XTB XTB is an online brokerage tailored for trading in Forex, Crypto, and CFD markets. They pride themselves on offering a personalized approach with rich educational resources and a platform that has won numerous awards. Their aim is to foster lasting relationships with clients by equipping them with the essential tools for successful trading.

Be aware that XTB operates across 17 countries and offers an international version. Variations in spreads, leverage, account types, funding methods, and other specifics can be found. Unless noted otherwise, the details provided refer to International Accounts.

Risk Alert: A significant 79% of retail investor accounts suffer losses when trading CFDs via XTB Limited.

XTB at a Glance

| Broker | XTB |

| Regulation | Authorized by FCA (UK), CySec (Cyprus), KNF (Poland), IFSC (Belize) |

| Minium Initial Deposit |

£250, €250 or $250 |

| Demo Account |

Yes |

| Asset Coverage | Access to over 1500+ CFD markets including Forex, Indices, Commodities, Shares & Cryptocurrencies |

| Leverage | 30:1 |

| Trading Platforms | xStation ( Web & Mobile ), MetaTrader 4 |

XTB Regulations

While many brokers secure regulation from just one or two entities, XTB is overseen by a multitude. With offices in over ten nations, such as France, Spain, Germany, Poland, UK, and Belize, XTB stands out.

XTB’s presence across diverse regions means it’s closely monitored by an array of global regulatory bodies such as CySec, KNF, FCA, and IFSC. Thanks to such widespread regulation, XTB upholds rigorous standards, especially concerning client fund protection.

XTB International Limited (XTB) holds regulation and authorization from the IFSC (International Financial Services Commission) in Belize under License No: IFSC/60/413/TS/17. Its registration in Belize is under Number 153,939 with its address at 35 Barrack Road, 3.rdFloor, Belize City, Belize, C.A.

XTB is part of the XTB Group’s repertoire. The group also includes X-Trade Brokers DM SA, XTB Limited, and XTB Sucursal, each managed by their respective international regulatory bodies. For instance, the Polish regulator, Komisja Nadzoru Finansowego (KNF), oversees X-Trade Brokers DM SA.

The Financial Conduct Authority in the UK manages XTB Limited (FRN 522157). Similarly, Spain's Comision Nacional del Mercado de Valores supervises XTB Sucursal.

XTB Ltd (XTB UK) has its registered trading office at Level 34, One Canada Square, Canary Wharf, E14 5AA, London. X-Trade Brokers DM SA’s registered premises are at ul. Ogrodowa 58, 00-876 Warszawa, Poland, and XTB Sucursal is based at C/ Pedro Teixeira 8, 6ª Planta, 28020, Madrid.

History of XTB

XTB has a rich history Tracing its roots to 2002, X-Trade was born in Warsaw as Poland’s pioneering foreign exchange brokerage offering leverage. It metamorphosed into XTB in 2004 to align with the revised Polish market regulations.

By 2005, XTB earned the nod from Poland’s Financial Supervision Authority (KNF) to offer a broad suite of brokerage services. That same year, Money Markets Journal honored XTB as the “Best Broker in Europe.”

By 2006, XTB was integrated into the Polish National Clearing House and the Warsaw Stock Exchange. In 2007, it inaugurated its first international branch in the Czech Republic, followed by expansion into Romania, Slovakia, Germany, and Spain in 2008.

X-Trade Brokers transformed to XTB Online Trading in 2009. By 2010, they set up brand-new offices in Portugal, France, Italy, and Hungary and extended licensing across numerous European nations.

In 2016, XTB struck a deal with famous actor Mads Mikkelsen as a brand face. That year also marked XTB’s successful entry onto the Warsaw Stock Exchange, witnessing a share price surge of over 4% on its inaugural trading day.

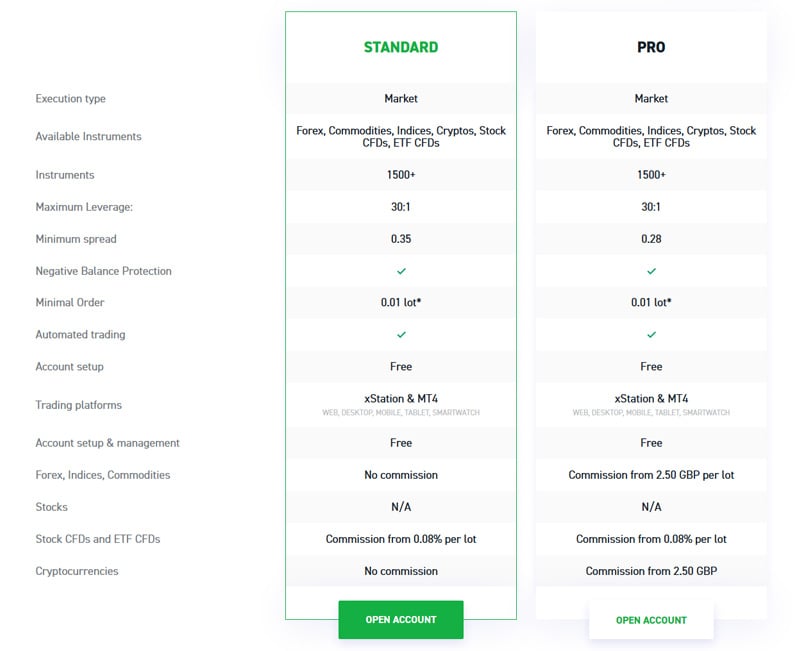

XTB Account Types

XTB has multiple account types, including a demo account with swift signup, allowing you to test the platform with platforms like MetaTrader 4 or the web-centric Xstation.

- Demo Accounts – An easily accessible Demo Account lets you explore the platform without commitment, with real-time features.

- Standard Accounts – Offers over 1,500 instruments from various domains including forex, commodities, crypto, and more. It promises features like market execution and leverage up to 1:200. The account type is free from setup fees and facilitates automated trading.

- Pro Accounts – Provides similar asset access with more competitive spreads and leverage. As with all account types, there’s zero setup or management fee, and they operate with both xStation and MT4.

- Islamic Accounts – Mirror features of Standard Accounts, with exceptions like crypto exclusion and no swap fees.

In the UK, only Standard and Pro Accounts are available. Both use floating spreads. While Pro Accounts utilize market execution, Standard Accounts retain a spread starting at 0.9 pips.

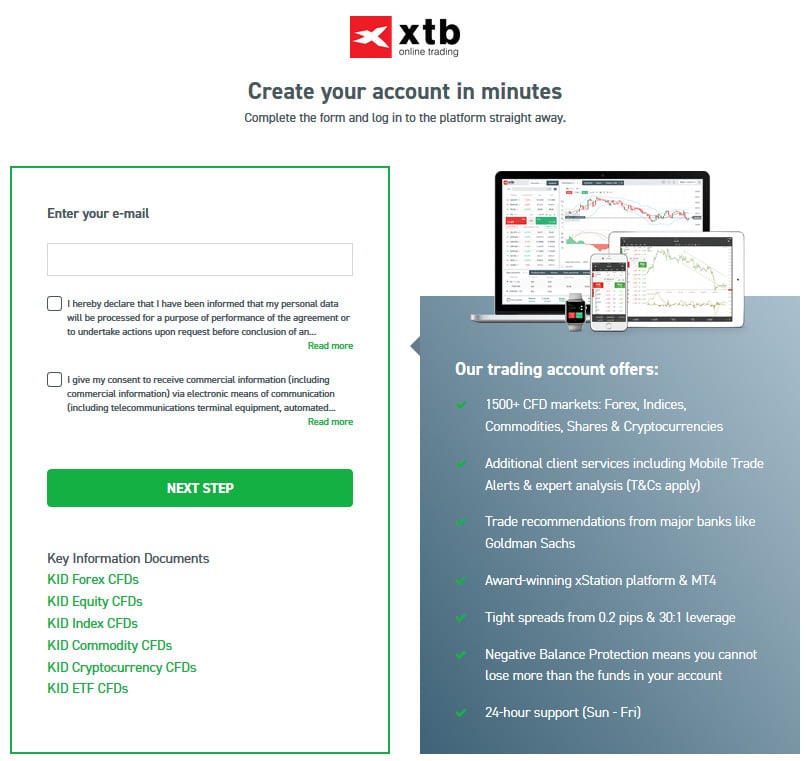

XTB Account Signup

Opening a XTB trading account is a breeze. To initiate, simply fill out the online form, find it simply on the homepage or practically any other page on XTB’s site.

Once details are verified, immediate access to trading platforms is granted, though additional documentation may be necessary. Post-approval, one can deposit funds and commence trading.

Requirements for Account Verification

After you create an account After account setup with XTB, activation is required to start trading. This involves ensuring identity and address verification, typically through document uploads. These requirements, although slightly regional, remain consistent.

For instance, in the UK, proof of identity can include a passport, a national ID, or a driver’s license, with both front and back needed for the latter two. Address proof from the last three months should be submitted.

Digital versions aren’t permissible. Acceptable address proofs (UK) cover bank or utility statements, landline phone bills, or tax statements.

XTB Spreads & Pips

With XTB, traders are able to enjoy spreads as high as 200:1 or as tight at 0.3 pips Gain market-level execution advantages with transparency throughout your trading journey at XTB. Pip values, spreads, and swap details are displayed prominently in deal tickets, ensuring no unexpected surprises. The adoption of advanced trading technology ensures smooth, quoteless executions.

Each type of instrument carries its distinct trading conditions. The Market Analysis section on XTB’s site holds the Price Tables. Here, you can overview current figures for bid, ask, spreads, etc. for each instrument.

Click “Instrument Specification” beneath each chart for comprehensive information about all instruments in a given category. Due to spatial constraints, only around 10-15 instruments appear on the main listing.

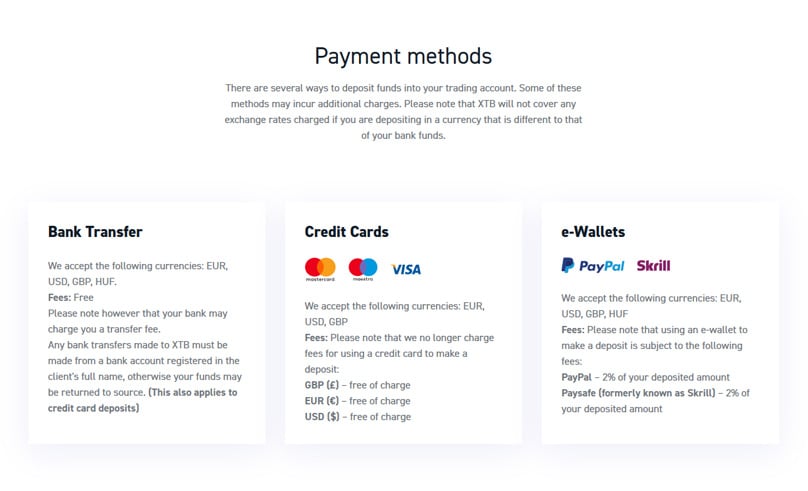

XTB Deposits

Depositing funds in your XTB account is straightforward—log in, navigate to “Deposits,” select your account, and pick a payment method. Most methods are fee-free, although some may incur small charges.

Remember that currency conversions won’t be covered by XTB if the deposited currency differs from your bank funds. Methods also vary by location.

Bank transfers, acceptable in USD, typically come without fees, though your bank might apply a charge. Ensure transfers originate from a bank registered in your name, matching your XTB account details, to prevent delays or fund returns.

Deposits via credit cards like Visa, MasterCard, and Maestro in USD attract no additional charges.

You can opt for e-wallets for XTB deposits too. Paysafe (previously Skrill) incurs a 2% fee, while SafetyPay has a 1.5% fee.

Deposit and withdrawal options differ by region. In the UK, Paypal or Neteller can be used, though SafetyPay isn’t available. Deposits can be in multiple currencies like USD, GBP, or EUR.

Minimum Deposit

The first deposit should be at least £250, $250, or €250 with no minimum requirement for subsequent deposits.

XTB Withdrawals

Withdrawing from XTB is as easy as depositing. Head to the Client Office after logging in, choose the account and amount for withdrawal.

Remember, if the currency of the account you’re using for withdrawals isn't the same as your trading account, Pekao will handle the currency conversion at its current exchange rate, applicable when either the bank receives the funds or upon request. As with deposits, withdrawals can only be routed to a bank account that precisely matches your name.

When requesting a withdrawal, XTB will process the payment using the SHA model, which pays the charges imposed by the Sending Bank. However, your bank might apply additional fees. If you decide to withdraw an amount under $100, be prepared to incur an additional $30 in charges.

| FEES FOR WITHDRAWALS BELOW THE SPECIFIED LIMIT | THRESHOLD | AMOUNTS LARGER THAN THRESHOLD |

|---|---|---|

| 20 USD | 100 USD | Free |

| 16 EUR | 80 EUR | Free |

| 12 GBP | 60 GBP | Free |

| 3000 HUF | 12 000 HUF | Free |

XTB Trading Instruments

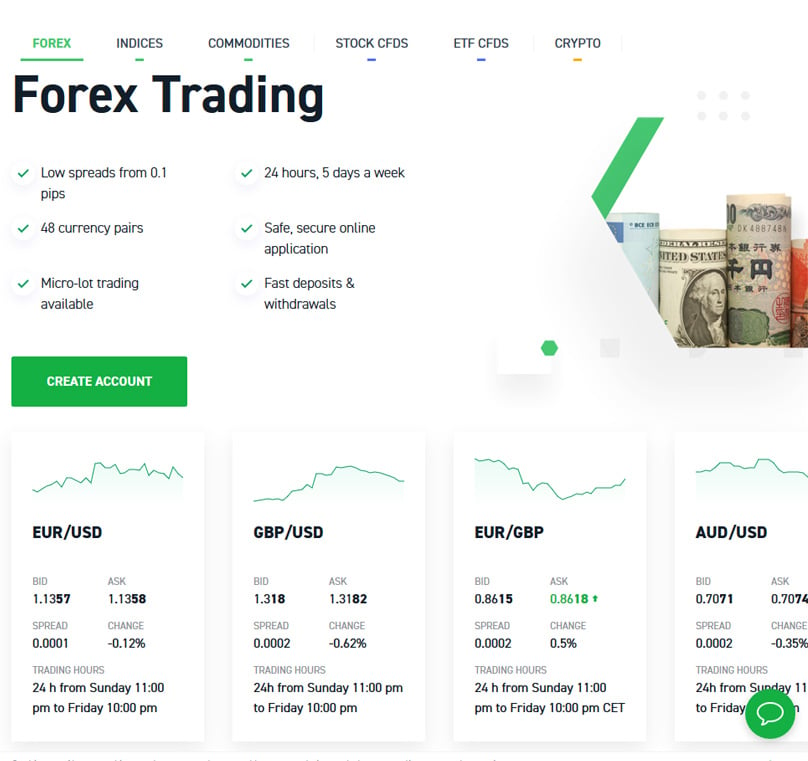

XTB makes an effort to attract various traders by offering an extensive roster of assets. They provide access to 3,000 different markets including forex, commodities, shares, and indices, allowing anyone to trade as they see fit.

In the realm of forex, the benefits include spreads starting as low as 0.1 pips, and you can trade these 24 hours a day, five days a week. There are 48 currency pairs you can trade, offering micro lot sizes, and there's no necessity for a minimum deposit to get started.

XTB provides access to over 20 indices, featuring notable markets from China, Germany, and the USA. These markets are offered at low transaction costs, with the flexibility to take long or short positions, leverage possibilities, and no overnight fees for maintaining positions.

Amongst the available commodities, popular choices like oil, silver, and gold are offered. These commodities provide 24-hour trading and zero overnight holding fees. Plus, their low transaction costs and the inherent volatility of precious metals and commodities make them appealing.

XTB facilitates trading in more than 1,500 different stock CFDs, offering leverage of up to 1:10. You'll find competitive commissions, starting at a mere 0.08% with lightning-fast execution while giving you the option to go long or short.

For those interested in ETFs, XTB provides 60 ETF CFDs complete with up to 1:10 leverage, low commissions starting from 0.08%, fast execution, and negative balance protection as a safeguard.

At last, XTB gives you the chance to dive into cryptocurrency trading. Whether you're drawn to Dash, Bitcoin, Litecoin, Ripple, Stellar, Ethereum, or others, the market is open round-the-clock, every day of the week, with minimal transaction costs and security against hacking attacks.

XTB Fees

Depending on the account type, commissions may differ slightly. With Standard Accounts, you won't pay commissions on trades involving crypto, forex, indices, or commodities. For other account types, commissions start at 0.8% per lot, which also applies to Islamic Accounts.

Pro Account holders can expect forex, indices, commodities, and cryptocurrency commissions to begin at $4 per lot. Stock CFDs and ETF CFDs commissions start at 0.08% per lot.

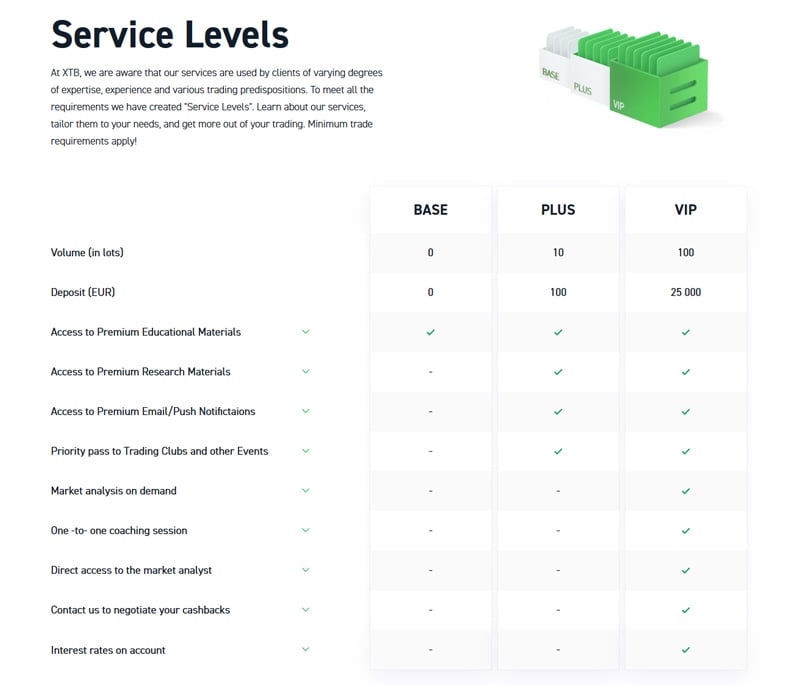

XTB Service Levels

Various service levels are available with XTB to meet the unique needs of each client, regardless of their trading experience or expertise.

The basic service levels do not require any minimum lot volume or deposit. This service includes access to Premium Educational Materials, developed by specialists at XTB, which cater to all levels of trading experience and are designed to guide you through your trading endeavors.

Plus service levels entail a minimum trade volume of 10 lots and a minimum deposit of 100 Euros. Along with Premium Educational Materials, this service level gives you access to Premium Research Materials, Premium Email and Push Notifications, and priority access to events such as Trading Clubs.

The Premium Research Materials are crafted by XTB’s award-winning analyst team. These materials keep you in the loop with the latest market trends and provide expertise to enhance your trading strategy.

You will receive Premium Email and Push Notifications packed with insights like market updates, trading signals, and evaluations, offering timely information to seize upcoming opportunities. Weekly Trading Clubs provide professional trader-led sessions with live analysis, and you’ll have priority access to XTB Masterclasses.

At the top-tier VIP service level, you must trade at least 100 lots and deposit a minimum of 25,000 Euros. This grants you one-to-one coaching, on-demand market analysis, and personal access to market insights as part of an exclusive service suite.

On-demand market analysis includes consultations with seasoned analysts who offer feedback about your trading tactics and probe specified areas for you. This pairs with direct analyst access to receive real-time market intel.

One-on-one coaching seeks to elevate your proficiency in technical analysis through tools like Market Geometry, Ichimoku, and Price Action. These sessions may also cover trading psychology or risk management topics, and VIP members can contact their Account Manager to get an updated list of the trainings on offer.

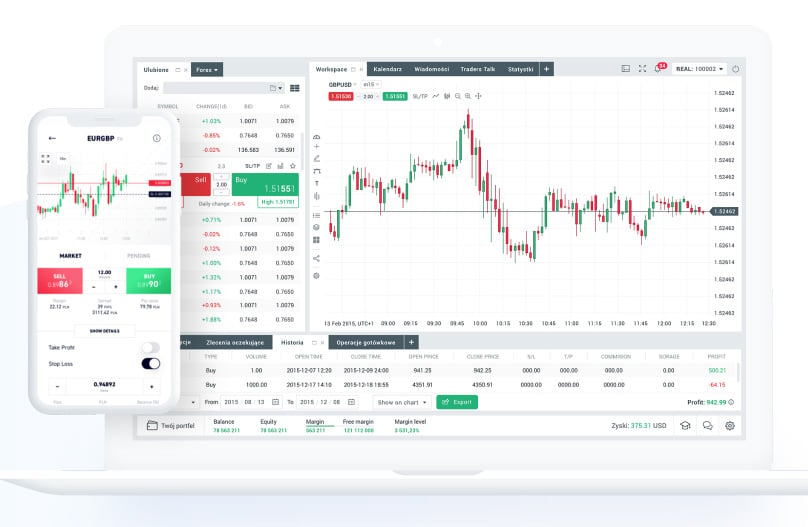

XTB Trading Platforms

The Online Personal Wealth Awards declared XTB as the winner for the 'Best Trading Platform 2016.' As a client, you'll get real-time market commentary and an economic calendar on a platform featuring ultra-fast execution speed and a toolkit for chart trading. Whether on your desktop, laptop, tablet, or smartphone, XTB is available across all devices.

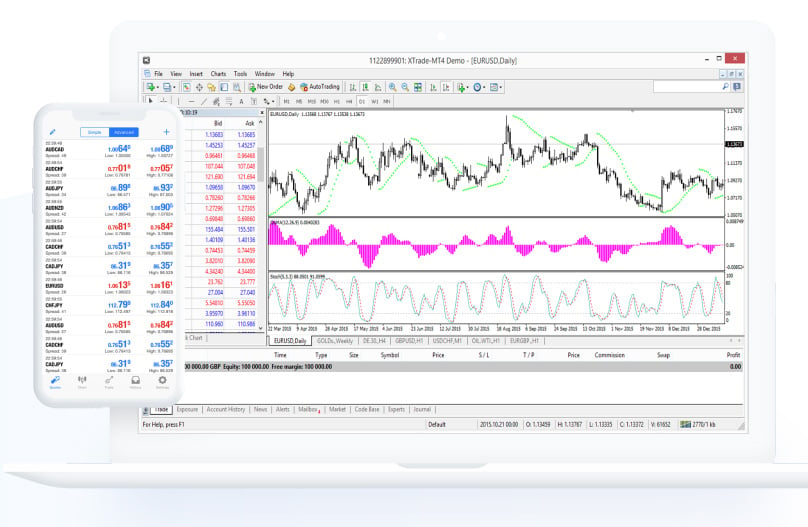

XTB clients have two state-of-the-art platforms at their disposal: xStation 5 and MetaTrader 4.

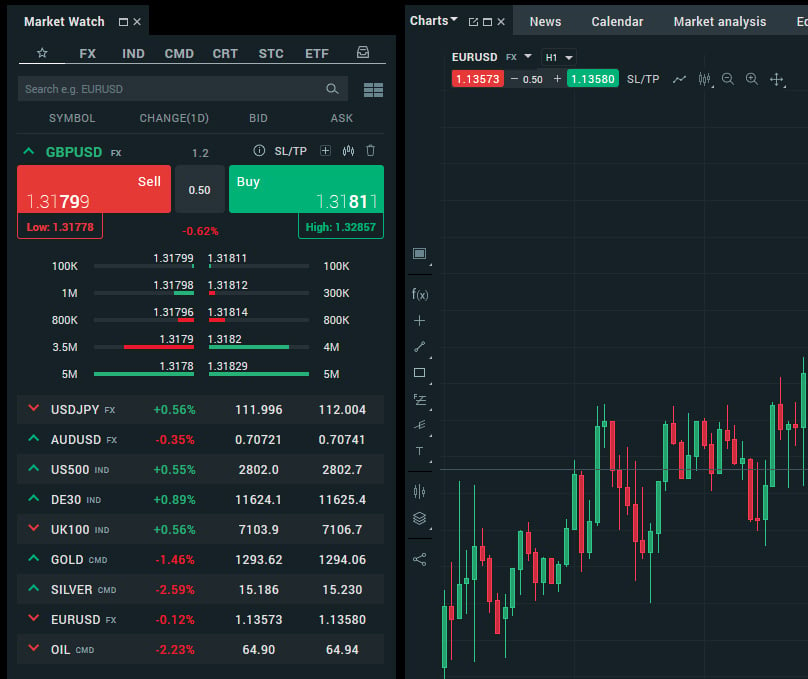

xStation

xStation 5 xStation 5 is a unique, award-winning platform from XTB. It's user-friendly and boasts exceptional speed. Packed with a trading calculator, advanced chart trading options, trader statistics, and sophisticated analysis tools, it also offers bulk order closures, trader discussions, market sentiment analysis, top movers, and a comprehensive equity screener.

You can use xStation 5 on desktop devices, tablets, smartphones, and even smartwatches. While the desktop version is comprehensive and the swiftest, the tablet app maximizes the tablet version's interface, presenting full trade management along with powerful functionalities.

In alignment with the desktop version, bulk order closures, entire trade management, and detailed interactive charts with technical indicators are available.

The mobile version of xStation 5 is notably popular, with over half of XTB’s clients utilizing it actively. It’s loaded with advanced features like complete trade management, interactive charts with technical indicators, and bulk order closures. On smartwatches, the app allows you to tap a few times to engage with the markets, supporting both Android and iOS devices. The interface is straightforward, allowing for easy trades and order management from your wrist.

MetaTrader 4

MetaTrader 4 MetaTrader 4 is well-regarded in the industry, offering XTB traders a tried-and-true, user-friendly platform. It includes a broad range of built-in analytical tools and the capacity to implement automated strategies, indicators, and oscillators.

MetaTrader 4 shines in optimizing technical trading through potent pattern recognition capabilities, highlighting emerging trends for precise entry and exit points and setting profit targets and stop losses effectively.

With the one-click dealing option, trades can be made swiftly and effortlessly. MetaTrader 4 includes a strategy tester, showcasing its extensive functionality.

Available for desktops, tablets, and mobile devices, MT4 provides an array of features on the desktop version. The tablet version grants complete control and manages your open trades. On mobile devices for iOS and Android, trade freely and execute transactions at any time, wherever you are. It offers intuitive transaction capabilities and market trend analysis.

Order Types

Trading with MT4 on XTB allows the option for Buy Stop, Sell Stop, Sell Limit, and Buy Limit orders. You can also open trades instantaneously. Additional options, including Stop Loss and Take Profit orders, are available with xStation, helping you optimize your trades.

How Do You Trade with XTB?

The specific steps to trading with XTB Which platform you choose will dictate specific functionalities. With MT4, initiate a trade via the Market Watch pane on the platform’s left. Alternatively, press F9 on your keyboard or use the ‘tools’ tab from the top menu, inputting and submitting your trade data.

xStation offers three user-friendly methods for trade initiation. Open the Market Watch window by clicking on a market name.

This window incorporates a calculation tool displaying aspects like commission, pip value, spread in pips and its financial equivalent, plus daily swap points. Alternatively, trade from the chart by finding buy/sell buttons at the top left, and directly modify quantities.

The three-click trade feature is another method. Choose the market to trade, select 'Place pending order on Chart,’ then click your desired trade spot, followed by selecting a stop loss point, and end with your profit target. This results in a new deal ticket where you just finalize by choosing Buy or Sell.

XTB Trading Tools

XTB stands out with a detailed snapshot of live trading statistics. This visibility is instrumental in highlighting strengths and potential improvements in your trading activities.

The broker includes a Trader’s Calculator in xStation 5, simplifying trade evaluations based on potential rewards vs. risk. You can assess potential losses or profits considering stop loss, limit orders, and lot sizes, supporting risk management efforts.

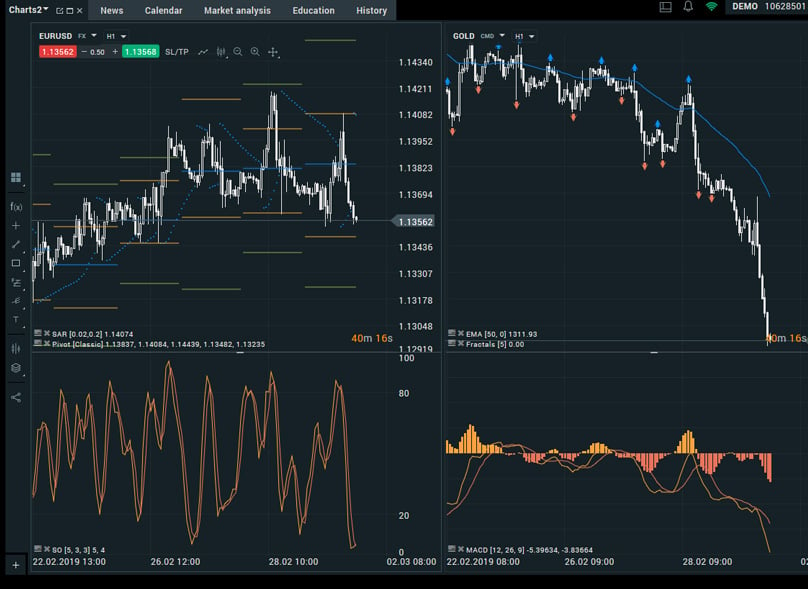

xStation 5 provides sophisticated chart trading, engaging straight from the charts with features like pending orders, profit placements, stop losses, and market orders alongside intricate technical analysis with indicators like RS, Moving Averages, Fibonacci Retracement, and others.

The bulk trade closure feature is your go-to tool for wrapping up winning or losing positions with just a click, helping you either safeguard your profits or control losses. Meanwhile, xStation 5's equity screener offers an advanced filtering system, making the search for prime market opportunities much more streamlined and efficient.

For those utilizing MetaTrader 4, the Strategy Tester tool is a powerful resource. It enables testing and refining of Expert Advisors (EAs), allowing traders to retrospectively evaluate strategies over their chosen intervals and assets. The detailed results are organized in three insightful tabs for in-depth analysis.

With MetaTrader 4, you gain the power of the MQL programming language, enabling you to develop and tweak tools for technical analysis. If you'd rather not delve into coding, the MQL4 community is a treasure trove of resources, offering downloadable tools, signals, and strategies that can be shared or adopted.

Side-stepping MQL is feasible when adding analysis tools to MT4; simply download and place them in the right directory. The XTB FAQ section is your go-to for comprehensive guidance on this simple process.

MT4 brings a suite of tools to enhance your trading experience, including custom price alert settings. Dive into technical resources like Gann tools and various Fibonacci indicators, with an assortment of chart options such as candlestick, bar, and line. You also have access to a range of oscillators and indicators like the Stochastic Oscillator, RSI, MACD, and Moving Averages.

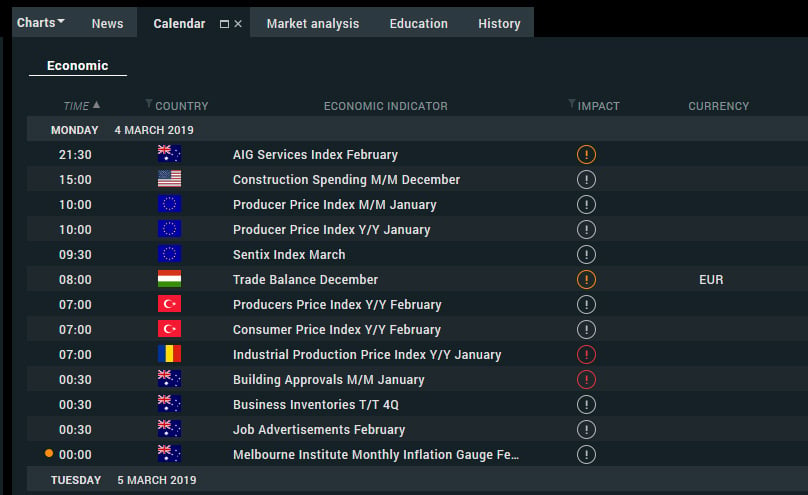

XTB boasts a market calendar, both on their website and within the xStation platform. This detailed calendar outlines current and forthcoming market-moving events, offering filters by impact level and country for tailored insights.

Adjust your market calendar experience with options for day, week, or month views, or set a custom timeframe. Each event entry is comprehensive, listing key details such as date, time, country, economic indicators, impact level, and historical and forecasted data.

Market News & Analysis

Through the xStation 5 platform, keep your finger on the market's pulse with Trader’s Talk, a dynamic live audio feed offering immediate access to breaking market news, ensuring you're always ready to seize new opportunities.

The XTB website dedicates a section to Market News, delivering fresh updates on tradable markets. You can skim the headlines or dive deep with articles that feature summaries and thorough breakdowns, incorporating charts and graphs when beneficial.

In this section, both news and analysis are available, with most articles fully accessible to the public, although some require login credentials. Any XTB account grants unrestricted access to the entire news and analysis library.

XTB Education

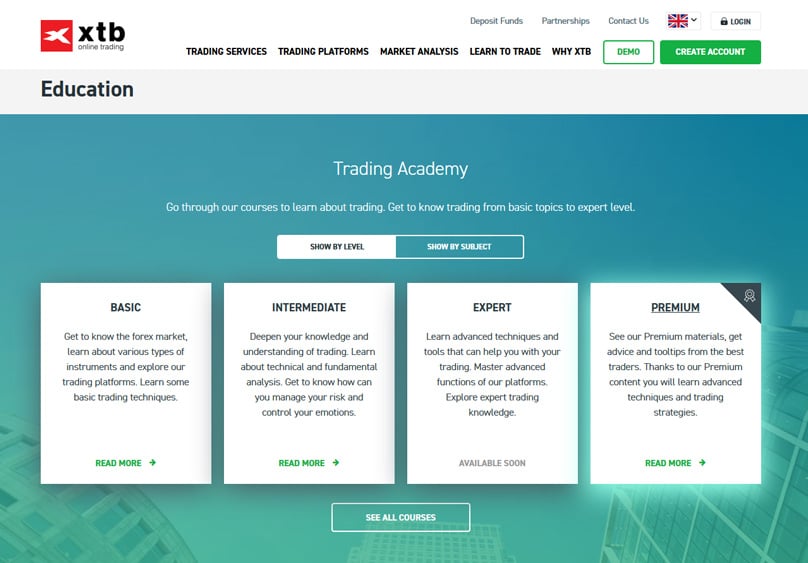

XTB ensures comprehensive knowledge is at your fingertips with an Education section, a prominent part of their website's navigation. Their Trading Academy is sorted by skill level or topic, with categories ranging from Basic, Intermediate, Expert, to Premium.

The Basic levels covers fundamentals of forex markets, instruments, and trading platforms, imparting essential trading skills. Intermediate dives into fundamental and technical analyses, focusing on risk management and emotional control. Soon, Expert courses will introduce advanced tools, trading knowledge, and platform functionalities.

For a deeper dive, the Premium section is packed with expert advice, tools, and strategies from seasoned traders, offering advanced techniques and insights. Access to most educational content is open, barring the Premium section which requires login.

Alternatively, browse through educational courses by topic rather than skill level. Options include tutorials on MT4 and xStation, introductions to CFDs, fundamental analysis, and forex trading.

Currently, the Basic category holds 27 in-depth lessons, covering aspects like specific platform use, risk management, chart types, trend trading, and macroeconomics. The Intermediate category includes 15 lessons focusing on platform features, market sentiment, stocks, cryptocurrencies, and intermarket correlations.

A handy search function on the Education page lets you pinpoint the topics you wish to explore further.

Depending on your selected language and region on the XTB site, live webinars may be available. These sessions connect you with market experts from XTB, offering a comfortable environment to learn and polish skills.

XTB FAQ Section

XTB, like many brokers, features a FAQ or Knowledge Base. However, at present, the FAQ section lacks content on the International page, signaling it as 'Soon' with potential categories for Platforms, Accounts, and Trading Glossary.

Without a comprehensive FAQ, you might need to reach out to customer support for queries or trivial problems, potentially leading to longer wait times due to increased support demands.

If your regional XTB site lacks a complete FAQ section, consider visiting another region's site, such as the UK version, which offers a robust FAQ section with 31 categories and 51 topics.

XTB Affiliate Program

XTB provides both an Affiliate Program and an Introducing Broker (IB) program. As an affiliate, you'll receive marketing tools to promote XTB on your platform, earning commission for successful referrals, with potential earnings up to $600 per trader monthly.

Through the Introducing Broker program, you refer clients to open accounts with XTB, earning a commission based on your referred clients' trading volumes.

XTB's client support ranks highly with its clients, who have rewarded it with a five-star rating. This owes to their timely, friendly service and XTB’s focus on nurturing long-term client relationships. Support operates 24/5, from Sunday through Friday, ensuring timely assistance when needed.

XTB Customer Support

Personalized service at XTB is a standout feature, as every client receives their own account manager, streamlining communication and service delivery.

With XTB's regulation, client funds are secured in segregated accounts, separated from the broker’s own funds. Additional protective measures include ring-fenced accounts, ensuring client funds remain unimpacted in cases like XTB's insolvency.

Is XTB Safe?

For UK-based clients, additional security comes from the Financial Services Compensation Scheme (FSCS), providing insurance up to £50,000 per person should XTB become insolvent.

Your personal data at XTB is well-protected via SSL-secured connections, preventing unauthorized access. Trust in their processes is bolstered by XTB’s broad regulatory and licensing coverage from international financial bodies.

XTB Security

XTB stands tall among similar brokers which have been previously reviewed.

Competitors

Throughout its 12-year tenure, XTB has earned numerous accolades from the likes of Forbes and Bloomberg, among others including M&A Today Global Awards 2018 and AtoZForex.com’s 2017 Forex Awards, celebrating its high standards.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

XTB Awards

In 2016, it clinched an Online Personal Wealth Award, and back in 2013, it was appreciated at the World Finance Exchange Brokers Awards alongside gaining the title of Bester Forex Broker from the Leser Award. In 2010, XTB’s quality as a Forex and CFD Broker was recognized.

An internationally established online broker, XTB, with 14 years in the field, operates across ten countries, enabling access to a vast array of trading instruments. Renowned for its robust platform, swift order executions, and transparency, XTB’s high level of regulation and public trading status bolster your confidence in trading with them.

Conclusion

The bulk order closing feature is a nifty tool in trading that grants users the power to close all losing or winning trades with a simple click. This helps in managing losses or securing profits effectively. Over at xStation 5, there's an equity screener that fine-tunes your stock search with advanced filtering, making the hunt for prime trading opportunities a breeze.

Traders utilizing MetaTrader 4 get the perk of the Strategy Tester, a tool designed to test and optimize your Expert Advisors. Through this handy feature, you can backtest every strategy against different intervals and market assets, pinpointing which approach delivers the best results. The insights from Strategy Tester are comprehensive, split across three different tabs for a detailed analysis.

Embracing the MetaTrader 4 platform grants access to the MQL programming language, allowing users to develop and tweak technical analysis tools. However, if coding isn’t your forte, MT4 opens the gates to the MQL4 community for sharing or downloading tools, signals, scripts, or strategies.

Adding technical analysis tools to MT4 can be hassle-free without delving into MQL, simply by downloading and placing a tool in the proper directory. Detailed instructions on this process reside in the XTB FAQ section.

MT4 spreads its wings with a variety of additional tools to aid trading endeavors. You can set up price alerts and dive into technical tools like Gann and Fibonacci indicators, along with selecting candles, bars, or line chart formats. Among the suite of oscillators and indicators are the Stochastic Oscillator, RSI, MACD, and Moving Averages.