales are often wealthy individuals with substantial holdings, capable of influencing market trends to align with their financial goals. In this discussion, we delve into what motivates them and the moves they make that can lead to both surges and declines in pricing.

The “Bearwhale”

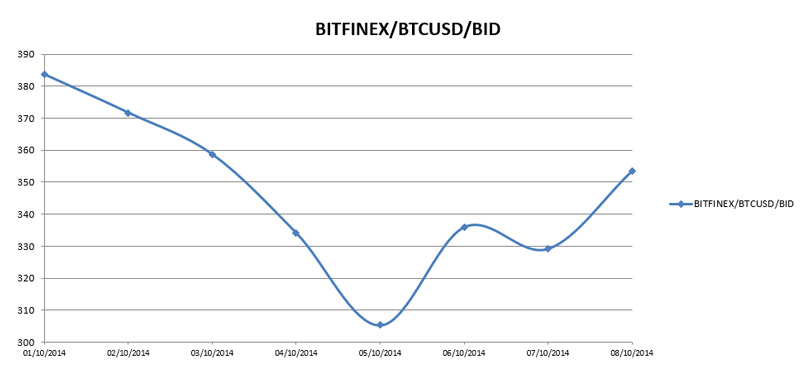

On October 5, 2014, with Bitcoin trading around $320 amidst a decline, someone executed a massive sell-off of 30,000 bitcoins at $300 each, forcing all exchanges to adapt to this price. This maneuver sent ripples through the Bitcoin market, akin to a giant splash from a whale. Bitcoin price , consequently, plummeted, marking a historic instance of price volatility in the digital currency’s trajectory, resulting in a pattern that appeared as follows:

Data Source: Excel chart created using collected statistics from https://www.quandl.com/

Following the incident, as memes circulated and debates erupted over the identity and intent of the so-called BearWhale, this event is now seen as the inaugural whale activity in cryptocurrency markets. This ripple stirred unease among crypto enthusiasts, caught off-guard and puzzled by such motivations. The individual's rationale, it was revealed, extended beyond mere financial reasons, becoming more of an ideological statement. long Reddit thread last year Since the BearWhale episode, other influential entities, similarly resource-rich in cryptocurrencies, have strategically stirred smaller markets. These cunning whales orchestrate market drops, going on to acquire coins at bargain prices, thereby reaping significant profits, much to the chagrin of the affected crypto community.

Price Suppression

Events where whale tactics have impacted newer, alternative cryptocurrencies have been frequent. The ETP coin, for example, experienced a dramatic drop from $3.8 to just four cents due to whale interference, and

also faced threats from whale manipulation, though the committed community worked together to thwart the scheme NEO fell from $37 to $4, both in just one day. Vechain by launching a concerted effort against the whale's tactics. The manipulation by whales typically unfolds as follows: possessing considerable capital and interest in a specific cryptocurrency, they set an oversized sell limit below the current market rate. This strategy ensures that other traders in the market can't absorb the vast quantity being sold at once. This forces competitors to drop their prices, crystallizing substantial losses for them and officially lowering the crypto’s value. The whale retracts their order after sparking a wave, swiftly buying up the cheap coins. They rinse and repeat this technique, causing waves until their desired amount is secured at their target price. .

Consider the scenarios and draw parallels to assess the overarching influence whales exert on crypto markets. For an impactful wave, a whale's influence must match the market size or risk having their efforts nullified by active buyers. This is why smaller markets are more susceptible to whale maneuvers. BearWhale sustained Bitcoin’s low at $300 only briefly, as a substantial number of buyers quickly swept up the sell order, even when Bitcoin was much less prominent than today. However, such events yield more pronounced effects in emerging markets.

An Artificial Sell Wall, Image from SmartOptions .

How they Work

When NEO’s value plunged to about 11% of its original price, it stayed there because fewer buyers existed to counteract the whale’s sell order, a scenario dubbed “breaking the wall.” A whale’s market manipulation may be ideal for fresh investors to acquire assets at discount rates, but it spells disaster for existing investors trying to offload coins.

Similarly, whales could hypothetically provoke inflation in crypto prices by placing enormous buy orders rather than sell. This artificial demand surge would elevate the cryptocurrency’s value. Unlike solo whales, this tactic is generally executed by groups in concerted efforts to boost prices.

Price Pumping

Such collectives place significant buy orders together, driving up the crypto's value, then leverage the swell to sell at newly inflated rates. This reality firmly implies that

the execution of a coordinated whale operation could indeed influence Bitcoin or smaller altcoins through synchronized efforts, 1000 people own 40% of the bitcoin market indicating that Bitcoin's past has seen or future may see such large-scale market calibrations. Notably, detecting a whale-induced inflation wave could tempt common investors to seize the opportunity and sell their holdings. some people even suspect This tactic, bearing a semblance to traditional “pump and dump” stock operations, skillfully plays the unregulated cryptocurrency playground, skirting legality enforced in stock markets.

A variety of elements contribute to the steep rise or fall of cryptocurrencies beyond whale activities. It behooves buyers to pinpoint external factors causing devaluation. Whale-induced drops are often more abrupt than those from other influences. For instance, cryptocurrencies plummeted after China and Korea imposed bans—a downturn easily mistaken for a whale move, knowing the geopolitical roots responsible for the depreciation.

Conclusion

Currently, whale manipulation coupled with FUD peddled by mainstream media form hurdles that persist until market caps swell to thwart such exploits, or until regulation arrives curtailing such antics legally.

Editor-in-Chief of Blockonomi and founder of Kooc Media, a UK-centric digital media enterprise. Advocate for open-source initiatives, blockchain innovation, and an equitable, accessible Internet.