The meteoric rise of ICOs in 2017, followed by their steep decline towards the end of 2018, has sparked debates about their regulatory standing and potential as a crowdfunding tool.

The surge of altcoins in late 2017 made it ridiculously easy to fundraise, but this led to a staggering 80% of ICOs being labeled as scams. This caught the attention of regulators who, albeit slowly, have started to lay down the rules about tokens and their legal framework.

The SEC has finally dropped its long-awaited report, which was a significant step, though it left a few stones unturned about ICOs and IEOs. Crypto Token Framework IEOs have emerged as a promising alternative to sluggish ICOs, showcasing some benefits despite relying on intermediaries who might not always have the best track record in the shadowy depths of the crypto markets.

But what does an IEO truly entail, and what are the ripples it sends through the market? How do we define what an Initial Exchange Offering is? .’

The Future of IEOs: What's in Store for Cryptocurrency Investments?

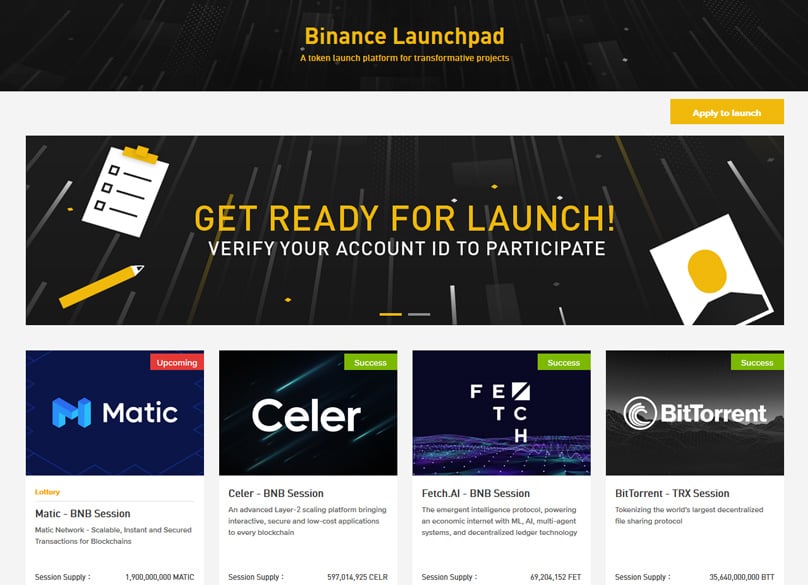

Breaking down an IEO, it's primarily an ICO executed via an exchange or 'launchpad,' which has been gaining attention due to some significant token sales, such as the BitTorrent token on Binance.

Hype might be part of the equation, but IEOs play a crucial role in driving successful sales. exchange As ICOs lose their charm, private investments, like venture capital seed rounds, are resurging, accompanied by exchanges pushing for launchpads to sell tokens to their extensive user bases.

BitTorrent raised $7.2 million in 18 minutes , and Fetch.AI recently raised $6 million in 22 seconds on Binance’s IEOs are generally arrangements between project developers and exchanges for token placement. Unlike the often murky ICO processes, IEOs aim to be a more trustworthy method of distribution.

Exchanges take the responsibility of vetting projects. They conduct audits and handle the entire sales process, ensuring the IEO matches predefined parameters like pricing and token supply.

Identifying why IEOs are popular involves understanding the roles of the three main parties involved in the token sales: has picked up Exchanges benefit from these by receiving listing fees and attracting new users. These fresh participants, whether drawn by trading quality or simply for the IEO, are a win for the platforms.

Projects are offered a more official channel for token sales, backed by exchanges that have scrutinized the project's credibility. This gives them exposure to large investor audiences eager to dive into fresh opportunities, as seen with BitTorrent and Fetch.AI.

Investors benefit from tokens being immediately liquid on an exchange and the flexibility to purchase using different currencies, whether fiat, BTC, or altcoins.

However, there's a catch. Investors are stuck trusting exchanges, which have historically been less than stellar, especially when the general advice in crypto is ‘Don't rely on potentially unreliable middlemen.’

- Exchanges

- Projects

- Investors

Exchanges may conduct thorough checks, but individual IEO processes vary and past slip-ups by platforms should caution investors to tread carefully.

Benefits of an IEO

The new SEC guidance doesn't tackle specific concerns surrounding IEOs, like the effect on startups abroad or what they mean by 'active participants,' making its impact murky.

While IEOs present a promising model for startup funding in the crypto world, investors remain vulnerable.

Look at EXMO's February 2019 IEO: their due diligence mirrors traditional coin assessments, hinting that ICO fundraising does not guarantee project success. Their strategy isn't all that comforting. They emphasize evaluating a project's 'desire' to engage in marketing efforts like airdrops, suggesting a blend of reputation management and promotion. Despite the buzz around Binance's Launchpad and the upcoming IEOs on Bittrex garnering attention, they seem hauntingly similar to ICOs.

For investors, while IEOs might seem safer, the rise and fall of ICOs taught a valuable lesson: navigate new asset classes and funding models wisely. Conduct your own research rather than leaning on third parties. QuadrigaCX debacle Investors seem to have grown wiser, potentially driving the noticeable drop in ICO activity. In parallel, the landscape of digital asset investment increasingly resembles traditional venture capital practices. Projects like Coda Protocol are seeing renewed investment interest. As we move through 2019, the pace at which traditional investors are dipping into digital assets looks set to accelerate. IEOs offer diverse investment options and better liquidity but still echo the same risks seen in ICOs.

In a world where ‘Don't trust, verify’ resonates deeply with crypto enthusiasts, relying on reputation as a safeguard for exchanges to properly vet projects misses the point, focusing instead on their inherent goal: profit.

Read: What is an STO?

Launchpads are creating a buzz, similar to the wild enthusiasm of Fall 2017. So why is everyone rushing for these project tokens?

IEOs may provide a fleeting boost to altcoin funding, but their longevity in a market becoming more prudent with seasoned investors remains doubtful.

I am a Blockchain writer, web developer, and content creator, passionate about the decentralized internet and the evolution of crypto platforms. You can contact me at brian@level-up-casino-app.com. defines Here Are Six Crypto Projects That Are Redefining Web3 Education at Its Core

Opinion Piece: How Decentralization Could Better Society – But Cryptos Might Not Hold the Key

Opinion Piece: The Hidden Threat of Data: How Blockchain Might Lead to Digital Autocracy

Content on level-up-casino-app.com is strictly for information and isn't an offer or solicitation for buying or selling investments, securities, or products. The opinions here are not financial advice, and readers should seek independent advice as needed.

All rights reserved. Company Registration No. 05695741

Blockfresh - Your Source for Crypto, NFT, and Metaverse News

Traditional Investment Growing

Type above and press Enter to search. Press Esc to cancel. Become a METAWIN Millionaire! You Have a Chance to Win $600,000 in USDC: Click Here to Enter Understanding IEOs: A Comprehensive Overview of Initial Exchange Offerings

In recent times, IEOs have become more prominent as ICOs began losing momentum - Learn more in our in-depth guide.

After the explosive growth of ICOs in 2017 followed by their decline in late 2018, the future of ICOs' regulatory and fundraising strategies has been under serious consideration.

The frenzy to secure funds during the altcoin boom in late 2017 resulted in around 80% of ICOs being labeled as scams that year, prompting regulatory bodies to eventually establish frameworks concerning token legitimacy.