In 2023, the decentralized finance sector, known as DeFi, has witnessed explosive growth on the Ethereum blockchain, with apps like Uniswap and Curve seeing unprecedented user engagement. or popular .

Recently, the DeFi sector has been supercharged by the emergence of 'yield farming.' But you might wonder, what exactly is this trend, how does it function, and how can you join in?

Today's guide aims to break down the basics of yield farming for novices, enabling you to start reaping crypto rewards on your own initiative.

What Yield Farming Is

DeFi applications are still in their infancy, requiring enthusiastic users to help them mature and reach their potential.

Seeing this necessity, many DeFi projects have turned to yield farming. It involves distributing governance tokens to users to spark activity and reward early adopters.

Consider the example of Compound, a prominent DeFi lending platform, which launched its yield farming efforts around its COMP governance token. Earlier this year, they distributed COMP to past users and offered it as ongoing rewards to current ones.

Put simply, you could earn COMP just for utilizing Compound, giving you a voice in future governance—a concise depiction of yield farming.

What You’ll Need to Start Farming

Starting out with yield farming is straightforward. Here's the basic rundown of what you'll need:

- Your own Ethereum address (a hardware wallet is preferred)

- Some ETH to pay for transactions

Once equipped with a wallet and some ETH, you're all set to evaluate and discern the yield farming opportunities that best align with your goals.

Finding Farming Opportunities

New yield farming schemes are emerging daily. Assessing which ones merit involvement is crucial to success.

The upside? Numerous tools have become available that simplify this process considerably. Some include:

- Etherscan’s new Yield Farms This platform offers a comprehensive and unbiased roundup of various ongoing yield farming projects,

- The yieldfarming.info another site provides curated yield farming opportunities and detailed wallet-based stats, such as your projected annual percentage yield (APY) and more.

- Coingecko, a site dedicated to crypto market data, also hosts a Farms page that highlights premier yield farming prospects and offers tools like an APY calculator, an impermanent loss calculator, among others.

Keep in Mind APY + Gas Prices

It's essential not to engage with a yield farming protocol without understanding the potential APY. The sites mentioned above can be invaluable in providing this insight. Consider the following additional aspects:

- Yield farming projects will display APY statistics on their websites. These figures can be misleading, so don't rely on them as the absolute truth.

- High APYs often equate to high risk and high reward, so proceed with caution.

- APYs fluctuate over time since yield farming campaigns have phased distributions. Stay informed about how these distributions are structured and adjust (for example, diminishing token rewards over four weeks).

Another crucial factor is the gas fees involved in Ethereum transactions.

With DeFi's current prominence, demand for processing on the Ethereum blockchain is at an all-time high, leading to steep gas prices.

Entering or exiting yield farming positions can become quite costly; make sure to consider these gas fees when evaluating opportunities.

Jumping Into Liquidity Pools

Yield farming revolves around liquidity pools. By depositing assets into these pools, you earn LP tokens and stand to gain from a share of the pool’s transaction fees.

Fortunately, platforms like DeFi dashboards make it a breeze to supply liquidity to trending farms, Zapper.fi or Zerion allowing you to effortlessly allocate your assets and make investments at the touch of a button. Next, it’s time for staking.

Staking for Making

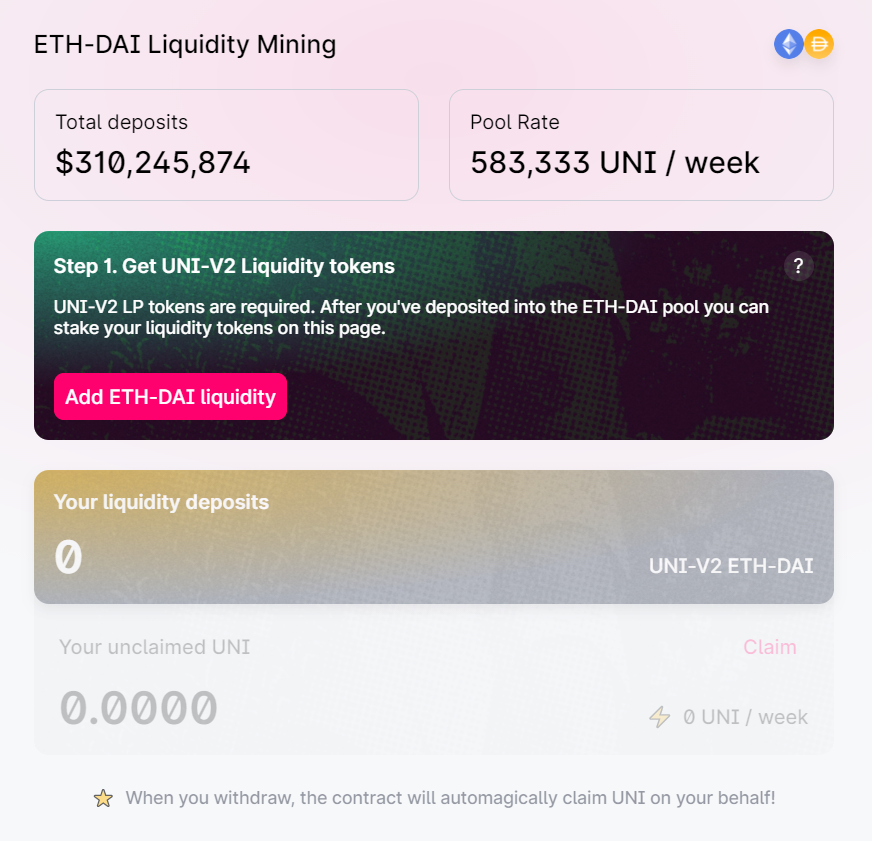

Once you hold LP tokens for a particular farm, you can stake them to begin earning the project’s governance token. Take Uniswap's UNI farming as an example.

One of Uniswap's initial UNI reward pools is the ETH/DAI liquidity pool. Let’s say you've prepared your ETH/DAI LP tokens. You’d then visit Uniswap and carry out these steps:

- Click on the UNI tab

- Click on the ETH/DAI Deposit button

- Click on the Stake button

Finalize the transaction, and you’ll start acquiring UNI automatically as long as the farming campaign is active. You can employ a similar approach for other yield farming opportunities.

A Beginner's Pathway to Yield Farming: Discover yEarn Vaults

yield aggregator protocol yEarn This platform revolutionizes DeFi by automating yield farming and simplifying the process. One standout feature is yEarn Vaults, DeFi products that allow you to optimize your collateral automatically.

For instance, consider yEarn’s yETH Vault. By depositing ETH, the system works its magic, leveraging ETH for additional returns effortlessly.

In addition to yETH, yEarn offers various Vaults, such as a yLINK Vault for enthusiasts wanting to leverage Chainlink.

The Prospects of Governance Tokens

Ultimately, yield farmers focus on acquiring governance tokens. These tokens can be cashed out for quick profits or held for a potential stake in protocol governance.

This area is uncharted both in the crypto space and globally. Managing these protocols is a bold experiment, and it’ll be fascinating to see how yield farming and governance evolve together.

Bitcoiners Can Join In, Too

Even if your portfolio is concentrated in BTC, you don't have to miss out on yield farming.

Currently, Uniswap's ETH/WBTC pool tops all other DeFi farming pools, with over $400 million in Value Locked (VL) as reported by Coingecko. Here's a strategy to consider:

- Convert some of your BTC to WBTC

- Contribute your WBTC to Uniswap’s ETH/WBTC pool

- Farm UNI and optionally exchange it for more BTC!

Beware Risks and Scams

Yield farming involves several risks. Firstly, avoid mindlessly chasing every yield farming opportunity—there are always scams alongside legitimate projects.

Moreover, there's the risk of bugs, hacks, and impermanent loss, meaning you might have been better off just holding onto your asset instead of providing liquidity in certain pools.

Once you familiarize yourself with these risks, you're better positioned to explore yield farming opportunities.