The cryptocurrency known as Ripple Ripple became a phenomenon in financial circles last year, thanks to its massive price leap of 35,000% in 2017 before it took a nosedive in early 2018. But what's the real deal with Ripple? Although aimed at influencing the banking sector, is XRP actually getting used by banks? Is Ripple even a bona fide cryptocurrency? We'll delve into these queries and more in this feature all about Ripple.

What is Ripple?

To the uninitiated, Ripple might seem like the new kid on the cryptocurrency block, but it actually dates back to 2004—a time long before Bitcoin was birthed. It was engineered with a clear focus: enhancing interbank transactions, particularly those spanning borders. It wasn't until 2012, though, that Ripple stepped into the crypto world.

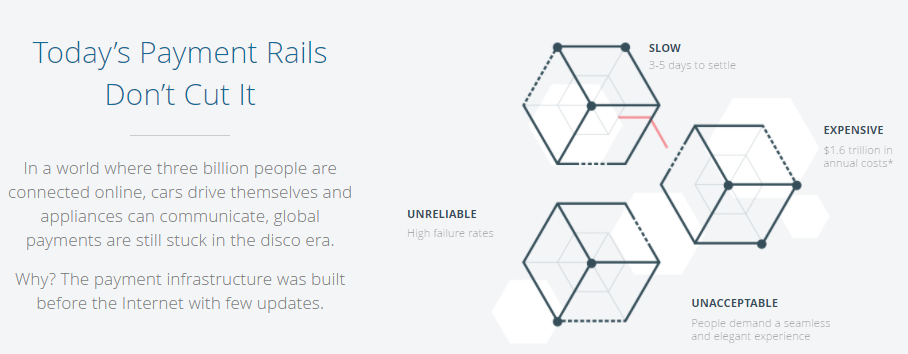

Imagine transferring funds from one country’s bank to another—it’s a labyrinth! Fees stack up, and errors are par for the course. All over the globe, systems like Swift and ACH try to facilitate these transfers, but they don’t play well together, often causing delays that require trusted intermediaries, further complicating matters.

Ultimately, what you're left with are expensive, sluggish processes that could drag on for days or even weeks, not to mention they don't work on weekends.

Enter Ripple—the supposed savior for international transfers. Though details are scanty, the Ripple network was meant to make cross-border transactions as fast as a blink and much cheaper than traditional methods. Unlike other cryptocurrencies involved in direct exchanges, Ripple was conceptualized to boost fiat transfer efficiency without the end user even knowing it.

That vision is bold, but how does it stack up to reality? Are any banks genuinely embracing XRP these days?

Ripple in the real world

Unfortunately, the revelation comes with a sigh, as none have jumped on the XRP bandwagon for routine international banking tasks. When banks do dabble in crypto, it's under wraps or solely experimental.

That said, Ripple isn't idle. The company has crafted other financial technologies untied to cryptocurrencies. Notably, in February, Santander announced that they'd be using Ripple’s technology for personal payments. technology they call xCurrent . News broke Though it's promising for Ripple as an organization, it's crucial to note that this development is unrelated to cryptocurrency per se. Santander remains unlinked to XRP. Their focus is on xCurrent, which functions independently.

Ripple gained more traction in the media spotlight, securing time on key news outlets. There was even a segment guiding on how to acquire it through Bitsane and Coinbase. This level of attention is quite noteworthy, particularly for an altcoin not charting top levels.

Ripple Price & Hype

Add fuel to the fire with online murmurs hinting that Coinbase might introduce Ripple to their platform. Traditionally, this causes significant price jumps for assets due to increased accessibility, as seen with Bitcoin Cash. CNBC back in January The sharp price increase wasn't just Ripple-specific but mirrored a broader market surge in December, linked to many assets tied to Bitcoin.

At its zenith, Ripple dazzled at approximately $4.50 each, an increase making Ripple's CEO among the world's richest temporarily—before plunging.

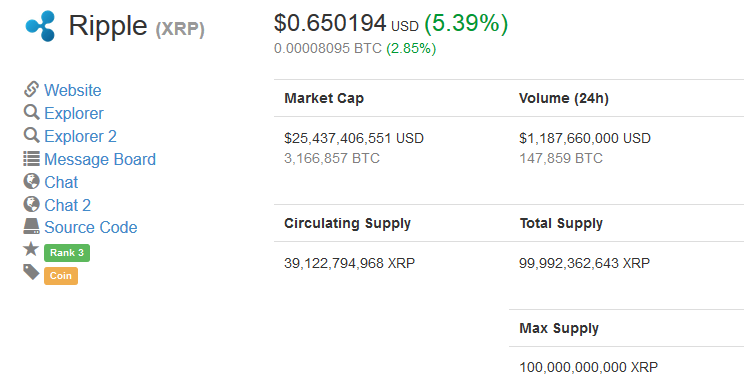

Currently, Ripple trades around $0.65, down from its peak but still substantially up from less than a cent in 2014.

Ripple is quite an anomaly. It operates with a different set of principles from its peers—not mined, no proof-of-stake, no initial coin offering. Unlike many tokens on foreign networks, Ripple coins are predominantly held by the Ripple company.

Transaction costs on Ripple burn away, with no miners to take them up, diverting toward deflation with an immense supply nearing 100 billion, more than 60% remaining withheld.

Under the hood

Ripple’s network follows an exclusive pattern, with just a handful of validation nodes active. Some claim only financial institutions or market makers can hold nodes, raising concerns about decentralization, as the network could falter if its core nodes are compromised.

The original Ripple idea is certainly intriguing. Despite a decade's passage, no bank seems eager to embrace XRP.

Despite Ripple's peer-to-peer potential, its lack of privacy and centralization questions make it suboptimal.

Do banks care about Ripple?

Considering asset storage or long-term investments, Ripple presents uncertainties. With the majority of coins governed by company insiders, investors can only hope they won't flood the market.

If banks finally utilize XRP, it could prove its worth, but whether this translates to steady growth remains uncertain. Even with widespread bank adoption, the vast supply dilutes potential impact.

It's indeed possible banks might bypass Ripple altogether; instead, they could opt for recognized decentralized alternatives like Bitcoin or Ethereum or simply create proprietary networks inaccessible to the public.

Ripple holds a formidable position within cryptocurrency by market cap. Though fascinating, its true potential remains clouded until a real-world application emerges. Until then, skepticism and caution are valid approaches due to the current lack of practical XRP use.

Banks will be banks

Note: This piece's writer holds no XRP investments nor plans to for at least the next quarter.

Robert, an editor at Blockonomi, brings years of crypto enthusiasm, advocating for a future of digital autonomy. Reach out at Robert@level-up-casino-app.com

A Spotlight on iExec: Building Trust Layers for DePIN and Artificial Intelligence

3Comments

Being a prominent altcoin outside the major trifecta receiving such limelight is extraordinary.

ahem. Brad Garlinghouse

During that timeline, XRP maintained its reign among the top three.

Ripple's coin price hovered around $0.94 at the release's publication—not $0.65.

Investors nervously bank on the hope that major holders won’t devastate market prices with sudden sell-offs. However, XRP is securely locked in Escrow, mitigating such risks.

No, and anyone can establish a validator. Ripple is forging ways to offer superior decentralization compared to Bitcoin and Ethereum by year-end. Check https://ripple.com/dev-blog/decentralization-strategy-update/

Ripple’s market supply is immense; even vast bank purchases might still barely dent the available quantity.

Exploring Ripple (XRP): The Currency Making Waves and Debunking the Hype

Last year, Ripple was the shining star in the world of traditional finance analysis. Its value skyrocketed by an astounding 35,000% over 2017, but faced a steep fall as the new year began.

Unpacking the Ripple Phenomenon: Is It Justified or Overblown?

Ripple had quite a year in the spotlight among financial experts, seeing its price catapult 35,000% during 2017, only to crash dramatically soon after. What lies behind Ripple's allure, and what exactly is it? There’s a lot of buzz regarding its potential with banks, but how many are leveraging XRP? Is Ripple deserving of the cryptocurrency title? This piece aims to delve into these questions and more.

Contrary to what you might expect, Ripple's history is relatively deep, with its origins dating back to 2004—before Bitcoin even came on the scene. From the outset, its mission was to facilitate bank-to-bank transactions, especially those that cross international borders, with what would become the 'Ripple payment protocol'. It was not until 2012 that Ripple started its journey into the cryptocurrency space.

Today, navigating the process of transferring money from a bank in one country to another is a daunting task marred by numerous fees and potential mishaps. Typically, transactions rely on networks like Swift or ACH, which don't work seamlessly together, necessitating translations. Things get trickier when an intermediary bank is needed for trust purposes, slowing everything down and adding costs.

The result of this convoluted process? Lengthy waits that can stretch into weeks, inflated costs, and a high likelihood of errors.

Enter Ripple: Its proclaimed mission is streamlining international bank transactions to take mere seconds, bringing down fees significantly. Unlike peer-to-peer cryptocurrencies such as Bitcoin, the Ripple network is designed to operate behind the scenes, assisting in the swift global transfer of fiat currency.

That's the vision anyway, but what’s happening in reality? Are any banks actually tapping into Ripple’s XRP for their cross-border transactions?

0/10 for me on this one.