Wirex It's an application that empowers you to manage both your standard financial assets and digital currencies effortlessly.

Initially launched as E-Coin, offering virtual cards, the company evolved and rebranded to Wirex in February 2016, broadening its service range.

Presenting a personal banking solution, Wirex fuses conventional banking with cryptocurrency benefits, claiming to be pioneers in merging fiat currency acceptance with blockchain agility and speed.

Through secure wallets for Litecoin and Bitcoin, Wirex offers mobile and online application support.

Wirex smoothly integrates global payment technologies and peer-to-peer transfers, making transactions easier with enhanced privacy, fortified security, and a superior customer experience. They continuously refine their services and products to better cater to their clientele.

About Wirex

Wirex operates with a substantial transaction volume of $2.0 billion, serving 1.8 million users. Headquartered in London, it has offices in Kiev, Ukraine, and Tokyo, Japan, supporting around 130 countries, excluding the United States.

Wirex envisions a world where everyone is part of the financial evolution, encouraging the use of both traditional and cryptocurrencies in daily transactions, eliminating the strict necessity to choose one over the other.

Additionally, Wirex believes in global access to banking services. All that's needed is an internet connection—no forms to fill out, no closing times, no weekends off.

Wirex strives to shatter geographic barriers in finance, envisioning instant global money transfers.

Wirex Features

Utilizing Wirex, you can link your credit and debit cards. The app facilitates storing and buying cryptocurrencies, including Bitcoin, with competitive exchange rates and high limits, or convert crypto to traditional currencies.

Wirex allows fee-free digital currency transfers to users worldwide or very low-fee money transfers, reducing the costs seen with traditional money-sending services.

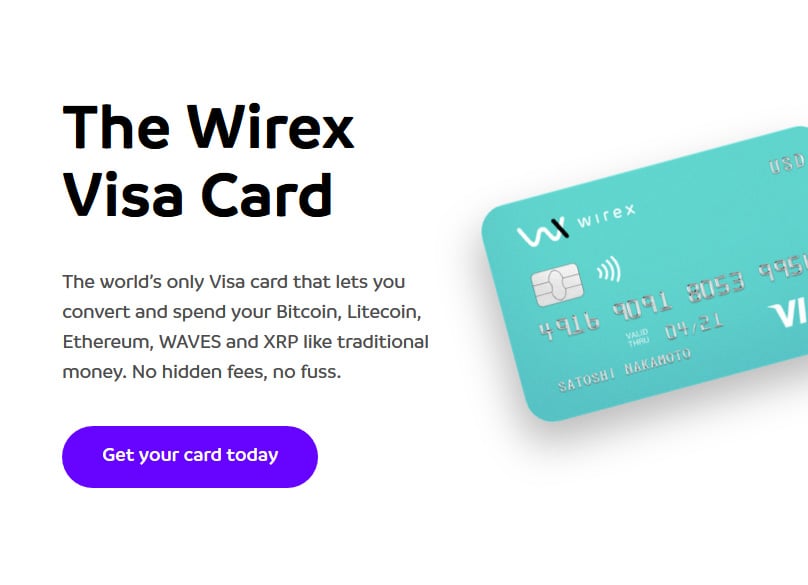

Wirex Visa Payment Card

The Visa card is contactless, enabling convenient payments directly from your Wirex account, effectively letting you spend crypto like fiat in various places such as shops, restaurants, and on transport.

Wirex promotes this as the sole Visa card globally that facilitates crypto conversion into standard money for regular spending.

- Connect your card to your Bitcoin, Litecoin, Ethereum, WAVES, or XRP wallets and seamlessly spend them in daily life

- Real-time convert Bitcoin, Litecoin, Ethereum, WAVES, and XRP to GBP, EUR, and USD at live rates

- Gain 0.5% in Bitcoin as a reward every time you use your Wirex Visa card, whether punching in your pin, swiping, or using contactless features in-store

Instant Crypto to Fiat Conversions

The card allows instant crypto conversion for spending ease comparable to fiat currency. Compatible with Bitcoin, Ethereum, Litecoin, and Ripple.

Accepted globally, in retail, online, and ATMs, you can choose GBP, EUR, or USD as your card's base currency, including the option for all three.

The Wirex Visa card ensures exchange rates superior to banks without hidden fees or commissions. The app assists with budget management and sends immediate spending alerts.

Cryptoback Rewards

Using your Wirex Visa card rewards you with Cryptoback incentives. Each in-store transaction earns you 0.5% back in Bitcoin, redeemable instantly for spending or conversion.

Adding Funds

To fund your Wirex Visa, simply add money to your Wirex account through credit/debit cards, cryptocurrency deposits, or bank transfers.

A GBP card equates to a Visa debit card with a bank account number and sort code, whereas a USD or EUR card is prepaid, linking its balance to your Wirex currency account.

Wirex Rewards Paid in Bitcoin

As highlighted, Cryptoback rewards offer 0.5% back in Bitcoin on retail purchases made with the Wirex Visa card.

Wirex also features a Refer-a-Friend incentive. By inviting friends and family to join Wirex, both parties can earn Bitcoin at no cost, up to $10 each.

To engage in the referral program, distribute your unique link found in the app under Rewards. Your friends sign up and verify in two quick steps.

Upon your friend spending $100 on crypto with a card, you both earn $5 in Bitcoin. When they acquire a Wirex Visa and shop in-store, another $5 in Bitcoin for both.

These reward programs shine with no earning limits in either Cryptoback or Refer-a-Friend schemes.

Both Cryptoback and Refer-a-Friend rewards are given in Satoshis, Bitcoin's smallest unit, redeemable anytime, online through the app, to spend, store, or exchange as preferred.

Wirex Cryptocurrency Wallets

Wirex users can opt from six distinct currency wallets, featuring secure cold storage, traditional currency, and multi-signature functionality. Four are especially user-friendly crypto wallets.

These wallets permit buying, storing, or managing both crypto and fiat currencies. Supported cryptocurrencies encompass BTC, LTC, ETH, XRP, and WAVES, while fiat currencies cover GBP, EUR, and USD, translate instantly at live rates.

Multiple funding methods exist, including bank transfers or card payments. Attach the Wirex Visa card to your wallet to convert and spend cryptocurrency online and in-person.

Differences Between Crypto and Fiat Wallets

With a Wirex crypto wallet, you're empowered to exchange between digital and traditional money at live rates, funding through transfer or card, with expenditure potential via the Wirex Visa.

For traditional currency wallets, cards in GBP, EUR, or USD are available, ideal for travelers reducing merchant rates and unfavorable exchanges, offering bank-beating rates, fee-free.

How to Use Wirex

Simply register on the Wirex website Your Wirex account becomes instantly operational within minutes.

Begin with downloading the Wirex app via Apple App Store or Google Play. Register, verify your account, and enjoy.

Select a USD, EUR, or GBP account for immediate access, managing your funds anytime, anywhere.

Exchanging Currencies on Wirex

One key Wirex highlight is currency exchange at competitive rates without fees or commissions. Acquire traditional or digital currency smoothly in two steps.

Load funds into Wirex, access the website or app, and convert instantly to BTC, LTC, ETH, WAVES, or XRP, or into GBP, USD, or EUR effortlessly. Buy or convert between fiat and cryptocurrency.

Wirex Money Transfers

Wirex stands out in global money transfers with simplicity and low fees, evading typical high charges.

Experience highly competitive rates sending USD, EUR, or GBP anywhere. For crypto transfers, convert with no commissions, paying only conversion costs.

Start with loading your wallet via bank transfer or card; crypto auto-converts for transfer, echoing your chosen fiat preference.

Choose your currency—crypto or fiat—for transferring, input the amount, then proceed by providing the recipient's wallet address.

If the person you intend to send money to doesn't have a wallet yet, they can easily set one up for free using the Wirex app. Once the wallet is ready, just hit confirm, and you're good to go. While the transfer usually finishes in about ten minutes, sometimes it can stretch up to an hour.

Wirex Fees

What makes Wirex a favorite in its field is its transparency and incredibly low costs. There aren't any hidden charges or transactional fees lurking around. The price you see for each exchange is exactly what you'll pay.

No fees come with downloading the mobile app, utilizing a multi-sig wallet, operating an e-money account, or even the high-security features like two-factor authentication. Even when it comes to card issuance, delivery, and cryptocurrency AML, Wirex keeps it fee-free. The only recurring charge is a small card management fee that’s notably less than what others charge—just under a pound or dollar per month.

Adding funds to your account is also delightfully fee-less, whether you opt for crypto, a credit or debit card, or a bank transfer. Most of what you do—be it cryptocurrency swaps, currency exchanges, or Wirex transfers—comes at no extra cost. Even shopping online or in stores incurs zero charges, and yes, you'll get cashback fee-free as well.

Although you will face a modest fee when withdrawing from ATMs, it's surprisingly lower than what most competitors ask for. Within Europe, you'll pay around one to two pounds, or two to three dollars if you’re outside Europe.

Here's the full scoop on fees you'll face with Wirex:

Account and Wirex card charges

| Mobile app | Free |

| Multi-sig wallet | Free |

| E-Money account | Free |

| Security features (2FA) | Free |

| Card issuance | Free |

| Card delivery | Free |

| Cryptocurrency AML | Free |

| Card management | £1.00 / €1.20 / $1.50 per month |

Top-Up charges

| Bank transfer | Free |

| Credit/Debit card | Free |

| Cryptocurrency | Free |

Transaction charges

| Cryptocurrency exchange | Free |

| FIAT exchange | Free |

| Wirex cryptocurrency transfers | Free |

| Wirex FIAT transfers | Free |

| Online card purchase (ePOS) | Free |

| In-store card purchase (POS) | Free |

| ATM (in Europe) | £1.75 / €2.25 / $2.50 |

| ATM (outside Europe) | £2.25 / €2.75 / $3.50 |

| Cashback in-store | Free |

Wirex Limits

Wirex seeks to attract every possible user, offering some of the industry's most relaxed limits. Whether exchanging, depositing, or shopping online or in-store, you'll face no limits.

Any caps Wirex does impose are actually pretty reasonable and aligned with industry standards. Most everyday users won't find themselves limited. For example, the daily cashback limit is set at £50, and you can transfer up to 10 BTC each day.

Withdrawing cash from ATMs is capped at £250 per day. You can top up your account with credit or debit cards by up to £7,500 daily, while your card balance can maximize at £15k.

Limits

| Exchange | Unlimited |

| Deposit | Unlimited |

| Transfer | 10 BTC per day |

| Online card purchase (ePOS) | £7500 / €8000 / $10000 |

| In-store card purchase (POS) | £7500 / €8000 / $10000 |

| ATM | £250 / €250 / $250 per day |

| Cashback in-store | £50 per day |

| Top-up with credit/debit card | £5000/€5000/$5000 per day |

| Maximum card balance | £15000 / €16000 / $20000 |

Wirex Business Payments Solution

On the professional side of things, Wirex doesn't just cater to individuals but also caters to businesses with their Wirex Business account. It's designed to handle both crypto and traditional money, supporting payments anywhere and anytime.

With Wirex Business, you experience not only swift transactions but also unparalleled flexibility. It merges global fiat acceptance with cryptocurrency's nimbleness.

Businesses can open accounts in various currencies like EUR, GBP, and over two dozen others. Feel free to also store unlimited amounts of Bitcoin, Litecoin, XRP, or Ether in Wirex wallets.

As for payments, Wirex Business allows you to seamlessly accept international transactions, whether in crypto or fiat currencies. This is made possible with technology such as blockchain and networks like SWIFT and SEPA.

Wirex Business is packed with valuable features including managing counterparties, assigning roles, and permissions. And naturally, you can track account activities with real-time updates.

For ultimate consistency, Wirex Business lets you set up an account under your company's name. Everything from saving to converting and receiving payments, whether in fiat or crypto, happens on one streamlined platform.

Is Wirex Safe?

Wirex holds the rare distinction of being the third crypto-friendly firm that earned an e-money license from the FCA. This licensing assures clients, as it requires Wirex to comply with strict security standards.

The firm ensures top-notch security by using the highest level of PCI DSS certification. Plus, safe transactions, fraud prevention, and secure wallets further solidify the security setup.

Wirex goes above and beyond to protect user assets. An astounding 99% of user funds are held in segregated, multi-signature cold wallets—making sure only you can access them.

Utilizing 3-D Secure by Visa enhances protection, even reducing risks in cases of card cloning or stealing. This, paired with PCI DSS certification, nearly eliminates fraud.

Managing your Wirex card is hassle-free; you can instantly disable or re-enable it through the app, a handy feature for misplaced cards. For substantial spendings, smart confirmations kick in for extra safety.

When it comes to data safety, Wirex employs 256-bit AES SSL encryption for all your personal info and documentation, both while being sent and stored.

Concerned about unauthorized access? Wirex covers you with multi-factor authentication, device, and biometric verification, ensuring you control which devices can get into your account.

You can always check which devices are linked to your account and remove any unfamiliar or outdated ones with a single tap for peace of mind.

The application includes push notifications alongside text and email alerts. This means you'll know the moment something happens with your account, letting you quickly tackle potential fraud.

To maintain peak security, Wirex is built on blockchain technology—constantly monitored to ensure robust defenses are always up and running.

Wirex adheres to best practices, drawing on guidelines from its tech partners and regulators to ensure its risk management protocols are sound.

Wirex Customer Support

While Wirex doesn’t offer a phone hotline or desktop live chat, a live chat feature is available within their mobile app. You typically contact support via email or by filling out a form in the Help Center.

Reaching out through the Wirex Help Center is straightforward: Click 'Get in Touch', fill in your details, and submit. A community page also exists for peers to share information.

The Support Center within the Wirex Help Center is accessible 24/7 and offers common solutions categorized for easy exploration. The search tool expedites finding what you need.

Most questions can be resolved through the Help Center. If not, filling out the contact form triggers a prompt response from Wirex.

Wirex Help Center

Wirex combines fiat and crypto holdings in one account, accessible via a singular app. Multiple wallet options suit various currencies.

The Wirex Visa card is a standout, working like a debit or prepaid card to use wherever Visa is accepted. This enables you to spend your crypto at supermarkets, shops, online, or dining out.

Conclusion

Wirex has extensive security measures and receives authorization from the UK Financial Conduct Authority, adding a layer of trust.

Note that Wirex is currently dealing with some issues surrounding password recovery. We noticed password reset emails due to recent data breaches, reflecting proactive security measures.

Unfortunately, complaints have surfaced about difficulties re-accessing accounts. Although this shouldn't deter new users, existing ones might find it bothersome.

At present, Wirex remains unavailable to US residents, yet their global reach is expanding. A list of supported countries is provided on their website.

In conclusion, Wirex is paving new paths by bridging fiat and crypto spending, opening doors for more industry adoption. But ensure you're aware of tax rules, as many purchases can be taxable events.

If you're trying to send funds to someone who hasn't set up their Wirex wallet yet, they can effortlessly obtain one through the Wirex app at no cost. Once they've got it, all you need to do is hit confirm, and you're good to go. Normally, transfers zip through in about ten minutes, but sometimes, they might stretch up to an hour. here .

What sets Wirex apart in the crowded marketplace is a rare combo of transparency and reasonably low fees. Forget about getting hit with unexpected charges, as they have eliminated commissions and transactional fees completely. Essentially, what you see is exactly what you get for every type of exchange.

Using their mobile app comes with zero cost, and the same goes for the multi-signature wallet, e-money account, and security perks like two-factor authentication. They’ve waived any fees typically associated with card issuance and delivery, plus complying with cryptocurrency anti-money laundering policies. The only fee you’ll occasionally encounter is for card maintenance, but it's fairly minimal compared to rivals – just a pound, euro, or dollar and a half monthly.

2Comments

As for ATM withdrawals, they cap daily at two hundred and fifty in pounds, euros, or dollars. When you top up using credit or debit cards, the ceiling is seven and a half grand in pounds, eight thousand euros, or ten thousand dollars a day. Additionally, the most your card can hold is fifteen thousand pounds, sixteen thousand euros, or twenty thousand dollars.

Apart from personal options, Wirex provides businesses with a feature-rich cryptocurrency-enabled payment solution called Wirex Business. This international service lets businesses settle payments anytime, anywhere, in either crypto or fiat currency.

Wirex Business boasts exceptional transaction velocities and unbeatable adaptability. This is a blend of the traditional acceptance of fiat currency with the cutting-edge efficacy of cryptocurrency.

Organizations can form accounts in multiple currencies under their own names. With the ability to support currencies ranging from EUR and GBP to 25 others, businesses are spoiled for choice. They can also use the wallets to safeguard limitless amounts of Litecoin, Bitcoin, XRP, or Ether.

In terms of accepting payments, Wirex Business facilitates seamless transactions in both crypto and fiat currencies worldwide. This capability is empowered by the integration of blockchain, SWIFT, and SEPA technologies.

Wirex Business comes packed with valuable features for business users, including the ability to store information about counterparties, assign wallet permissions, and designate roles. Real-time access to account activity is a given.

Setting up a Wirex Business account is a straightforward process, offering a consistent, crypto-welcoming account setup using your legal entity's name. Manage a variety of transactions in a simplified manner by consolidating them on one platform, saving, exchanging, and receiving payments in both fiat and crypto. Plus, observe and manage all financial movements efficiently thanks to tracking tools.