XM XM is a digital trading platform that enables clients to engage with a variety of financial assets.

Launched in 2009, XM Group equips traders with the complete suite of MetaTrader platforms provided by MetaQuotes Software Corporation.

XM Group has grown into a versatile online broker, providing access to 57 currency pairs and 1000 CFDs, including five on cryptocurrencies like Bitcoin and Ethereum.

Risk Alert: CFDs are delicate tools with a high risk of rapid financial loss due to leverage. A staggering 71.61% of retail accounts report losses when dealing in CFDs with this provider. Evaluate your grasp of CFD trading and assess your risk tolerance.

XM The platform boasts a clientele of 10 million users spread across 190 nations globally.

To date, XM has facilitated over 1.4 billion transactions, boasting zero refusals or wrong quotes. The leadership team has journeyed to over 120 cities to connect with clients and collaborators.

Since its inception in 2009, XM has blossomed into a leader in the financial sector, staffed by over 300 seasoned professionals with deep industry expertise.

With impressive multilingual support covering more than 30 languages, XM is tailored to traders worldwide, regardless of their experience level. The firm offers 16 fully integrated trading platforms for client selection.

XM at a Glance

| Брокер | XM |

| Регулирование | Licensed by the FCA (UK), CySEC (Cyprus), ASIC (Australia), and IFSC (Belize) |

| Минимальный начальный депозит |

$5 |

| Демо-счет |

Да |

| Покрытие активов | Delve into diverse instruments with Forex, Crypto CFDs, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, and Shares at XM. |

| Кредитное плечо | Максимальное кредитное плечо 1:1000 |

| Торговые платформы | Trade effortlessly across MetaTrader 4, MetaTrader 5, Web Trader, and Mobile platforms. |

Как XM регулируется?

The XM brand comprises several regulated online brokers. The first entity was born in 2009 in Cyprus, under CySEC regulation, originally named Trading Point of Financial Instruments Ltd.

In 2015, the XM group fortified its presence by establishing an ASIC-regulated entity in Sydney, Australia, while gaining FCA-regulated status in London under the Trading Point of Financial Instruments UK Ltd name.

In 2017, XM Global Limited appeared in Belize, regulated by the IFSC and holding license number IFSC/60/354/TS/18.

Другая юридическая информация

With official premises at No. 5 Cork Street, Belize City, Belize, C.A., XM Global (CY) Limited maintains offices at 36, Makariou & Agias Elenis, ‘Galaxias’ Building, 5th floor, Office 502, Nicosia, Cyprus.

It's essential to note XM services are restricted in some regions. Residents from the USA, the Islamic Republic of Iran, and Israel cannot access XM Global Limited services.

Browse all pertinent legal documents on XM's website under the Legal Documents section, including terms and conditions, the conflict of interest policy, and more. At the establishment's time, 12 downloadable PDFs were available.

Обзор XM

Брокер предлагает усовершенствованную торговую платформу XM brokers are familiar with fluctuating client demands, adjusting trading conditions to suit global clients. Their deep market knowledge enhances client service.

Dedicated to excellence, XM facilitates trading currencies, CFDs, precious metals, energies, and equity indices, providing unrivaled service.

Central to XM's appeal is its operational philosophy–building client satisfaction by nurturing loyalty, understanding that reputation is earned through trust.

XM proactively responds to increasingly discerning and sophisticated client demands by tracking industry shifts and innovations, maintaining the quality of execution and tight spreads.

XM cherishes the human connection in commerce, evident in management's visits to over 120 cities worldwide to meet clients and partners, valuing face-to-face interactions.

In its quest to enhance trading skills, XM hosts extensive seminars globally, aiming to equip traders with knowledge for better decision-making. Hundreds of events have already been organized, with more in the pipeline.

Фонд XM

Through the XM Foundation, the focus is on fostering equality through humanitarian efforts. Their mission is to positively impact lives, helping others reach their full potential irrespective of origin or culture.

The XM Foundation takes initiatives advancing vocational skills and education. Collaborating with international and local humanitarian organizations, it also provides global aid.

To access current initiatives and donation details, visit the XM Foundation page on the broker's website.

Какие типы счетов предлагает XM?

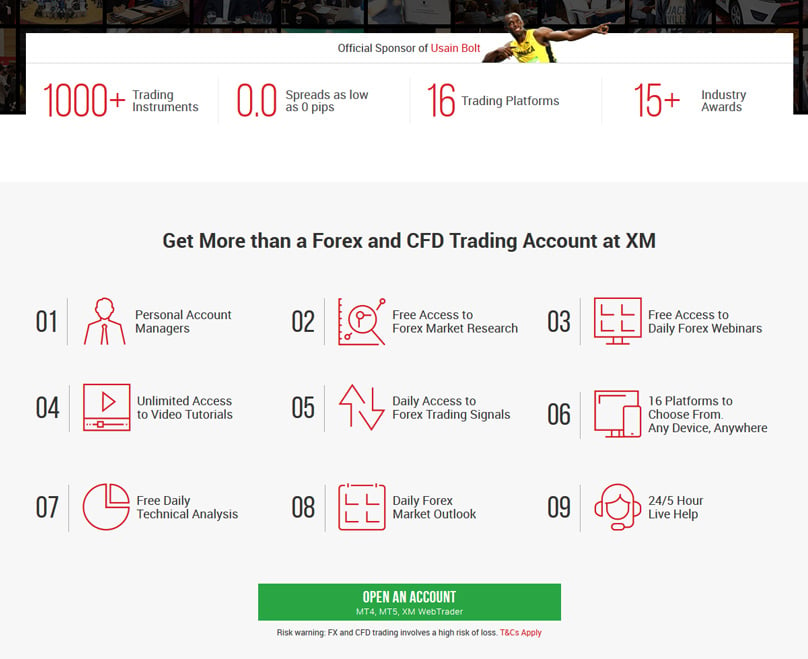

XM предлагает клиентам выбрать из четырех основных типов счетов Account types like Micro, Standard, XM Ultra Low, and Shares Accounts provide exceptional trading terms with MT4/MT4 EA access without limits.

Clients can trade standard or micro-lots with consistent execution across account types, benefiting from daily market updates and technical analyses, plus multilingual support and dedicated Personal Account Managers.

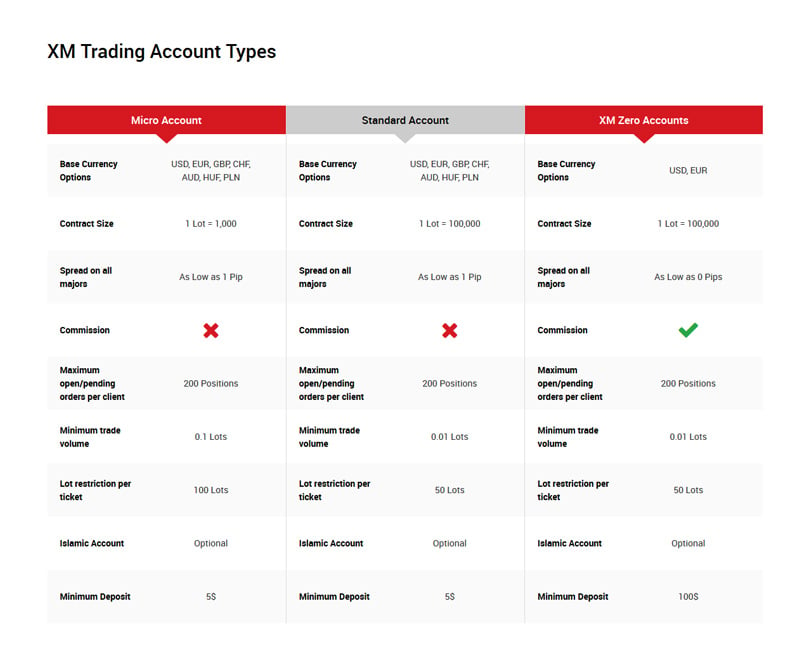

Микро и стандартные счета

Микро счета Available base currencies include USD, GBP, EUR, CHF, JPY, AUD, PLN, HUF, RUB, ZAR, or SGD. Transactions incur no commissions, plus accounts are protected from negative balance.

With a $5 minimum deposit, Islamic accounts are an option; hedging is supported. Trading on MT4 requires a 0.01 lot minimum volume, which amounts to 0.1 on MT5, with a cap of 200 open or pending trades.

In contrast, Standard Accounts mandate a lot size of 100,000, capped at 50 lots per ticket, with a minimum 0.01 lot trade volume. Other differences from Micro Accounts are minimal.

Ультра низкий счет XM

An XM Ultra Low Account Accounts can be USD, GBP, EUR, SGD, AUD, or ZAD based, exempt from commissions and protected from negative balance. There are no bonuses tied to trades or deposits, though hedging is supported.

- The $5 deposit threshold applies across account types, with a maximum of 200 concurrent open or pending trades.

- XM Ultra Low Accounts are categorized into Standard Ultra and Micro Ultra.

- For Standard Ultra Accounts, trades commence at a 0.01 lot volume, limited to 50 lots per ticket.

- Micro Ultra Accounts set these metrics at 0.1 lots with a 100 lot maximum per ticket.

What Other Accounts Does XM Offer?

Shares Accounts are strictly Islamic, initiating with a $10,000 minimum deposit, excluding trading bonuses, deposit incentives, or hedging.

Contracts constitute one share with a minimum trade volume of one lot. Clients may have up to 50 active trades, with lot constraints varying by share.

XM supports personalized account designs for forex trading, offering versatility tailored to client requirements.

Islamic Accounts

Most XM accounts offer Islamic, swap-free options without overnight rollover interests.

To convert a standard to an Islamic account, register and verify an account, then request conversion via XM. Abuse might trigger a repeal of swap-free status.

XM stands out with Islamic Accounts without raising spreads, unlike many brokers imposing extra fees on swap-free accounts.

Promoting transparency, XM avoids substituting ‘swap-free’ with alternative charges, often disguised yet counterproductive to fair Islamic trading principles.

What Assets Can You Trade With XM?

XM gives clients the ability to trade more than 1,000 instruments across 9 asset classes:

- Forex,

- Crypto CFDs,

- Stock CFDs,

- Turbo Stocks,

- Commodities,

- Equity Indices,

- Precious Metals,

- Energies,

- Shares

Access details on every available trading instrument on their dedicated asset pages.

- Choose from 57 forex pairs, including major, minor, and exotic options.

- Trading spans across 1,210 distinct stock CFDs, with filters by geography for ease of navigation.

- The stock CFDs span 17 countries.

- These include listed stocks in countries such as the USA, UK, Germany, and more.

XM enables trading across eight commodity futures CFDs, 18 cash indices, 12 index futures, two spot metal instruments, and five energy futures.

Leverage and Margin at XM

XM extends leverage from 2:1 up to a maximum of 30:1, allowing significant trading positions with lower investments but amplified risks.

In trading, the margin is essentially a security deposit needed to open a new trade position. For markets like forex, gold, and silver, you’re allowed to start new trades as long as you have enough available funds, or free margin, in your account to meet the margin requirement. However, for other types of instruments, the rules for margin may be a bit stricter.

Margin Requirements

Each position's margin is calculated on its own, taking into account the leverage of the account and the particular symbol, whichever is the smallest value. Here's a case to illustrate the concept:

Margin Requirement = [Number of Lots * Contract Size * Price at Opening] / [The Smaller of (Leverage on Account, Leverage on Symbol)]

Suppose your account offers a 200:1 leverage, but the symbol’s leverage is capped at 100:1. For the margin calculation, the lower leverage of 100:1 will be applied.

Risks of Leverage

- Leverage is a handy tool that allows traders to control larger trade sizes with a smaller amount of capital.

- While leverage can amplify gains, it can just as easily magnify losses if the market moves against you.

- Using leverage beyond a ratio of 30:1 carries a significant risk and isn't generally advised.

To manage risk, XM provides:

- To keep track of your trading account’s health, it’s crucial to monitor how much of your margin is used versus what's free.

- If your account equity dwindles too much, margin call alerts are triggered to warn you.

- Should your equity drop below 50% of the margin that's required, your positions might be closed automatically. This is called a stop-out level.

Although XM provides generous leverage options, it also equips you with risk management tools. It’s essential for traders to use leverage wisely and according to their own risk capability.

XM Spreads

It's crucial to recognize that XM prefers variable spreads, akin to how the interbank forex markets operate. Variable spreads negate the need for an additional insurance charge, which is otherwise essential with fixed spreads—generally higher than variable ones.

Moreover, fixed spreads become problematic since brokers often limit trading around news events. The additional insurance charge essentially loses its value in such cases.

By choosing to offer variable spreads, XM avoids these problems for traders. There's also no restriction regarding trading around the time of economic news releases.

Another feature for XM clients is access to fractional pip pricing, ensuring they get the best rates from XM’s liquidity providers.

This effectively means that a fifth digit is added to the typical four-digit pricing, letting traders capitalize on even minuscule price changes with more precise quotes and tighter spreads.

Curious about how XM handles overnight trading positions?

When it comes to holding positions overnight, XM stands out with its competitive and clear swap rates. The rollover system means XM will credit or debit a client’s account to handle the interest.

This policy applies to all positions that remain open after 22:00 GMT, excluding weekends when markets are shut.

Despite this break, banks do compute interest on positions held over weekends, so XM applies a three-day rollover on Wednesdays to account for this.

How Do You Place an Order With XM?

At XM, you're able to place a variety of orders, including stops, limits, and market orders, aside from trailing stops. You can trade anytime within market hours, even placing orders over the phone if that's your preference.

What Are the Trading Hours?

XM's trading hours align with those of the global market. For the forex market, one exchange door closes while another one swings open, thanks to hubs in cities like New York, Sydney, Tokyo, and London.

This means forex trading can happen around the clock, five days a week. XM’s trading hours span from Sunday at 22:05 GMT through to Friday at 21:50 GMT and include phone trading.

Any trades attempted outside of these schedule parameters simply won’t execute. You can still explore the platform and its features during off-market hours.

What Is the XM Execution Policy?

XM prides itself on real-time execution for trades, ensuring no requotes. Since implementing this policy in 2010, there's never been any rejection of orders or requotes. It boasts a 100% execution rate, with 99.35% of orders completed within a second.

You can make trades using the XM platforms anytime during market hours, and your trades will remain open until you close them. The account balance reflects real-time market prices and updates accordingly. Note that there’s a cap of 200 active positions at once, including any pending orders, per client.

Given XM’s fractional pip pricing, traders experience tighter spreads and highly accurate pricing.

A simple click is all it takes to fill a market order. Market orders can be completed for up to 50 lots (equivalent to 5 million). For larger trades, you can either break them into smaller portions or place them over the phone.

Limit and stop-loss orders are also guaranteed up to 50 lots, executed at the best available market price to help clients manage their exposure effectively.

XM has a clear-cut approach for dealing with market gaps, such as those between Friday close and Sunday open, covering holidays and weekends. Pending stop and limit orders will be fulfilled at the first available market price for the trade size.

Even in situations involving thin market conditions or high volatility, XM maintains a competitive edge. It collaborates with a host of liquidity providers to minimize liquidity risk and executes orders at the optimal market prices even under unpredictable conditions.

What platforms does XM offer for your trading endeavors?

Clients of XM have access XM allows trading on either MT4 or MT5, platforms popular in the MetaTrader family. Both support multiple devices, with the XM WebTrader option accessible via browsers.

In spite of countless traders flocking to the widely-used MT4 and MT5 platforms, XM distinguishes itself. It was an early adopter that focused initially on MT4’s trading execution quality. On XM's MT4, traders benefit from leverage as flexible as 1:1 to 1:1000 with no order rejections or requotes. XM’s MT4 platform is loaded with features. It offers access to over 1,000 tradable instruments. Through one login, you can navigate eight different platforms. The platform supports Expert Advisors and one-click trading features with three different chart types, accompanied by powerful technical analysis tools totaling 50 indicators and charting resources.

MetaTrader 4

Spreads start from as low as 0.6 pips, and traders can choose micro lots. Other perks include VPS functionality and the freedom to hedge.

Moreover, the MT4 platform comes with built-in guides for using it—as well as for Metaquotes Language 4. It has the capacity to manage a diverse range of orders and supports the creation of custom indicators and timeframes.

With MetaTrader 4, traders can maintain a trade history database, with the option to import and export data. It also has its own internal mailing system, providing assurances of complete security and backup.

MetaTrader 4 is accessible on PC, Mac, iPad, iPhone, Android devices, and as a WebTrader, offering similar functionality across all devices, enabling easy transitions between gadgets.

Although technically a variant under XM’s MT4 umbrella, the MT4 Multiterminal version packs extra features. This is engineered for traders who manage multiple MT4 accounts from a single interface.

The MT4 Multiterminal lets you access all your accounts using a single login and password, accommodating up to 128 trading accounts.

MT4 Multiterminal

It still shares many of the renowned MT4 functionalities. The MT4 Multiterminal allows for three allocation strategies, various order types, and real-time execution and handling of trades.

The rival MetaTrader 5 platform provided by XM takes MT4's offerings further with the addition of 1,000 stocks/shares CFDs, making it a competitive multi-asset platform.

Traders still enjoy equally flexible leverage with MT5 and avoid any requotes or order declines. You get a single login for access to seven platforms.

MetaTrader 5

The MT5 platform is available on PCs, Macs, iPads, iPhones, Android devices, and Android Tablets, or via WebTrader.

MT5 gives room for hedging, supports full EA function, and enables one-click trading. All order types are supported, and spreads begin as low as 0.6 pips.

With over 80 technical analysis tools and more than 40 analytics objects, MT5 showcases market depth with the freshest price information.

This platform also allows traders to run up to 100 charts at once. The superior MQL5 development environment within the system attracts those needing more capabilities, as does the multi-currency tester, alert features, and internal communication system.

Besides other edification tools, XM deeply enhances users’ MT4 and MT5 experience by offering ample guidance. Platform-specific pages contain numerous tutorial videos, covering things like Expert Advisors and trading orders, with 27 clips just for MT4.

At the bottom of these platform pages sits an FAQ section, covering MT4 topics such as validation and account access. Similarly, there's an FAQ for MT5 too.

Interested in mastering XM's trading platforms? Here's how.

Given MT4's and MT5's immense popularity, there's a wealth of third-party educational and support resources readily accessible online.

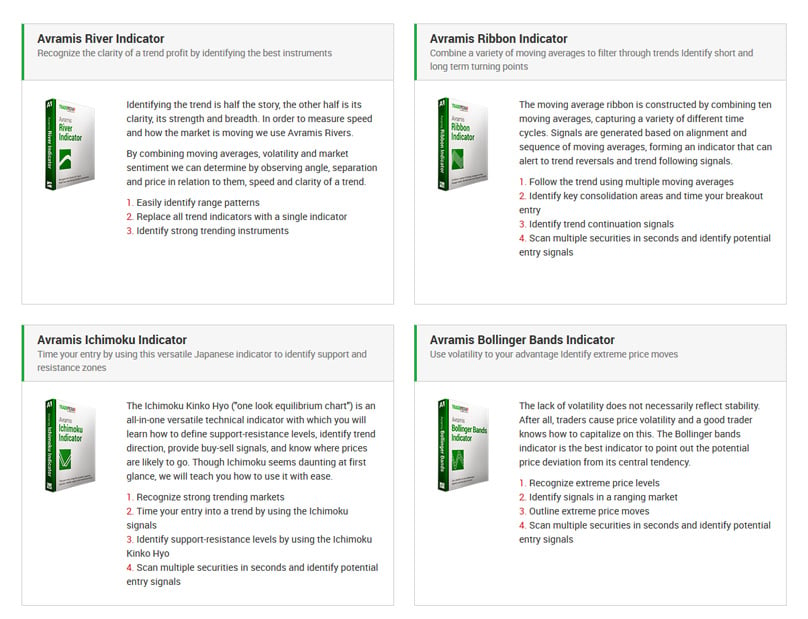

XM provides clients with a robust selection of algorithmic trading apparatus.

Among these are tools like the River, Ribbon, Ichimoku, Bollinger Bands, ADX, and PSAR Indicators.

XM Trading Tools

To integrate any of those, contact your Personal Account Manager. These complement the in-built algorithmic trading features on MT4 and MT5.

For live account holders, XM offers complimentary forex signals curated by Avramis Despotis in the Member Area, along with MQL5 Trading Signals, an economic calendar, and forex calculators.

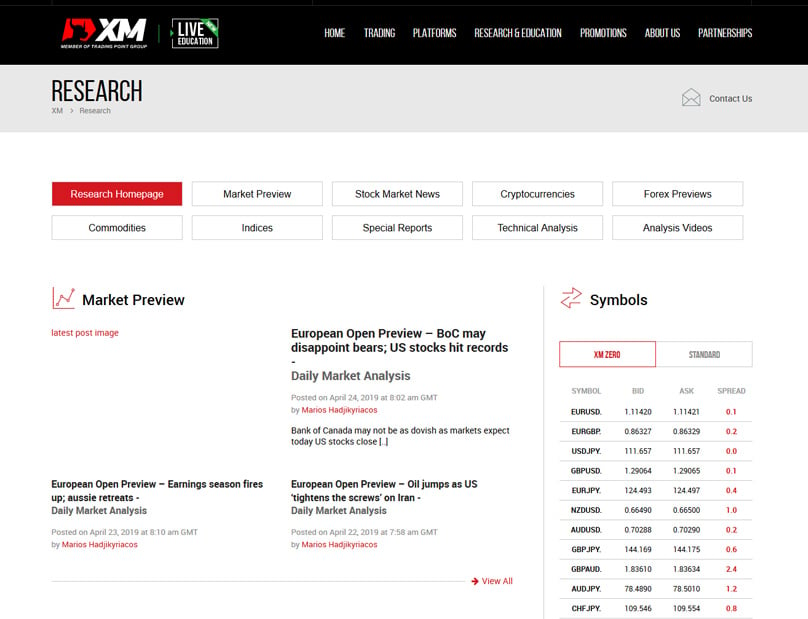

Through XM, clients get to tap into a formidable Research and Education center, with daily updates on vital trading sessions and briefings about significant market events.

A diverse team of twenty market experts provide this information in multiple languages daily.

Research and Education

XM provides vast research and learning opportunities. On the research page, you'll discover critical highlights, subsections, and current spread and price details of common assets. Below, a timetable for upcoming webinars is available.

The term 'margin' describes the initial deposit necessary to initiate a position in trading. In the context of forex, gold, and silver trades, new positions can be executed when the necessary margin does not exceed available funds. However, for other trading instruments, margin requirements are typically more stringent.

What Type of Research Does XM Offer?

There are separate homepages Every trading position has its margin requirements, which are calculated depending on the lower of the account's leverage and the symbol's leverage, as illustrated here:

Margin Requirement is computed as: [Lots * Contract Size * Open Price] / [The lesser of account leverage or symbol leverage]

For example, if there's a scenario where the account leverage is 200:1 but the symbol leverage is 100:1, the calculation for margin will utilize the lower leverage of 100:1.

Leverage is a tool that enables traders to handle larger positions with comparatively small amounts of capital.

Keep in mind, however, that using higher leverage can lead to significantly larger losses if trades do not go as anticipated.

Using leverage ratios over 30:1 can be hazardous and is generally not advised due to the increased risk.

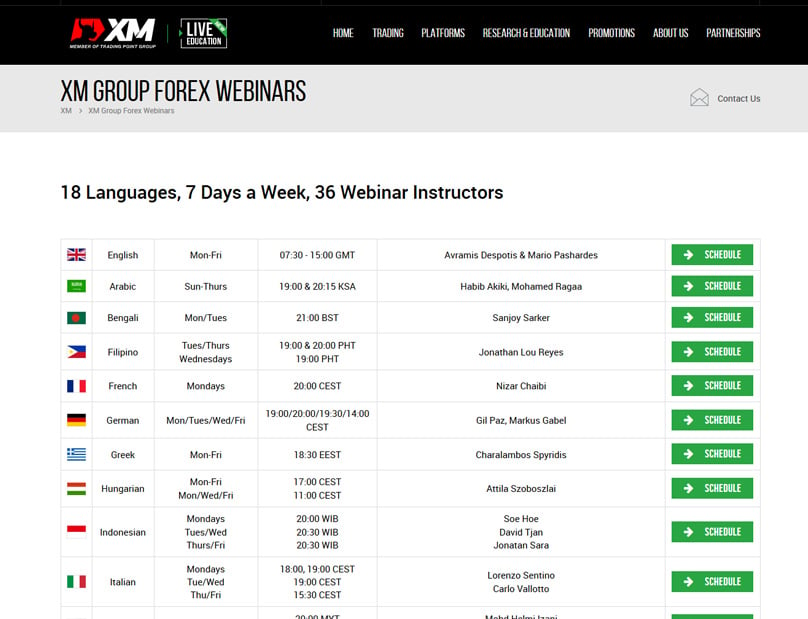

XM Webinars

It's crucial to keep tabs on used margin and the margin that's still free in real-time.

In situations where equity decreases excessively, margin call warnings are issued.

Positions can be automatically closed when equity drops below 50% of the necessary margin, known as the stop-out level.

XM provides significant leverage options alongside tools designed to help traders monitor their risk levels. Leverage should be used wisely, taking personal risk tolerance into account.

A key feature offered by XM is its use of variable spreads, which align with practices in the interbank forex market. Employing variable spreads eliminates the requirement for an insurance premium, unlike fixed spreads which typically run higher.

Compounding the issue, many brokers impose restrictions on trading in the vicinity of significant news releases, rendering these insurance premiums futile.

With variable spreads, XM sidesteps such issues. Plus, there are no trading restrictions coinciding with news announcements.

What Other Education Does XM Offer?

XM also offers Education Rooms Clients of XM also benefit from access to fractional pip pricing, ensuring optimal pricing from XM's liquidity providers.

Basically, an additional decimal place can be added to the usual four-digit price quotes, allowing traders to capitalize on even minor price changes for accuracy and tighter spreads.

For positions held overnight, XM is committed to offering swap rates that are both transparent and competitive. Their rollover policy involves either crediting or debiting client accounts to manage rollover interest.

This applies to all trades left open past 22:00 GMT. It's essential to note that rollovers do not happen on Saturdays and Sundays, as those are non-trading days.

Banks still calculate interest during weekends so XM applies a 3-day rollover strategy on Wednesdays.

XM provides a variety of order types, including trailing stops, regular stops, limits, and market orders. Trades can be placed any time during trading hours, and there's also the option for phone trades for those who prefer that method.

XM's trading hours follow the global forex market, meaning that one market closes as another opens, thanks to global cities like New York, Sydney, Tokyo, and London.

XM Customer Support

Therefore the forex market on XM is active 24/5, starting from Sunday at 22:05 GMT and wrapping up on Friday at 21:50 GMT, inclusive of phone trading.

Attempting to trade outside these hours won't execute; viewing features only is possible.

With XM, real-time execution comes free of requotes. Since instituting this policy back in 2010, XM has achieved flawless execution with 100% of orders being fulfilled and 99.35% occurring within a second.

You can submit trades on any supported XM platforms anytime within trading hours. Your positions remain active until you execute a closure, and your account's balance will update in real time to mirror market movements. There is a limit of 200 open positions per client, inclusive of pending orders.

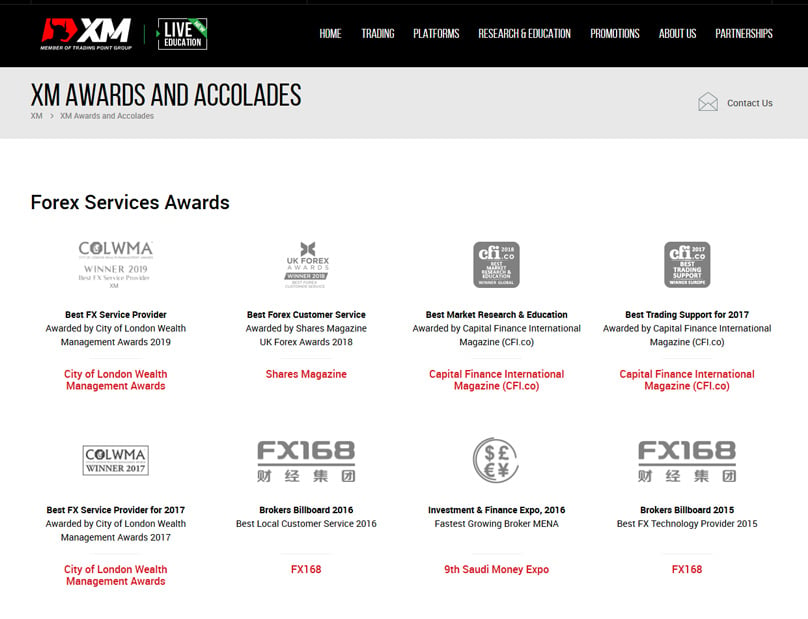

XM Awards

XM delivers fractional pip pricing, facilitating trading using narrow spreads while allowing for precise quoting.

- Entering market orders is effortlessly performed with just a click, covering a capacity of up to 50 lots (or 5 million). For more significant trades, options include phone orders or breaking the trades into smaller portions.

- Orders related to limits and stop-losses are guaranteed up to 50 lots, executed at the most favorable market price available. This capability helps clients mitigate risk.

- Definitive policies are in place regarding market gaps during weekends or over holidays; XM ensures the execution of pending stop and limit orders at the earliest available market rate.

XM Competitions

- Even amid liquidity challenges and market volatility, XM maintains competitiveness by partnering with various liquidity providers to counter liquidity risks. During volatile times, XM settles orders at the finest market-available prices.

- Trading on XM platforms like MT4 or MT5 offers you substantial flexibility. You can use them across devices or opt for the XM WebTrader in your browser.

- Despite the popularity of MetaTrader platforms, XM distinguishes itself by prioritizing execution quality with its MT4 platform, offering leverage from 1:1 up to 1:1000, excluding rejections or requotes.

- XM's MT4 platform is loaded with options, supporting more than 1,000 tradeable instruments. Through a single login, eight different platforms await.

XM Copy Trading

- Full support for Expert Advisors (EAs), one-click trading, three chart types, and technical analysis tools featuring 50 indicators are available.

- Platform spreads kick-off at a slim 0.6 pips and include micro lot trading. VPS functionality and hedging are also supported.

- MT4 offers helpful guides and supports Metaquotes Language 4. The platform manages a variety of order types and allows customization of indicators and time frames.

- With MetaTrader 4, you can access your trade history, perform data imports and exports, use an internal mailing system, and enjoy guaranteed security and backups.

- Available across PC, Mac, iPads, iPhones, Android devices, and as a WebTrader, MT4 allows for seamless switching between gadgets with consistent functionality.

Conclusion

XM MT4 Multiterminal, a variation for XM users, incorporates enhanced functionality for managing numerous accounts from one platform.

Accessing this setup with one login and password accommodates up to 128 trading accounts, maintaining familiar functionality.

The MT4 Multiterminal supports allocation methods for orders and real-time management capabilities.

XM's second flagship platform is MetaTrader 5, which builds on MT4's offerings by adding over 1,000 stocks and shares as CFDs. This positions it as a robust multi-asset platform.

It continues the trend with flexible leverage, no requotes, or rejections, maintaining its single-login multi-platform access.

You can tap into MT5 on various devices or as a WebTrader, much like MT4.