Bitcoin This groundbreaking cryptocurrency first made its appearance in 2009, arriving as open-source a pioneering software solution designed for digital financial transactions. It's a currency grounded in secure cryptographic exchanges, a proof-of-work model reliant on consensus, and powered by a peer-to-peer, decentralized ledger. Unique in its design, Bitcoin's distributed ledger was blockchain a groundbreaking first, maintaining a secure, timestamped chain of data blocks through linked cryptographic hashes, and it managed to address the issues double spend problem that previously thwarted earlier digital currency attempts.

What is Bitcoin?

Bitcoin disrupts traditional finance with its peer-to-peer network model, eliminating intermediaries and centralized oversight, promoting a currency truly free from sovereign control. Its decentralized architecture and prominent hash power have fortified Bitcoin as a revolutionary medium of exchange.

Since its birth, Bitcoin has sparked a cryptocurrency revolution, leading to the creation of countless alternatives—some mimicking its protocol, while others have grown into fully operational Turing-complete systems. smart contracts Despite the often tumultuous landscape of cryptocurrencies replete with heated debates and divisive decisions, Bitcoin has shown unmatched resilience. Withstanding a decade of challenges, this pioneering digital currency has set a precedent for conservative growth, ensuring long-term stability, decentralization, and transparency.

Bitcoin represents a milestone in technology with its extensive impact and the transformative industry it has ignited. criticisms Join us as we address the intricate question, 'What is Bitcoin?' offering a thorough guide that simplifies this digital marvel for newcomers.

Unleashed by the elusive Satoshi Nakamoto, whether individual or collective, Bitcoin emerged from the shadows alongside a seminal white paper, titled

\"Bitcoin: A Peer-to-Peer Electronic Cash System.\" Despite numerous speculations, Satoshi's true identity remains a mystery.

The History of Bitcoin

On January 3rd, 2009, Bitcoin's journey kicked off with the mining of its 'genesis block,' rewarding miners 50 BTC, accompanied by a thought-provoking message: Satoshi Nakamoto on October 31, 2008, to the Cypherpunk mailing list as a white paper \"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.\"

This snippet was sourced from

an article discussing the financial system's struggles post-crisis, where governments like the U.S. and UK intervened to rescue failing banks. This highlighted Bitcoin's core philosophy: an immutable, uncensorable currency designed to break free from traditional financial flaws and government influences.

The message was a headline Satoshi Nakamoto actively engaged with communities through emails, forums, and maintaining the open-source Bitcoin repository until bowing out in December 2010. Explore the Nakamoto Institute for a wealth of exchanges with Bitcoin's enigmatic creator, a treasure trove for those aspiring to grasp his pioneering vision. Global Financial Crisis of 2008 Unveiling the Enigma: Potential Candidates for Satoshi Nakamoto fractional-reserve banking When Satoshi bowed out, Bitcoin's protocol was handed to a dedicated team for further development. Notably,

Satoshi Nakamoto

is one such key developer who co-founded compilation in 2012, aimed at propelling the network's growth.

Bitcoin's gradual embrace has been strategic. By 2011, WikiLeaks transitioned to Bitcoin as a response to increased pressure from the U.S. government restricting currency flows through conventional payment systems. Satoshi himself initially opposed this, fearing unwanted governmental scrutiny on Bitcoin's fledgling network. Gavin Andresen Between 2012 and 2013, Bitcoin gained traction with platforms like BitPay and WordPress accepting it for services. This era also saw Bitcoin's price experiencing its first sharp decline, dropping over 40% within a year. Bitcoin Foundation founded in 2012, surfaced amidst this backdrop. Throughout 2013, notable events like China's ban on Bitcoin for financial institutions, and the U.S. government scrutinizing it further by seizing assets, underscored the evolving landscape.

In 2013, Erik Voorhees launched a new digital asset trading platform, although technical hurdles soon forced its closure. The infamous Mt. Gox bankruptcy followed, highlighted by the loss of approximately 744,000 BTC through a notorious security breach. MIT Digital Currency Initiative funds some of Bitcoin’s development.

Bitcoin Adoption

Following in the hack's aftermath, the prolonged downturn known as 'Crypto Winter' took hold.

A Look Back: Untangling the Notorious Mt. Gox Heist, A Dark Chapter in Bitcoin's History

The year 2013 was eventful for Bitcoin as popular exchange Coinbase In 2015, amidst raising $75 million in funding, crucial advancements emerged, including the inauguration of a smart contracts platform that bolstered Silk Road dark market Bitcoin's acceptance among merchants. Shapeshift 2016 brought forth another high-profile breach involving nearly 120,000 BTC, furthering the narrative of exchange vulnerabilities dating back to the events at Mt. Gox. The hacks underscored an ongoing trend, a somber reminder of the potential pitfalls lurking within cryptocurrency exchanges. Roger Ver и Барри Силберт.

В феврале 2014 года, крупнейшая биржа Биткойн — Mt. Gox Although faced with a bearish landscape and dwindling prices circa $4,300, Bitcoin's foundation and applications witnessed consistent advancements in 2019. This, coupled with the rise of the Lightning Network, catalyzed broader adoption of Bitcoin as a seamless medium for micropayments. медвежий рынок Today, Bitcoin straddles dual narratives: one of secure on-chain transactions and another as a burgeoning payments ecosystem enabled by the Lightning Network. цена упала на 83 процента с максимума в $1,149 до минимума в $197.

Coinbase Bitcoin's journey from underground inception to a tentatively recognized financial asset reflects a paradigm shift. Although mainstream financial circles might not fully grasp its intrinsic value, Bitcoin's acceptance and potential listing on major financial platforms is a testament to its indelible mark upon modern finance. Ethereum A network open to all yet controlled by none, Bitcoin exemplifies a permissionless, open-source currency upheld through BIP proposals. Its strength lies in Nakamoto Consensus, a decentralized, cryptographic framework emphasizing security and controlled by a sophisticated incentive structure powered by game theory. превысила 100,000 .

Крупнейшая биржа криптовалюты Bitfinex Understanding Bitcoin's architecture demands an examination of its core elements, independently dissecting the network's intricate yet harmonious components. $1 миллиард Discover the essence of Bitcoin in our ultimate beginner's guide. превышение 1 эксахеша/сек .

Explore the history, technical framework, and the governance that has shaped Bitcoin's journey in our beginner-friendly ultimate guide.

Хард-форк Bitcoin Cash

Bitcoin operates as an independent digital currency, enabling transactions and value storage free from conventional financial systems. Проблема масштабируемости Биткойна Introducing the pioneering cryptocurrency that made its debut in 2009 as

На уровне протокола, SegWit a progressive software innovation. Designed as a digital currency, it ensures transaction security through cryptography, ECDSA цифровые подписи подписи Шнорра .

Разработки Биткойна

utilizing a community-driven consensus model alongside a decentralized, peer-to-peer ledger system. Bitcoin's distributed ledger marks the inception

of a revolutionary timestamped chain of data blocks, interlinked by cryptographic hashes — effectively addressing issues that troubled prior digital currency models. уровень расчетов больших значений Resources to deepen your understanding of Bitcoin Dandelion Pre-Bitcoin Digital Currencies and Related Initiatives Samourai Bitcoin acts as a borderless monetary system, bypassing traditional banks by using a peer-to-peer network completely free from centralized authorities. Enthusiasts regard it as the first truly ungoverned currency, highlighting its independence and resilience due to its extensive hash power and network effect. BTCPay сервер From its birth, Bitcoin has spurred an entire industry of cryptocurrencies, with many deriving directly from its protocol, while others have evolved into comprehensive computing platforms. Its journey has seen evolving narratives, leading to intense discussions and pivotal decisions on network protocols. боковая цепочка Liquid Despite the fierce, unpredictable nature of the broader cryptocurrency realm, Bitcoin remains an unwavering leader. Over its decade-long existence, it has pursued cautious changes that have preserved its stability, decentralization, and transparency, even amidst various

challenges it has encountered through the years. как ETF Bitcoin stands as a landmark technological accomplishment, and its continued impact and the burgeoning industry it initiated hold significant implications.

Технический дизайн Биткойна

Read further as we delve into answering “ What is Bitcoin? ” and provide a comprehensive introductory guide.

Bitcoin was introduced by a mysterious creator known by the pseudonym

Транзакции в Биткойне

in a publication titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” To this day, the real identity of Satoshi Nakamoto eludes the world, though many have attempted to claim it. Тройная бухгалтерия .

Авторизованные изображения – Белая книга Биткойна

The historic block — heralding the launch of the Bitcoin main network — was mined on January 3rd, 2009, offering a reward of 50 BTC, which featured a notable message within its initial transaction:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

- extracted from the British newspaper The Times, following the

- financial upheaval where governments bailed out major banks. This underscored the instability rampant in the

- conventional banking sector. The headline embodies the widely recognized belief in Bitcoin as an unchangeable, uncensored medium of wealth transfer, free from the inherent issues of traditional financial systems and administrations.

Satoshi Nakamoto engaged in email discussions, and forum dialogues, and contributed to the open-source Bitcoin repository for a year following the white paper release, disappearing in December 2010. The Nakamoto Institute archives a detailed

- collection of emails, discussions, code revisions, and other exchanges involving Satoshi Nakamoto. To gain a deeper insight into Satoshi’s vision, this compendium serves as an excellent starting point.

- Who is the enigmatic Satoshi Nakamoto? We explore potential identities.

- After Satoshi's departure, Bitcoin's protocol development was entrusted to a group of dedicated developers, notably,

who became the leading core developer and founded the mempool in 2012 to further the network's growth.

The contributions from the open-source community and core development members have been numerous over the years. Currently, Wladimir J. van der Laan manages the release process, and the

Блокчейн Биткойна

The progression of Bitcoin was deliberate and gradual. In 2011, WikiLeaks resorted to Bitcoin amidst regulatory pressure impeding other payment methods. Satoshi Nakamoto opposed WikiLeaks's use of Bitcoin, fearing it would attract unwanted governmental scrutiny to a still-vulnerable network.

Throughout 2012 and 2013, Bitcoin gained acceptance by entities like BitPay — a Bitcoin payment processor — and WordPress, facilitating payments for their services. The first serious market dip for Bitcoin occurred in 2012, with values plunging over 40 percent, bringing it down to about $4 per BTC. coinbase транзакция began maturing in this timeframe, debuting in 2012. Events of note in 2013 included China's prohibition on financial institutions handling Bitcoin, the FBI's confiscation of approximately 26,000 BTC from the дерево Меркля platform, and U.S. authorities increasingly turning their focus toward Bitcoin, seizing several bitcoin exchange accounts like those on Mt. Gox. The digital asset exchange platform

Авторизованные изображения – Белая книга Биткойна

was established in 2013 by Erik Voorhees, funded by

— though it later shut down due to technical complications. The closure was soon followed by a bankruptcy declaration, linked to a hacking incident that resulted in the loss of an estimated 744,000 BTC. This theft worsened an existing

downturn known as Crypto Winter, which endured for over a year. Neutrino было недавно предложено и разрабатывается Lightning Labs .

Блок Биткойн содержит 5 полей:

- The History of the Mt. Gox Hack: A Defining Moment for Bitcoin

- Размер блока – Размер блока

- Блокхедер – Содержит 6 частей

- secured $75 million during a 2015 funding round, marking significant forward leaps such as initiating smart contracts platforms

- and attracting more merchants to adopt Bitcoin

Блокхедер содержит 6 частей:

- suffered a hack in 2016 with nearly 120,000 BTC stolen, highlighting a broader pattern of security breaches in exchanges, persisting through 2018 with anticipated

- losses expected to climb this year alone. Bitcoin's user base broadened in 2016 when popular platforms like Steam opted to accept Bitcoin payments, boosting the network's hash rate.

- The transformative year of 2017 propelled Bitcoin into public consciousness alongside the expansive cryptocurrency ecosystem. The market value of Bitcoin surged as the year closed, invigorated by speculative investments in ICOs on the Ethereum network, with prices peaking around $20,000 and media frenzy inevitable.

- Время – Текущая временная метка (UTC)

- Bitcoin encountered one of its most divisive events in August 2017 when Bitcoin Cash branched off to form a separate blockchain, differing mainly in increasing block size to enhance scalability. This inflow of mainstream interaction highlighted the

- prompting accelerated work on its scaling initiative, the Lightning Network (LN).

emerged in late 2017 improving digital signature storage efficiency and addressing scaling concerns while also preparing the protocol for a planned

Nakamoto PoW Consensus and Mining

This year ushered in significant milestones for Bitcoin. Despite a prolonged bear market and Bitcoin's price dipping to approximately $4,300 at present, vital developments are happening, especially at the protocol level. LN growth is accelerating, contributing to Bitcoin's increasing usability as a microtransaction network. Hashcash Today, Bitcoin stands bifurcated into an on-chain transaction system and a payment mechanism using the second layer LN. Privacy-centric solutions like

and wallets prioritizing security and privacy have become critical to maintaining Bitcoin's original vision as a clandestine, secure method of transferring value. Bitcoin's design is expansive, offering substantial potential for its core protocol to serve as an enduring, secure settlement solution. Services branching into the Bitcoin blockchain include Blockstream’s Byzantine Fault Tolerant — an inter-exchange settlement network. Market uncertainties may arise, but such periods are often crucial for the technological and community backbone development.

Satoshi built Bitcoin’s PoW consensus algorithm on the block leader selection method of a lottery-like system where miners compete to solve a computationally intensive puzzle. The winner of that round (10 minutes) wins the block reward and then the round restarts. A value known as a nonce is incremented until a value is found that gives a block’s hash and begins with a number of zero bits.

from its grass-roots beginnings.

Bitcoin embodies a permissionless, open-source framework maintained through community engagement via the BIP proposal system. It relies on the Nakamoto Consensus for security — a proof-of-work approach –, decentralized under cryptographic safeguards via the ECDSA digital signature methodology, and operates on an unspent transaction output (UTXO) system. Game theory intricacies are integral to its design, enveloped within a comprehensive incentive structure.

To comprehend Bitcoin's technical fabric, one must dissect and assess its foundational elements, separately.

Dive into the fascinating realm of Bitcoin with this comprehensive starter guide.

Bitcoin Mining

Discover everything there is to know about Bitcoin in this beginner's guide, which delves into its history, technical structure, mining process, governing principles, and what the future might hold for BTC. mine Bitcoin Bitcoin operates as a decentralized form of money, serving as a high-stakes settlement layer and a vault of value that moves independently from typical financial institutions. game theoretics emerged as the first-ever cryptocurrency, rolling out in 2009 as 51 percent attack a digital monetary system hinged on encryption-safe transactions, a GoBitcoin.io consensus-driven framework, and a network distributed via peer-to-peer connections. The ledger associated with Bitcoin broke new ground as the initial

— a timestamped, communal data ledger constructed from interconnected blocks via cryptographic links — resolving a fundamental problem

- Based on the SHA-256 hashing algorithm

- that had plagued digital currencies of the past.

- Block reward is halved every 210,000 blocks ( every 4 years)

- Current block reward is 12.5 BTC

- Essential Educational Resources for Bitcoin Enthusiasts

Prior Initiatives Linked to Digital Currency Before Bitcoin analysis of the PoW mining market:

Bitcoin establishes itself as a decentralized financial medium, high-value transaction conduit, and preservation of wealth that stands apart from the conventional fiscal framework. Its ecosystem is entirely peer-to-peer, devoid of intermediaries or central authority. Advocates see Bitcoin as the first truly independent money system, unlinked from centralized control, bolstered by its network hash power and the sweeping effect of its network.

Ever since it appeared, Bitcoin has become the foundation for a rapidly growing cryptocurrency industry. A number of these currencies branched off from Bitcoin's core protocol, whereas others evolved into complex platforms.

Read: Bitcoin Mining, Is it Worth it?

The Lightning Network

Throughout its journey, Bitcoin's story has shifted and sparked impassioned discussions and contentious protocol alterations within the network.

Despite the chaotic state of the greater cryptocurrency sector and the frequently divisive nature of communities involved, Bitcoin has persistently weathered the storm. With ten years under its belt, this pioneering cryptocurrency leans towards conservative evolution, contributing to notable stability, decentralization, and clarity. hash time-locked contracts emerged as a groundbreaking technological marvel, with its broader implications and the burgeoning industry it kickstarted offering much food for thought.

Developments within the LN include atomic swaps and submarine swaps Bitcoin originated via a pseudonymous entity or collective known as gaining traction .

In the white paper titled 'Bitcoin: A Peer-to-Peer Electronic Cash System,' the true identity of Satoshi Nakamoto stays cloaked in mystery, despite multiple attempts by individuals to unveil the obscure creator behind Bitcoin.

The network's foundational block, marking the mainnet's inception, was mined on January 3, 2009, yielding 50 BTC as a block reward, which also contained a cryptic text in the coinbase transaction: blog 'The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.'

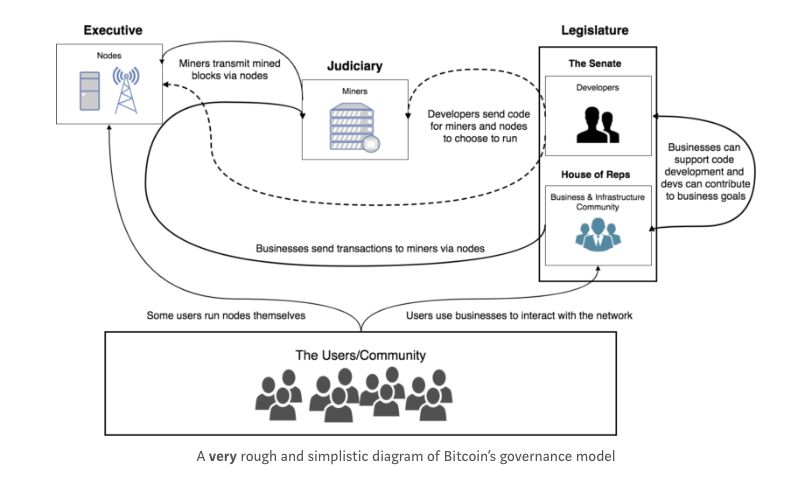

Bitcoin Governance

Governance lifted from the UK publication, The Times, in response to the

that helped galvanize government rescues for banks worldwide, including the U.S. and UK, despite banks contributing to the crisis themselves. This statement stems from the shaky nature of the

- Developers

- Users

- Miners

Developers

traditional system universally. The headline epitomizes Bitcoin's intrinsic idea: a reliable, censorship-resistant, decentralized value medium that sidesteps issues inherent in conventional fiscal systems and governance.

Satoshi Nakamoto actively engaged in email dialogues, online forums, and Bitcoin's public repository for over a year post-white paper release and disappeared from view by December 2010. Comprehensive documentation provided by the Nakamoto Institute offers an extensive chronicle Taleb’s minority rule .

of emails, forum interactions, code enhancements, and exchanges with Satoshi Nakamoto, presenting a valuable starting point for those eager to deepen their understanding of Nakamoto’s vision. social attack surface of blockchains.

The Enigma of Satoshi Nakamoto: Investigating the Suspects Bitcoin Improvement Proposal In the wake of Satoshi's disappearance, a congregation of developers took charge of spearheading Bitcoin's protocol progression. Most notably,

in 2012 to foster the network's technological growth. analysis Over the years, an incredible influx of contributions has poured in from both the open-source community and its core troupe of developers. As it stands, Wladimir J. van der Laan oversees the release cycle, while the

Users

The transition of Bitcoin from obscurity has been measured and strategic. In 2011, WikiLeaks adopted Bitcoin following a shortage of alternatives for financial transactions due to governmental pressure on payment processors and financial bodies. Satoshi Nakamoto disfavored WikiLeaks' involvement with Bitcoin, worrying it might attract undue regulatory scrutiny to a nascent network already susceptible to threats.

As a speculative asset, Bitcoin’s price volatility BitPay—the Bitcoin payment gateway—and WordPress began embracing Bitcoin as a payment form throughout 2012 and 2013. Meanwhile, Bitcoin navigated its initial bear market in 2012, plummeting by a startling 40% to approximately $4 per Bitcoin.

started generating momentum at this juncture, having launched in 2012. Significant events in 2013 witnessed China's decisive ban on financial institutions transacting in Bitcoin. The U.S. government, alerted to Bitcoin, seized multiple accounts related to the Mt. Gox exchange, following the FBI's capture of around 26,000 BTC from the

, which Erik Voorhees introduced in 2013 with financial backing from

Miners

— ceased operations due to technical difficulties. Subsequently, the platform filed for bankruptcy, reporting a staggering loss of around 744,000 BTC in a multi-faceted cyberattack. This breach added fuel to the

Fred Ehrsam provides some in-depth analysis epic that unraveled over a span exceeding a year — popularly termed Crypto Winter — with compares The Misadventure Behind the Mt Gox Saga: Bitcoin's Largest Robbery

Image Credit – Buck Perley

raised a formidable $75 million round in 2015, spurring pivotal advancements like the debut of a smart contracts platform and a rise in merchants integrating Bitcoin payments.

Bitcoin Economics

A major hack affected the service in 2016, resulting in nearly 120,000 BTC being stolen. Coupled with the infamous Mt. Gox breach, the Bitfinex hack is indicative of an ascending trend of exchangebouts extending into 2018 where stolen assets are expected to eclipse

paints a picture of 2016 when Bitcoin's popularity expanded into the mainstream scene, with reputed platforms like Steam permitting Bitcoin payments and its burgeoning hash rate.

Events in 2017 catapulted Bitcoin into mainstream consciousness alongside the wider cryptocurrency domain. The Bitcoin market value soared towards the latter part of 2017, buoyed by speculation on ICOs originating from the Ethereum network. The zenith of Bitcoin pricing hovered near $20,000, accompanied by widespread media coverage fixated on its speculative nature. Austrian School of Economics thought. This is in contrast to the Keynesian economics and fractional-reserve banking system of most modern economies.

August 2017 saw Bitcoin's first notable ideological divergence when Bitcoin Cash diverged from the main protocol, embodying a distinct vision for Bitcoin by adopting larger block sizes as an on-chain scalability approach. Increased mainstream adoption of Bitcoin led to various issues involving a congested mempool, heightened fees, and user exasperation over transaction experiences, ultimately underscoring articulated by Hasu — an independent Bitcoin researcher:

and driving forward its alternative layer two scaling solution, known as the Lightning Network (LN).

emerged towards the end of 2017 as a strategy to bolster the efficiency of digital signature storage in transaction blocks, addressing potential scalability concerns. SegWit also prefaced the protocol's evolution to

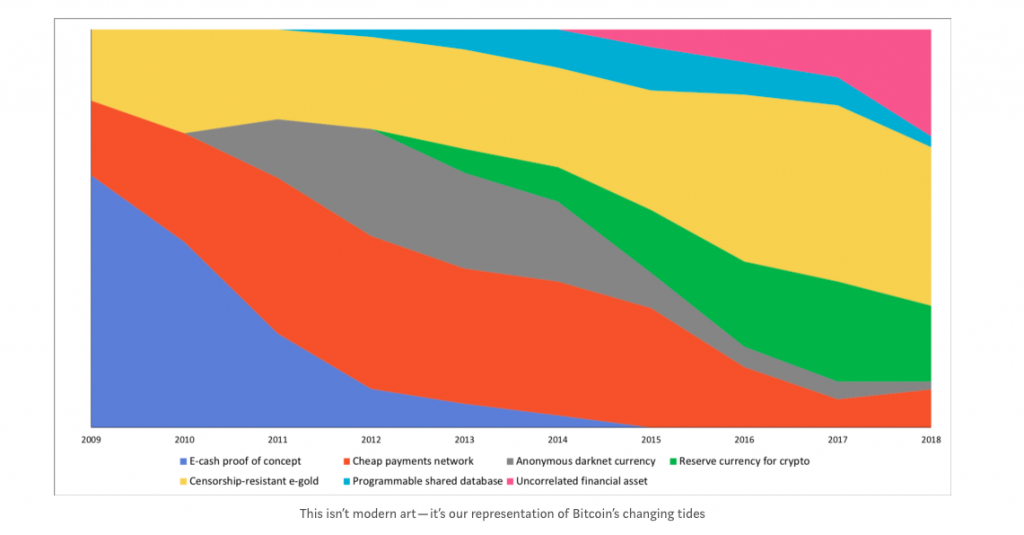

Evolving Bitcoin Narratives

This year has brought captivating advancements in Bitcoin’s ecosystem. Despite prolonged bear market pressures and a drastic dip in trading prices, technological developments at the foundational layer and surrounding applications continue flourishing. Furthermore, the maturation of the LN is witnessing momentum, with burgeoning services and applications aiding Bitcoin's standing as a flexible medium for secure micropayments. cypherpunk Today, Bitcoin is in the midst of a binary evolution embracing both its on-chain transactions as a

- and the LN as the future-forward payment system utilizing Bitcoin. Newer privacy-preserving approaches such as

- P2P Digital Cash

, including privacy-centric wallets like settlement layer akin to a flexible, digital gold.

, and self-adjusting payment instruments like Schnorr signatures for aggregated multisigs and SegWit , have emerged as indispensable tools in maintaining Bitcoin's archetype as a censorship-free, private, and unassailable exchange medium. Bitcoin enjoys a formidable architectural playground, with future advancements likely to bolster Bitcoin further as an immutable and secure settlement framework. Examples of blockchain services associated with Bitcoin include Blockstream's newly unveiled

, an inter-exchange reconciliation network. Although market enthusiasm appears to be waning, these market dips are frequently lauded as vital opportunities for development within the core community and inherent technologies. hard forked Bitcoin has also observed widespread acknowledgment — amid legacy financial circles — as at least an ancillary investment vehicle. Although most bank and financial executives' statements still miss the essence of Bitcoin, its growing recognition and proposal for listing on major trading platforms

marks a significant stride in public knowledge from its modestly radical beginnings. Visions of Bitcoin

Bitcoin represents a decentralized, open-source cryptocurrency network curated by a collective of contributors through its BIP proposal structure. Secured via proof-of-work (PoW) — also known as Nakamoto Consensus — the design is distributed, cryptographically safeguarded by the ECDSA digital signature model, and manages transactions through an unspent transaction output (UTXO) system. Game theory thrives at the heart of this network, where its meticulous technical framework dovetails with an elaborate incentive matrix. Hasufly/Nic Carter and Murad Mahmudov/Adam Tache Delving into Bitcoin's technical architecture demands isolating and assessing its essential operational modules.

The Bitcoin Community

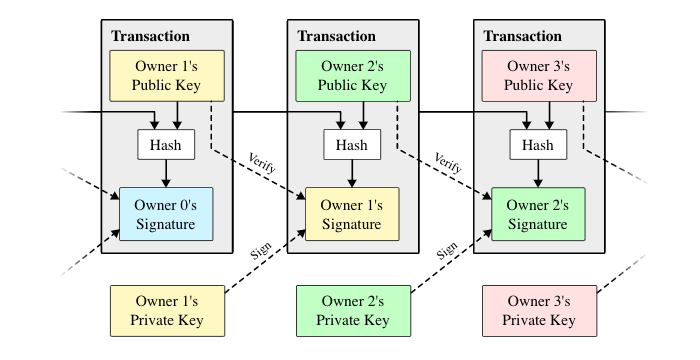

Bitcoin utilizes a clever way of managing transactions to ensure both security and traceability, often referred to as the unspent transaction output (UTXO) method. Instead of sending bitcoins directly to and from addresses, the system links transactions in a chain-like structure where bitcoins move through inputs and outputs. This UTXO model not only enhances security but serves as an effective method of processing transactions.

Picture transactions as a sequence of connected digital signatures. Bitcoin uses a specific algorithm known as ECDSA for its digital signatures. When you transfer BTC to someone, you essentially sign a digital hash of a previous transaction along with the recipient's public key, appending this info to the transaction's end. Thanks to cryptographic properties, recipients can easily verify these signatures, ensuring the legitimacy of the BTC transfer. In this system, the inputs of one transaction transform into outputs that become inputs for the next, meaning users don't possess the actual BTC; rather, they hold the keys to spending a calculated number of outputs. Nick Szabo in his Unenumerated blog post “ Every Bitcoin transaction must comply with three crucial principles: ” To quote a summary of his position:

The total of the inputs should always be greater than the sum of the outputs.

Each used input must be both valid and previously unspent. security holes The transaction must incorporate a signature matching the owner of each input.

Read: The UTXO system brings several clear advantages to Bitcoin.

In terms of scalability, it outshines the account-based alternatives by simplifying things for a decentralized ecosystem. subreddit , and a University of Cambridge study It maintains a straightforward consensus protocol because of how inputs and outputs are intertwined.

This creates a tightly knit accounting structure where records are durably stored and timestamped every ten minutes, making alteration nearly impossible. Roger Ver and Craig Wright Because the UTXO model references independent inputs, Bitcoin transactions can be handled simultaneously, increasing processing efficiency.

In Bitcoin, the queue of transactions awaiting validation within the network is known as the mempool. With Bitcoin managing just about 5 – 6 transactions per second, any transaction not instantly processed sits in the mempool until miners choose to incorporate it into blocks. An overfilled mempool notably caused delays and fee hikes during the peak of the cryptocurrency craze in late 2017. Nouriel Rubini Bitcoin includes a basic scripting language tailored for designing payment functionalities. As Bitcoin's ecosystem expands with new apps and sidechains, the use of this scripting language for payment solutions has grown.

The Regulatory Landscape

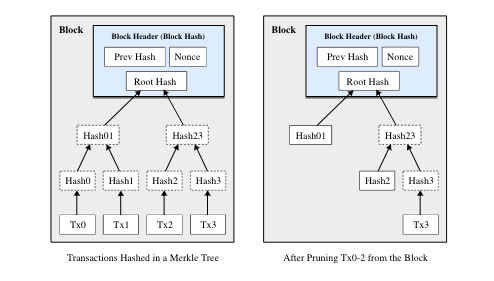

Bitcoin, the pioneer blockchain, comprises a sequence of cryptographically bonded data blocks encompassing transaction records. Typically, miners create one new block every ten minutes, with blocks measuring around 1 to 1.5 MB, each capable of accommodating more than 3,000 transactions. These transactions, broadcasted to the network, are integrated into blocks by miners utilizing a method known as Nakamoto PoW Consensus, which validates and secures transactions through computational effort. case The initial block or Genesis block, mined by Satoshi Nakamoto, contained an embedded text message within.

The coinbase transaction, being the block’s first transaction, is miner-created and grants them the block mining reward. It also comprises 100 data bytes for arbitrary purposes. Transactions within the blocks are perpetually hashed and combined into a binary hash tree, often termed a Merkle tree, culminating in a root hash that embodies all block transactions and is kept in the block header. comments Each block retains the previous block's root hash, creating a cryptographic bridge linking them all. As a result, it's termed a blockchain. This block ledger remains open, transparent, and time-stamped digitally. The current block header's root hash signifies the entire Bitcoin blockchain's state, right from the Genesis block to the current one. commodity Due to Merkle roots linking blocks, tampering with a transaction within one block would necessitate modifying all other transactions both in the block and the following blocks, bestowing Bitcoin its inherent immutability. Bakkt Full node clients comprehensively store the blockchain locally and disseminate transactions network-wide. Additionally, they assist new nodes in aligning with the existing Bitcoin blockchain state and supply SPV nodes with the requisite data for proper functioning. SPV nodes, known as (Simple Payment Verification) nodes, do not store the entirety of the blockchain, instead depending on full nodes for an accurate blockchain snapshot. There's an experimental light client protocol version nicknamed. delayed Magic Number — Constantly holds a 0xD9B4BEF9 value

Read: Transaction Counter — A positive integer

Transactions — A list capturing various transactions

BlockVersion — Represents the block version changing with upgrades Samourai , and cold storage wallets like Ledger and Trezor hashPrevBlock — A 256-bit hash of the prior block header

Future Bitcoin Developments

hashMerkleRoot — A 256-bit hash founded on all block transactions

Following the BIP system Bits — The current target altering with difficulty adjustments Coindesk .

Nonce — A 32-bit number commencing at 0 with a pivotal mining role. Schnorr signatures In a P2P network devoid of central authority, there's an inherent challenge in ensuring blockchain accuracy. Solving this warrants guaranteeing an exceedingly high probability that transactions in mined blocks are free from double spending. Bitcoin's notable triumph in this area was resolving the double spend issue via an intense computational proof-of-work model, dubbed Nakamoto Consensus.

Satoshi Nakamoto proposed the proof-of-work (PoW) consensus to establish a distributed timestamped server, essentially a blockchain, on a P2P basis. Satoshi drew inspiration from Adam Back’s concept, initially devised to combat email spam through small computational tasks. Known as Nakamoto Consensus, Bitcoin's PoW was instrumental in overcoming the double spend dilemma.

Essential Resources to Deepen Your Bitcoin Knowledge

Achieving agreement in a decentralized node network akin to Bitcoin necessitates a Byzantine Fault Tolerance (BFT) algorithm. Nodes are free to join and exit the network as they wish, necessitating a system resilient to intentional misconduct by malicious nodes. Past iterations of BFT algorithms — like pBFT — suffered from scalability limitations and hefty communication overhead, with the round-robin style for selecting a leader node clashing with Bitcoin's design aims.

The Bitcoin Whitepaper: Exploring Nakamoto Consensus? Here’s a Beginner's Guide – Satoshi Nakamoto

and

- fractional-reserve banking system of most modern economies.

- articulated by

- Hasu — an independent Bitcoin researcher:

- PoW consensus centers around making block mining challenging in terms of computational resources, with tangible costs stemming mainly from electricity used for block mining attempts. A crucial passage in Bitcoin's original white paper delineates the PoW consensus foundation, underpinning Bitcoin's security: Evolving Bitcoin Narratives

cypherpunk

- P2P Digital Cash settlement layer

- akin to a flexible, digital gold. Schnorr signatures for aggregated multisigs and SegWit

- hard forked Visions of Bitcoin

- Hasufly/Nic Carter and Murad Mahmudov/Adam Tache

- The Bitcoin Community Nick Szabo

- in his Unenumerated blog post “ “The proof-of-work also addresses representation in majority decisions. If based on a one-IP-address-one-vote system, it can be manipulated by anyone who can generate numerous IPs. Instead, proof-of-work relies on one-CPU-one-vote. The longest chain amounts to the highest PoW effort. When a majority of CPU power is honest, it surpasses any competing chains, growing the fastest. Altering a past block means redoing the PoW for that block and all subsequent ones and outracing the honest node efforts.” ” To quote a summary of his position:

- security holes Social Scalability

- Read: subreddit

- , and a University of Cambridge study

- Roger Ver and Craig Wright Nouriel Rubini

- The Regulatory Landscape case

- comments commodity

Precursors to Bitcoin and the Evolution of Digital Currencies

- Bakkt A dynamic work difficulty calibrated to a 6-block hourly average ensures timely block mining while compensating for hardware speed increases. The resultant PoW model hinges on the security premise that substantial effort goes into mining each block. It also assumes most nodes are uncompromised, driven by powerful incentives to maintain chain integrity and general pBFT assumptions on arbitrary node actions.

- delayed Bitcoin ETF

- Read: Samourai

- , and cold storage wallets like Ledger and Trezor

- Future Bitcoin Developments Following the

BIP system

- Coindesk Once a miner emerges victorious in mining a block, it's distributed to peer nodes for propagation and node confirmation. Once verified, the process restarts, inserting transactions into new candidate blocks until a miner finds the nonce. The deeper into the blockchain (block height), the more improbable it is to alter a prior block. Often, it's deemed computationally unfeasible to modify a Bitcoin block after receiving six subsequent confirmations.

- Schnorr signatures

- The Bitcoin Whitepaper:

- – Satoshi Nakamoto

- and fractional-reserve banking

- system of most modern economies.

articulated

- by

- Hasu

- — an independent Bitcoin researcher:

- Evolving Bitcoin Narratives

- cypherpunk

- P2P Digital Cash

settlement layer

- akin to a flexible, digital gold.

- Schnorr signatures

- for aggregated multisigs and

- SegWit

- hard forked

- Visions of Bitcoin

Hasufly/Nic Carter

- and Murad Mahmudov/Adam Tache

- The Bitcoin Community Nick Szabo

- in his Unenumerated blog post “ ” To quote a summary of his position:

- security holes Social Scalability

Read:

Miners heavily invest in equipment necessary for mining, compensated directly in Bitcoin for their work. The system's mechanisms ensure network attack endeavors are prohibitively costly. Attacking Bitcoin entails orchestrating a 51 percent effort where a malicious actor would seize over half the network's hash capacity, able to validate invalid transactions or double spend. Yet, sustaining 51 percent of the hash power is exceedingly rare with negligible benefits against the costs. As per current analysis, executing a 51 percent attack on Bitcoin would surpass $8 billion solely in hardware expenses, even at low costs.

Some vital elements in Bitcoin mining encompass: