The foreign exchange market (forex) The global currency exchange platform stands as the unrivaled giant in global markets, with trading volumes surpassing $5 trillion daily, as highlighted by the Bank for International Settlements, overshadowing even the mightiest stock markets.

The forex arena is a realm of international currency pairs, allowing speculators to anticipate exchange rate movements and manage risk as currencies shift in value against one another.

Fascinatingly, there is no singular marketplace for forex; trading is available around the clock, five days a week, through Over-The-Counter (OTC) centers in leading global cities.

A Quick Expedition Through the Modern Forex Odyssey.

The origins of money The journey of currency exchange is rich with history and evolution. Tracing back to Ancient Egypt, currency dealings have morphed over time, previously anchored to assets like gold or silver considered solid currencies.

World War 1 marked a turning point as nations abandoned the gold standard, leading to the birth of modern forex trading markets, with notable players like the Kleinwort family pioneering exchange markets in London.

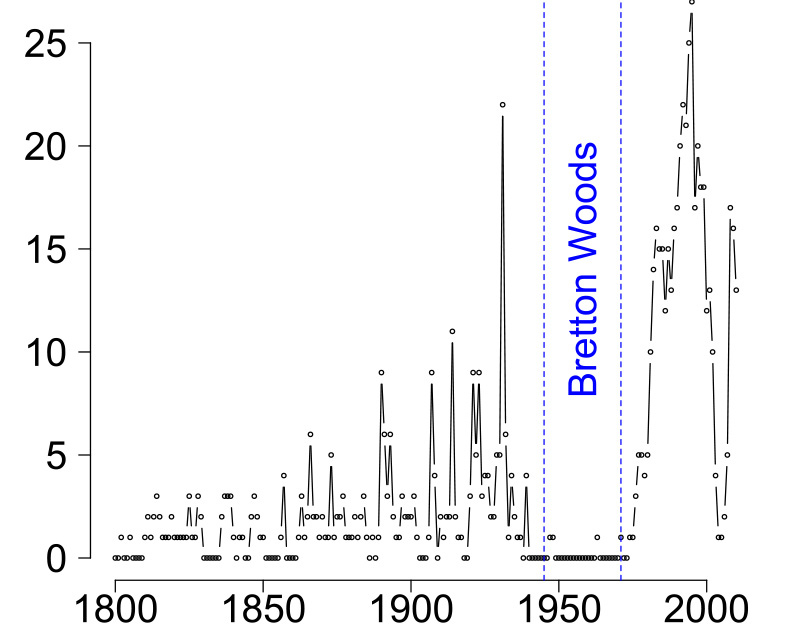

At the end of WW2, the Bretton Woods Accord Crafted in 1944 in Bretton Woods, New Hampshire, this accord charted the future path for the international monetary outlook.

The Bretton Woods Agreement saw a coalition of nations, including the U.S., Canada, and select European and Asian countries, launching a monetary system tethered to a gold reserve, enforcing tight exchange rate limits.

From 1945 through 1971, the Bretton Woods era was notable for its lack of banking crises. Wikipedia

This accord also brought forth the International Monetary Fund (IMF), streamlining an international reliance on the U.S. financial infrastructure.

President Richard Nixon's pivotal 1971 decision disrupted the dollar's fixed peg to gold, shifting the US Dollar into a floating fiat currency - a reserve currency status it retains globally. Bretton Woods Accord The transition to free-floating currencies crystallized into today's global currency system, enabling the forex market’s monumental growth.

Without a steady pricing anchor like gold, currencies' values are perpetually in flux, presenting lucrative arbitrage and hedging opportunities for traders.

Among the trio of primary forex markets, the spot market reigns, accompanied by forwards.

How Forex Markets Work

Distilled to its essence, the spot market forms the underlying asset for both futures and forwards trading. futures markets. The spot market is by far the most popular A myriad of participants inject liquidity into the forex scene, from multinational banks managing cross-border revenue to corporates hedging currency rate risk for their international operations.

In the spot market, currencies are briskly traded at current pricing, driven by a myriad of economic and political factors creating high liquidity among major trading pairings.

For example, the EUR/USD pair takes the lead as the world's top traded currency duo, with the Euro as the 'base' and the USD as the 'counter,' indicating how many dollars are required for one Euro. This transaction’s spread is pivotal in trading.

Currency spreads are minute, often calculated to four decimal places — known as a ‘pip.’ Traders strategically manoeuvre their positions based on these spreads to capitalize on shifts in the currency values.

EUR/USD Chart. TradingView

Spreads & Leverage

Given the slender spreads, capitalizing in forex often involves leveraging substantial volumes or margin trading, aided by the forex market’s immense liquidity permitting significant leverage.

Spot market trades finalize in cash, through agreements to exchange defined currency amounts at prevailing market rates.

Forex's forwards market relies on contracts with precise stipulations for OTC transactions, whereas futures settle on major arenas like CBOE and CME, complete with predefined delivery timelines.

Both futures and forwards often conclude in cash and serve as hedging apparatuses against stock market volatilities.

The forex space is populated by diverse entities, significantly enhancing the market's liquidity.

Market Participants

The forex landscape is tiered, with major commercial banks and securities dealers dominating trade volume.

Citigroup Inc. emerged as a forex titan, clinching nearly 12.9 percent of the marketplace in 2016. 51 percent Beyond these giants lies a layer of smaller banks, corporations, market makers, insurance outfits, mutual fund entities, and an array of smaller participants.

Forex’s strategic edge for multi-currency enterprises is hedging against swift exchange rate shifts — crucial for companies remunerating international employees or streamlining cross-border transactions.

Consider a company in the U.S. using EUR/USD for Euro transactions. If currency rates shift unfavorably—as they complete a substantial dollar-euro exchange—it can severely impact their finances.

Leveraging futures or forwards contracts is a norm among global corporations, helping mitigate unfavorable currency movements on fixed trade dates.

Central banks are forex’s stalwarts, using currency benchmarks to decipher trends and evaluate national fiscal health. These central banks engage with reserves, such as the US Dollar, seeking stabilizing market maneuvers.

Retail traders are surging into the forex arena, typically navigating this space through banks or brokers, who either facilitate transactions for a fee or directly oppose the trades as market makers. foreign exchange services Heightened regulation, chiefly due to the historic lack of accountability and prevalent broker misconduct, has prompted retail traders to be discerning about broker selections.

Forex Trading

Money remittance enterprises play vital roles in forex by aiding migrants in sending funds, although their fee framework and outdated service models draw critique.

The demand for social trading services At Blockonomi, we’ve reviewed forex brokers catering to both retail and professional traders, providing a spectrum from forex and cryptocurrencies to commodities and equities.

They frequently leverage Contracts for Difference (CFDs), essentially wagering on price fluctuations within specified financial instruments rather than direct ownership.

Forex Brokers

With forex’s staggering global presence, propelled by a floating currency backdrop, it's the heavyweight leader among asset classes worldwide.

Cryptocurrencies and digital assets are progressively offering a refreshing contrast to customary forex services, notably in remittance realms.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

- ATFX

Unpacking the Role of Digital Assets in Shaping Future Forex Trading.

As digital assets weave into traditional finance, brokers are expanding trading pairings, symbolizing robust integration into investment portfolios.

Known as the financial juggernaut with continuous global activity, the forex market is unparalleled.

Reflecting on fiat currency sustainability long-term, the forex market's monumental scale and intricacies highlight the challenges inherent in a post-Bretton Woods world of disparate national currencies.

A crafting wordsmith, blockchain enthusiast, and web developer with a zeal for decentralized paradigms and cryptocurrency evolution. Reach out at brian@level-up-casino-app.com perfect competition Forex Trading 101: A Newcomer's Overview for 2022

However, proponents of sound money like Bitcoin and gold Explore the world’s largest and most fluid marketplace with our comprehensive Guide—the foreign exchange market for global currencies. black swan events.

1Comment

Is Forex working in Somalia